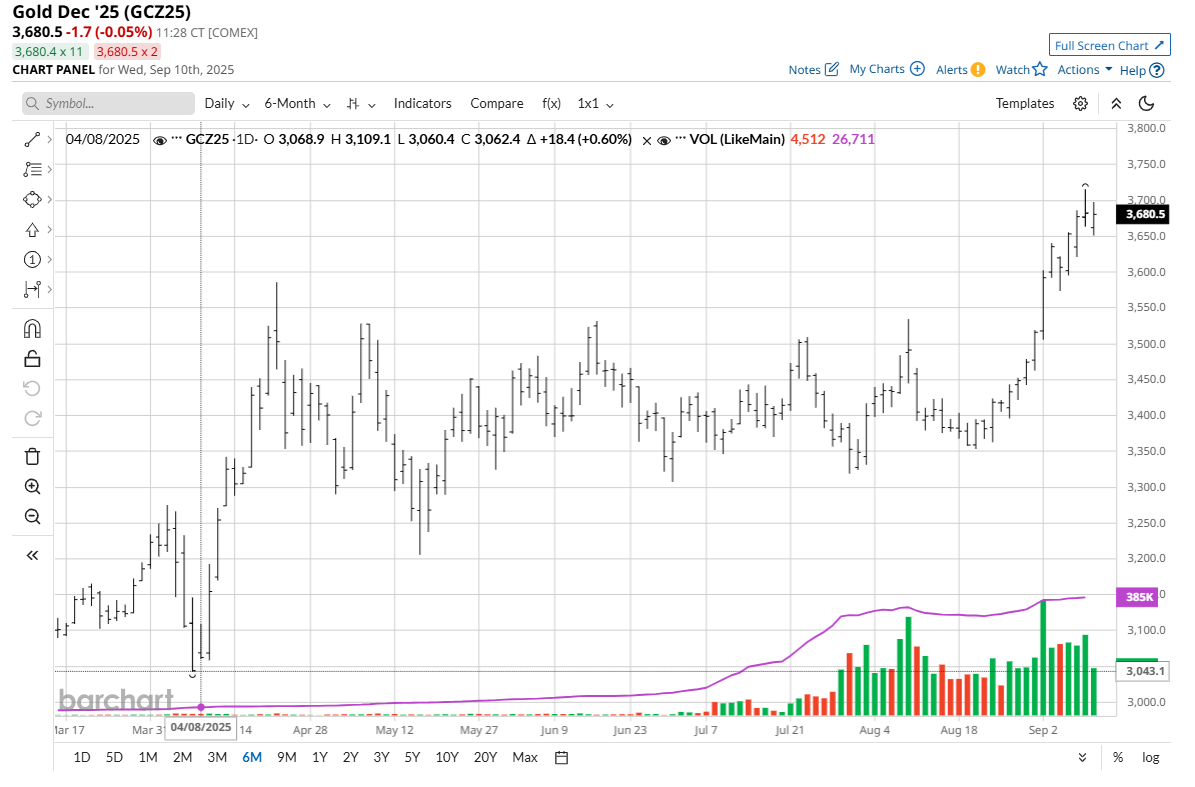

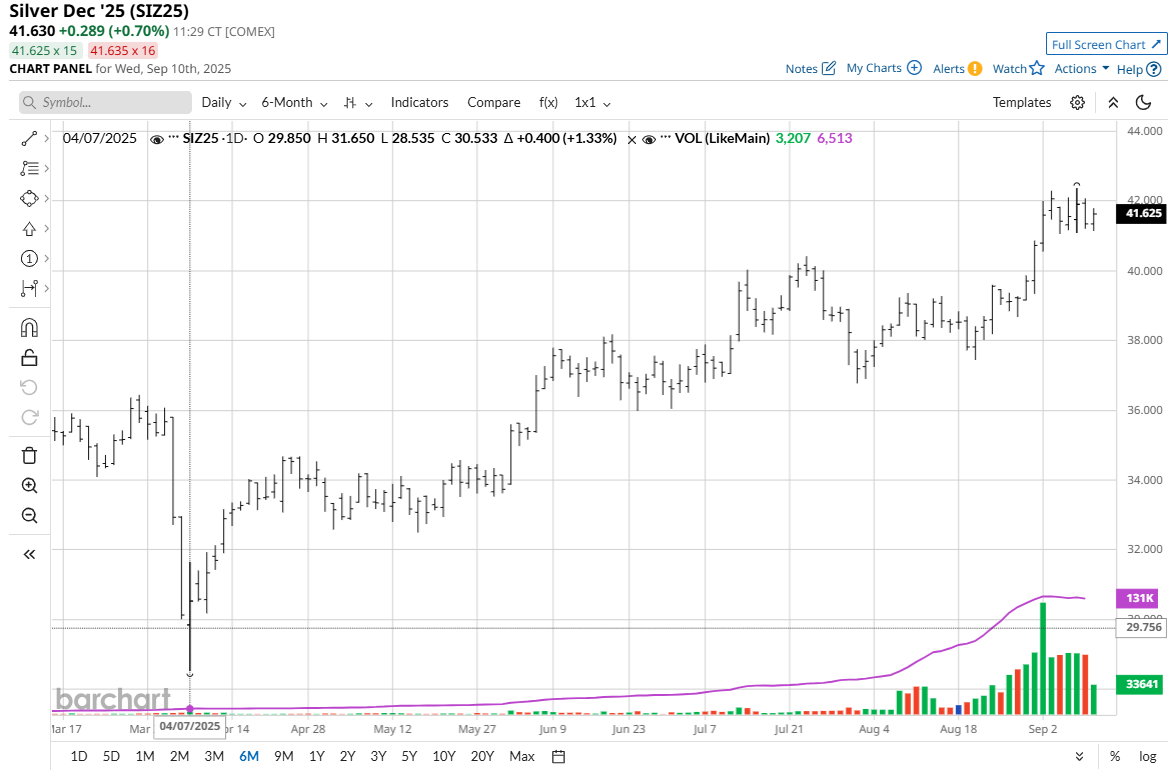

Comex gold futures (GCZ25) prices scored a record high on Tuesday of $3,715.20 an ounce, basis December futures. December Comex silver (SIZ25) stretched to a 14-year high of $42.355 an ounce on Monday. I’m going to offer up three important factors that should keep precious metal prices moving north for at least the next few months and possibly much longer.

Catalyst #1: Safe-Haven Demand to Continue as Geopolitics Heat Up Again

Geopolitical tensions are never too far from the front burner of the market. However, developments this week have pushed these tensions near center stage.

Overnight, Poland shot down Russian drones that crossed into its territory during Russia’s latest massive air strike on Ukraine. Poland called it an “act of aggression.” Polish Prime Minister Donald Tusk said the airspace violation in the early hours of Wednesday amounted to an intentional provocation from Moscow, forcing the NATO and European Union member state to close its airspace and order citizens in the eastern part of the country to stay indoors. Now, Poland will seek to trigger NATO consultations on a potential response, a procedure known as Article 4. This new development could draw NATO and its leading member, the United States, into direct military conflict with Russia.

The market knows Russia is no match for the U.S. when it comes to conventional military assets. However, Russia holds the wild card that every rogue nation wishes it had: intercontinental nuclear missiles.

In the meantime, Israel’s airstrike on Qatar’s capital on Tuesday delivered a major blow to U.S.-supported efforts to normalize ties with Gulf Arab nations and possibly crushed talks for a ceasefire in Gaza. The attack targeted leaders of Hamas and was condemned by Qatar's Gulf neighbors, including the United Arab Emirates and Saudi Arabia. The strike may have ended Qatar's role as a mediator in ceasefire negotiations, with other countries such as Turkey potentially being put on high alert.

The Israeli air strike on Hamas in Qatar follows a Hamas terrorist attack on Israeli citizens riding a bus earlier this week. The Israeli strike inside Qatar took the U.S. by surprise. President Donald Trump said about the matter: “I will tell you this, I was very unhappy about it,” he told reporters Tuesday night, adding that he expected to make additional comments today. “Very unhappy about every aspect — we got to get the hostages back, but I was very unhappy about the way that went down.”

It could well be that the past few months of relatively calm waters in the Middle East have come to an end. More instability in the Middle East will drive more safe-haven demand for precious metals.

Catalyst #2: Major Central Banks Are Leaning Easier on Their Monetary Policies

Tuesday saw sharp downward revisions in U.S. jobs growth numbers for the year ended in March. The numbers were down 911,000 for the year, which about cuts in half the monthly jobs-growth rate for the 12-month period ending in March from 147,000 to just over 70,000 a month. Those revised numbers could sap U.S. consumer confidence.

U.S. Treasury Secretary Scott Bessent called on the Federal Reserve to change its monetary policy stance and lower interest rates after the revised U.S. jobs numbers Tuesday. “They should, let’s see if they will,” Bessent said on Fox Business Tuesday, when asked if the Fed should recalibrate. “It turns out that we didn’t have good facts.”

In a posting on X Tuesday, the Treasury chief said further, “President Trump inherited a far worse economy than reported, and he’s right to say the Fed is choking off growth with high rates.” The market is nearly unanimous in thinking the Fed will cut the U.S. fed funds rate range by 0.25% at next week’s FOMC meeting. Much of the market thinks the Fed will reduce the Fed funds rate by a total of at least 0.75% by the end of this year.

The European Central Bank cut rates by 25 basis points to 2% in early June, followed by a decision to hold rates steady in July. The market expects the ECB to continue to hold rates steady at its meeting this week. Several other central banks have cut their interest rates this year, including the Swiss National Bank, the Bank of Canada, and the Bank of England.

Lower global interest rates suggest faster world economic growth and better consumer and commercial demand for raw commodities, including metals. Specifically, lower interest rates in the U.S. are bearish for the U.S. dollar on the foreign exchange market. Gold and the U.S. dollar have generally (but not always) traded in inverse relationships, daily, in past years.

Catalyst #3: Major Countries Are Rushing to Stockpile Key Minerals

This may be the most important and most bullish element of the three I have discussed in this report.

China appears on a mission to be the holder of the most strategic minerals on earth. China’s dominance over mining and processing, its export restrictions, and active stockpiling of valuable “rare-earth” minerals have caught the attention of other major countries which are now doing the same.

The U.S. has its own National Defense Stockpile of critical materials. Recent administrations have signed executive orders and funded initiatives to invest in domestic rare earth mining, processing, and recycling to reduce dependence on China. The European Union has established its own strategic stockpiling program for critical minerals. This is part of a broader strategy, including the Critical Raw Materials Act, designed to reduce supply chain vulnerability. Australia, Japan and South Korea have all done similar things to secure strategic minerals.

The trend of stockpiling strategic minerals (which includes precious metals) among major industrialized countries is relatively new from a historical perspective. It’s likely this trend will continue for many years to come. As China grows in economic power, it and the U.S. will be the major competitors for rare-earth minerals. Right now, it appears the rare-earth minerals mantra of both the U.S. and China is: “Too much is not enough.” That’s likely a bullish tonic for the precious metals markets for years to come.

Tell me what you think. I really enjoy getting emails from my valued Barchart readers all over the world. Email me at jim@jimwyckoff.com.

On the date of publication, Jim Wyckoff did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.