Dividend stocks aren’t usually affected as much by broad market volatility. Sure, they might follow similar patterns sometimes, but for the most part, they don’t tend to swing as wildly. Part of the reason for this is that investors who hold dividend stocks usually do so for the long term. The problem with dividend stocks, or more specifically, quality companies that have a history of increasing dividends, for say 50+ years, is that they often fail to outperform the market. The result? Some investors shy away.

So, today, I went out on a hunt to find some Dividend Kings - companies that have increased dividends for 50 or more straight years - that have actually outperformed the S&P 500 this year. Of course, I refined my list to include only the best of the best - according to the analysts.

Today, let’s look at them and see if they deserve a spot in your long-term or retirement portfolio.

How I Came Up With The Following Stocks

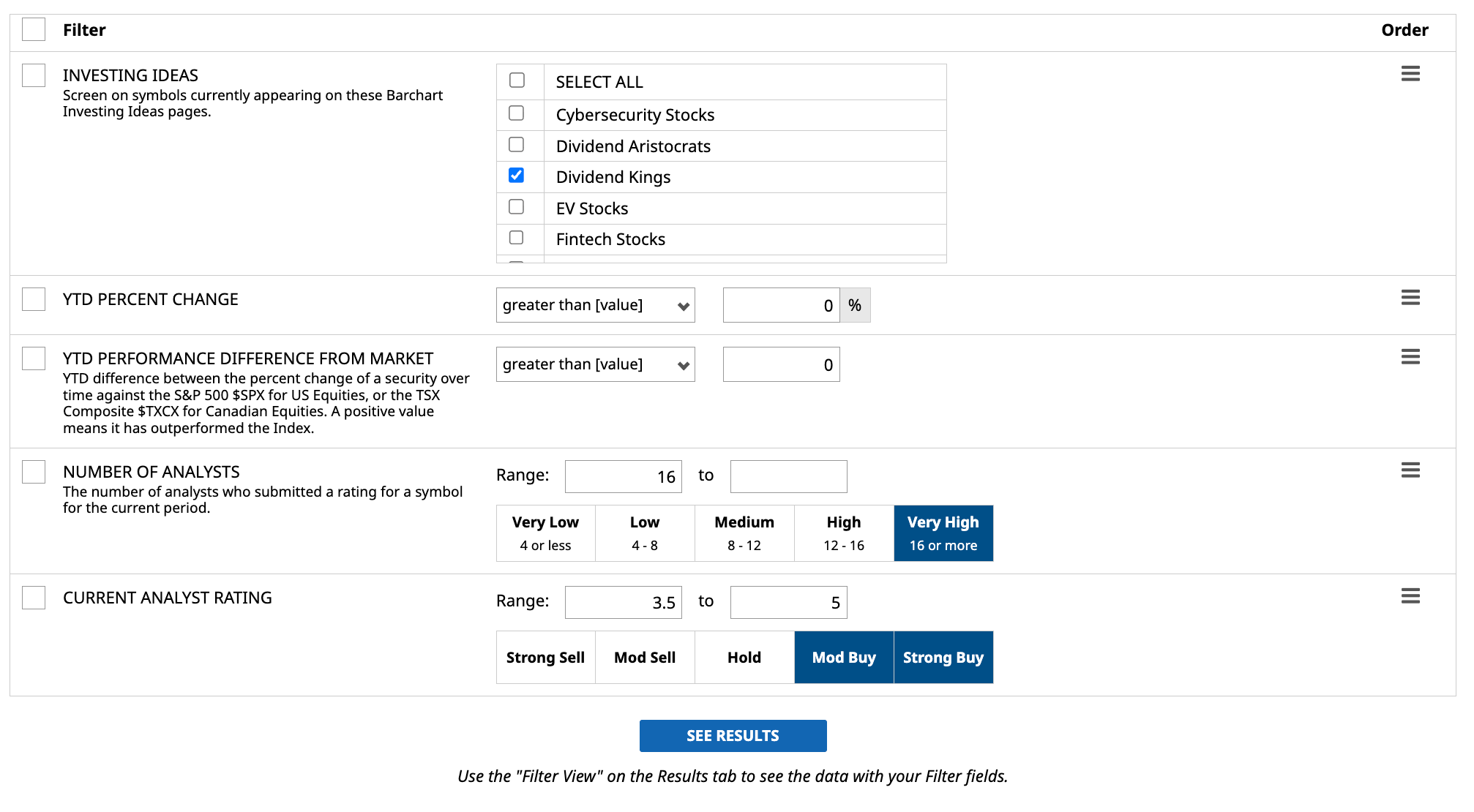

From Barchart’s Stock Screener tool, I searched for the following filters:

- Investing Ideas: Dividend Kings. These are companies that have paid increasing dividends for 50+ years.

- Current Analyst Rating: 3.5 to 5 (Moderate to Strong Buy). The results should be top-shelf Dividend Kings, at least according to Wall Street.

- YTD Performance Difference From Market: Greater than 0. This filter, meanwhile, limits the results to companies that have outperformed the S&P 500 by any amount. By the way, the values shown here represent the absolute difference in performance, not the percentage ratio.

- YTD Percent Change: Above 0. This filter limits the results to stocks that have shown positive performance year-to-date.

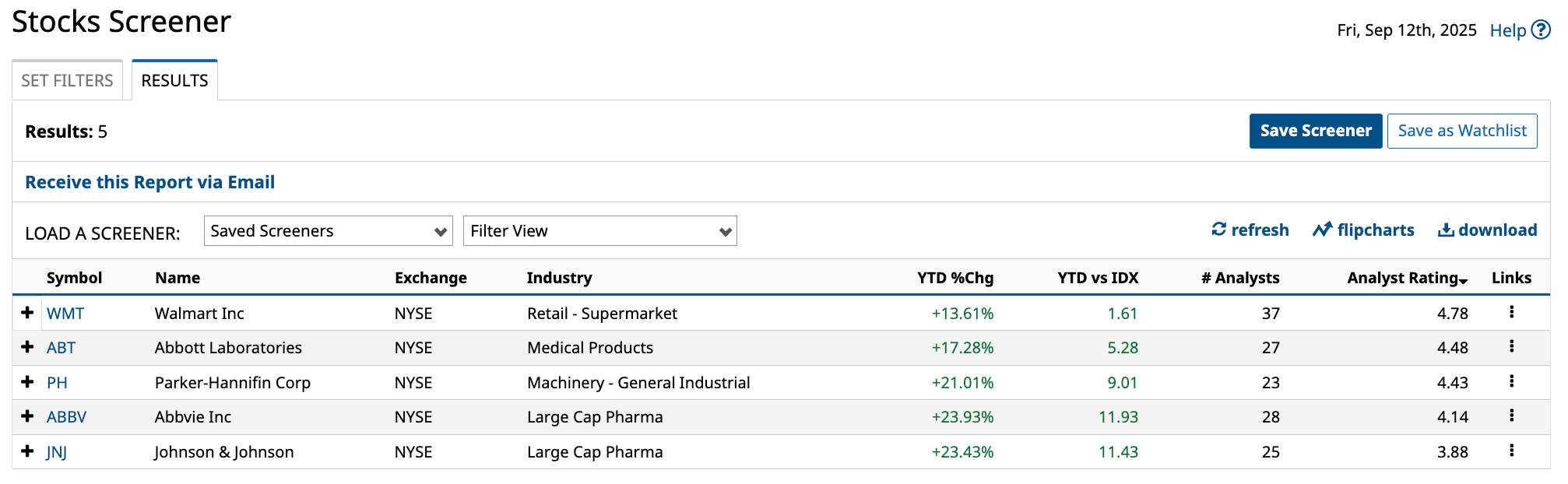

With these filters, I got exactly five companies, which I then arranged from highest to lowest analyst rating.

So, let’s get started with the highest-rated dividend king on the list:

Walmart Inc (WMT)

Walmart Inc. started as a modest brick-and-mortar retailer that has evolved into one of the world's largest omni-channel retailers. Walmart receives over 255 million customer visits across its 10,797 physical stores and online portals each week. There is no shortage of reach, which makes the company the formidable go-to retailer it is today.

WMT stock has grown 13.61% year-to-date, 1.61 percentage points away from the S&P 500’s performance over the same period. It might look small, but a win is a win.

As of 2025, Walmart has increased its dividends for 52 consecutive years. Currently, the company pays $0.2350 quarterly per share, or $0.94 per year, which translates to around a 0.93% forward yield. So far, that’s the lowest yield on this list.

However, WMT stock makes up for it with a strong buy rating and an average score of 4.78 - the highest on this list.

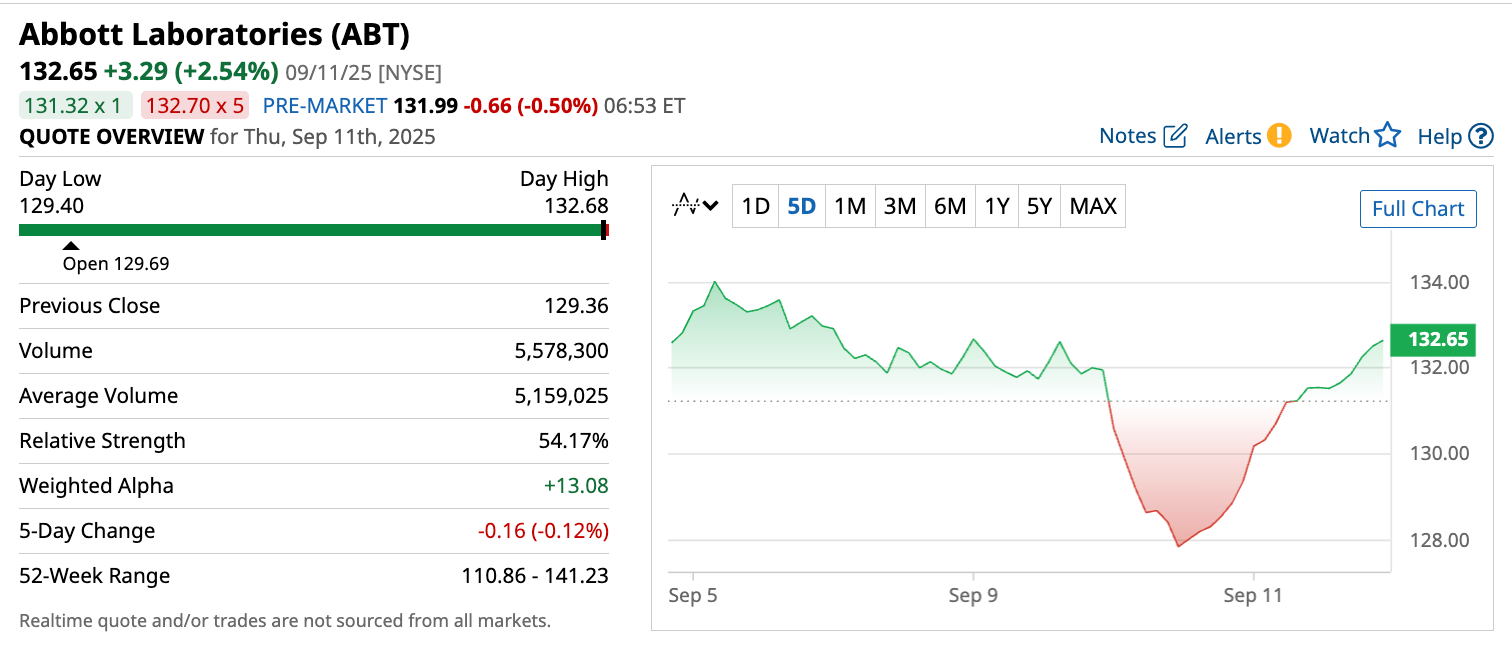

Abbott Laboratories (ABT)

Abbott is one of those rare companies that seems to do it all, and they’ve been doing it since 1888. Since then, Abbott has become the world's most diversified healthcare company operating worldwide. Whether it’s diagnostics, medical devices, nutrition, or everyday healthcare essentials, chances are you’ve come across an Abbott product without even realizing it.

What really sets Abbott apart, though, is its commitment to shareholders. Abbot has paid increasing dividends for 53 consecutive years. That’s a rather exclusive club, and it speaks volumes about Abbott’s business and management's commitment to shareholder value.

The company currently pays $2.36 per share annually, or $0.59 per quarter, which translates to a forward dividend yield of approximately 1.7%. With a payout ratio hovering around 46%, there’s still plenty of room for future growth.

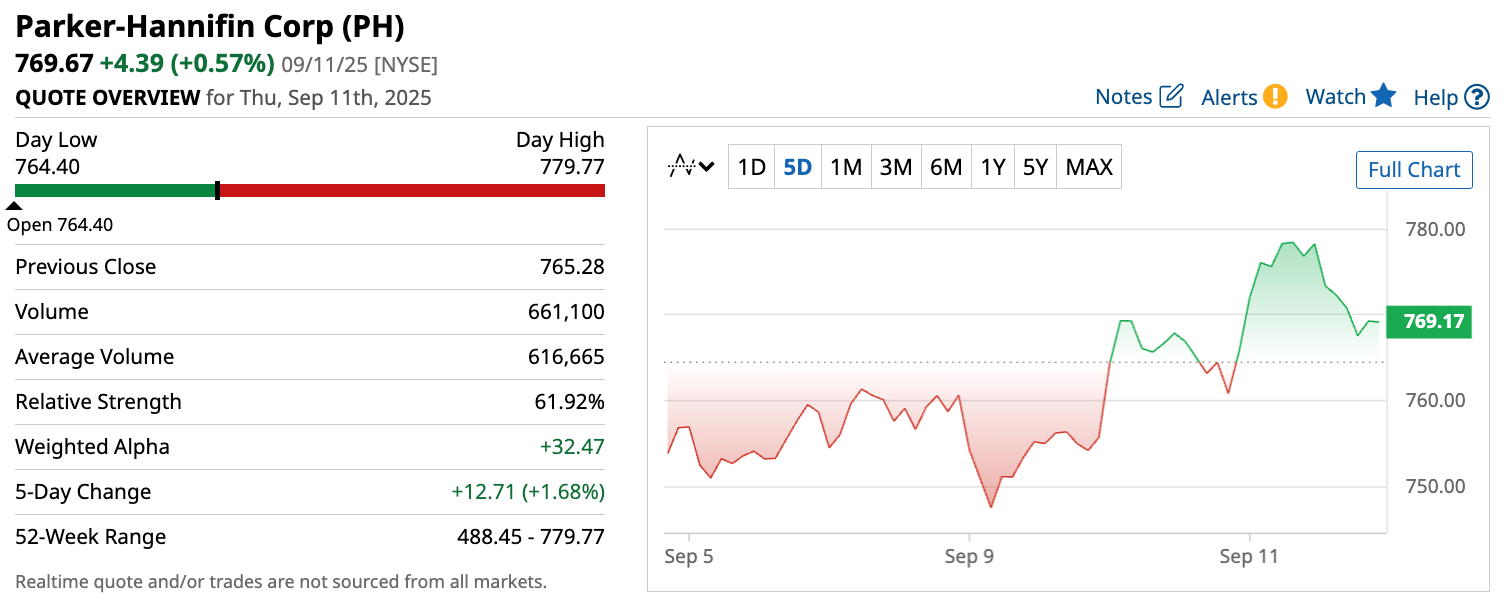

Parker-Hannifin Corp (PH)

Last, but certainly not least ,is Parker-Hannifin Corporation, commonly referred to as Parker for short. Parker is a top engineering firm and a global leader in motion and control technologies. Think hydraulic systems, pneumatics, adhesives and protective coatings, fluid and filtration systems, and aerospace components. Its products are used in everything from factories and underwater drilling stations to medical devices and space stations.

Parker-Hannifin is the best performer on this list, with a 21.01% year-to-date return, outperforming the S&P 500 by 9.01 percentage points.

Parker pays a 0.94% dividend based on a $1.80 quarterly payout. However, the company has maintained a 69-year streak of dividend increases, so its real strength lies in reliability and consistency, rather than yield numbers.

Additionally, analysts appear to be generally pleased with PH stock, rating it a strong buy with an average score of 4.52.

Final Thoughts

These three Dividend Kings have what it takes to beat the market now. What more can we expect in the next twelve months, with analysts expecting even more growth?

However, long-term dividend investing isn’t all about riding the highs. Even if the next year looks absolutely rosy for the companies on this list, the smart money knows not to let its guard down. Constantly monitor your positions and the news for further developments and remember, suggestions can be found everywhere on the internet, but your own due diligence should never be overlooked.

On the date of publication, Rick Orford did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.