Three stocks within the Electrical Equipment and Parts industry have recorded exceptional spikes in their momentum percentile rankings, signaling notable shifts in investor sentiment and price action over the past week.

This marked improvement in relative strength highlights each stock's accelerating price movement as compared to sector peers.

3 Electrical Equipment And Parts Stocks In Focus

GrafTech International Ltd. (NYSE:EAF), Flux Power Holdings Inc. (NASDAQ:FLUX), and Plug Power Inc. (NASDAQ:PLUG) improved their momentum rankings this week.

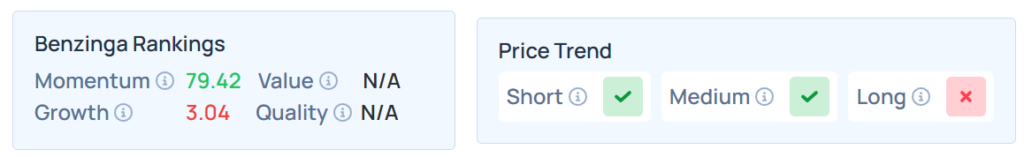

GrafTech International

- EAF achieved an impressive leap in momentum score, moving from the 17.26th to the 79.42th percentile, a gain of 62.16 points week-on-week.

- The stock has tumbled by 26.16% year-to-date and 45.14% over a year.

- It maintains a stronger price trend over the short and medium, but a weak trend in the long term, with a poor growth ranking. Additional performance details are available here.

See Also: 3 Gold Mining Stocks Shine As Prices Hit Records

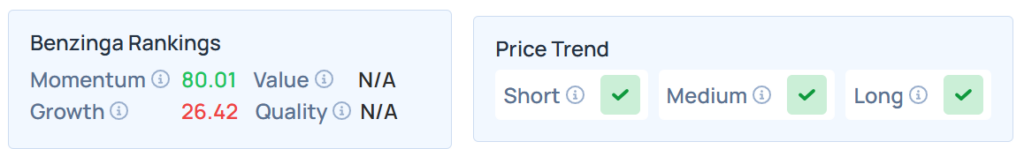

Flux Power Holdings

- FLUX posted a robust momentum improvement of 59.14 percentile points, surging from the 20th to the 80th percentile in just one week.

- Higher by 47.70% YTD, the stock was down 16.29% over the year.

- With a poor growth ranking, this stock maintained a stronger price trend over the short, medium, and long terms. Additional performance details are available here.

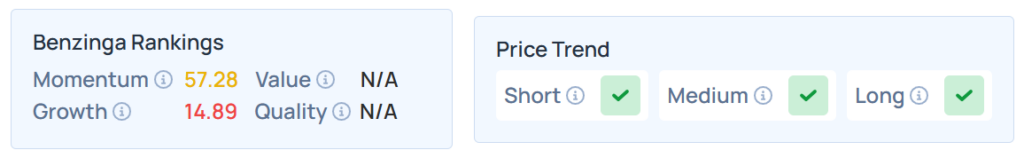

Plug Power

- PLUG rounded out the trio with an equally remarkable ascent, jumping 43.53 percentile points from the 13th to the 57th percentile.

- The stock declined 9.87% YTD and 1.94% over the year.

- It had a stronger price trend in the short, medium, and long terms, with a poor growth ranking. Additional performance details are available here.

What Do Momentum Spikes Mean?

According to Benzinga Edge Stock Ranking methodology, the momentum score represents a stock's relative strength based on its recent price movement and volatility, assessed across multiple timeframes and ranked percentile-wise against other stocks.

A swift week-on-week increase signals notable outperformance and can indicate shifting market interest, prospective trend reversals, or the beginnings of sustained rallies.

Price Action

The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, were mixed in premarket on Friday. The SPY was down 0.12% at $661.45, while the QQQ rose 0.19% to $596.47, according to Benzinga Pro data.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga

Image Via SHutterstock