Three gold mining stocks have marked significant improvements in their quality rankings, coinciding with gold prices reaching new highs this week.

These stocks have now entered the top 10% bracket for quality, a notable achievement that highlights their operational efficiency and financial health compared to industry peers.

What Does Quality Ranking Mean?

Benzinga Edge Stock Rankings‘ quality metric is a composite score that analyzes a company's operational efficiency and financial health, relying on historical profitability and fundamental strength indicators.

This score is expressed as a percentile, showing how a company measures up against its sector peers.

3 Gold Mining Stocks With Top-Notch Quality

Anglogold Ashanti PLC (NYSE:AU), Coeur Mining Inc. (NYSE:CDE), and New Gold Inc. (NYSE:NGD) achieved a place in the top 10th percentile, which signifies that these stocks are outperforming many of their competitors on these key metrics.

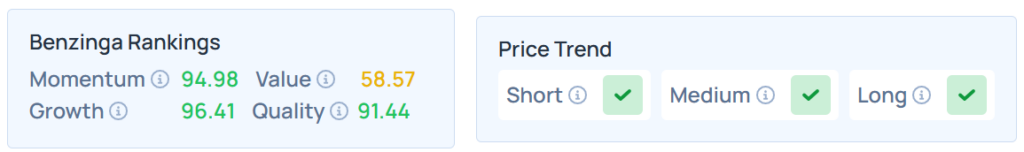

Anglogold Ashanti

- AU saw its quality percentile rise from 88.68 last week to the 91.44th percentile this week, a gain of 2.76 points. This move underscores the company's strengthening fundamentals just as the gold price surges.

- The stock has gained by 165.08% year-to-date and 136.60% over a year.

- It maintains a stronger price trend over the short, medium, and long terms with a strong growth ranking. Additional performance details are available here.

See Also: 3 Crypto ETFs Poised To Surge With Big Spikes In Momentum Ranking And Fund Scores

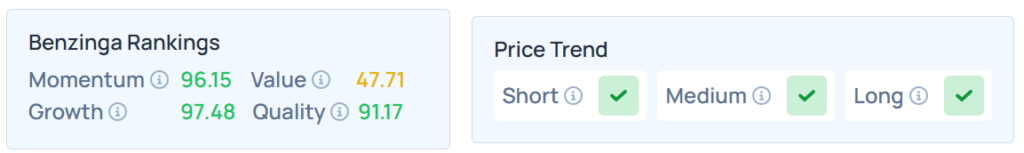

Coeur Mining

- CDE jumped from 89.21 to the 91.71th percentile, posting a week-on-week boost of 2.5 percentile points. CDE's inclusion in the top 10% reflects a marked improvement in profitability and operational metrics, aligning with the renewed investor focus on mining stocks.

- Higher by 158.06% YTD, the stock was up 137.04% over the year.

- With a moderate value ranking, this stock maintained a stronger price trend over the short, medium, and long terms. Additional performance details are available here.

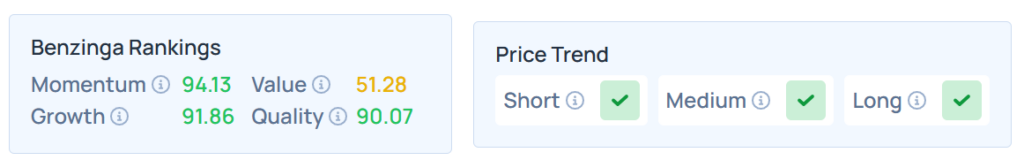

New Gold

- NGD climbed from 89.18 to the 90.07th percentile, with a positive change of 0.89 percentile points. NGD's ascent into the top quality bracket echoes broader sector tailwinds from rising gold prices.

- The stock advanced 146.56% YTD and 116.05% over the year.

- It had a stronger price trend in the short, medium, and long terms with a moderate value ranking. Additional performance details are available here.

Gold prices breaking fresh highs have prompted increased scrutiny and interest in leading gold miners. Investors are seeking quality as a differentiator, and these three stocks stand out for outperforming their peers on key financial and operational criteria. The percentile changes further validate their momentum, demonstrated by sharply improved rankings in a pivotal market moment.

Price Action

Gold Spot US Dollar rose 0.25% to hover around $3,669.12 per ounce. Its last record high stood at $3,707.70 per ounce. The prices have surged 19.93% over the last six months and 42.16% over the year.

The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, rose in premarket on Thursday. The SPY was up 0.86% at $664.86, while the QQQ advanced 1.03% to $596.07, according to Benzinga Pro data.

On Thursday, the futures of the Dow Jones, S&P 500, and Nasdaq 100 indices were higher.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga

Image via Shutterstock