In an unpredictable market that shifts between greed and fear, income investors who own Dividend Kings sleep better at night, almost assured income will keep flowing.

Dividend Kings are an elite group of companies that have consistently increased their dividends for at least the last 50 consecutive years. Unlike the Dividend Aristocrats, Kings don’t need to be S&P 500 listed. Regardless, I think it’s easy to conclude that if a company can increase its dividend for 50+ years, they aren’t just survivors of market downturns, recessions, and volatility; they thrived through them.

In this article, I will cover three Dividend Kings that demonstrate exceptional performance, and steady growth, all while providing exceptional value for shareholders. These companies prove that lasting success in the market is not anchored only on hype and short-term rallies, but on decades of discipline and resilience.

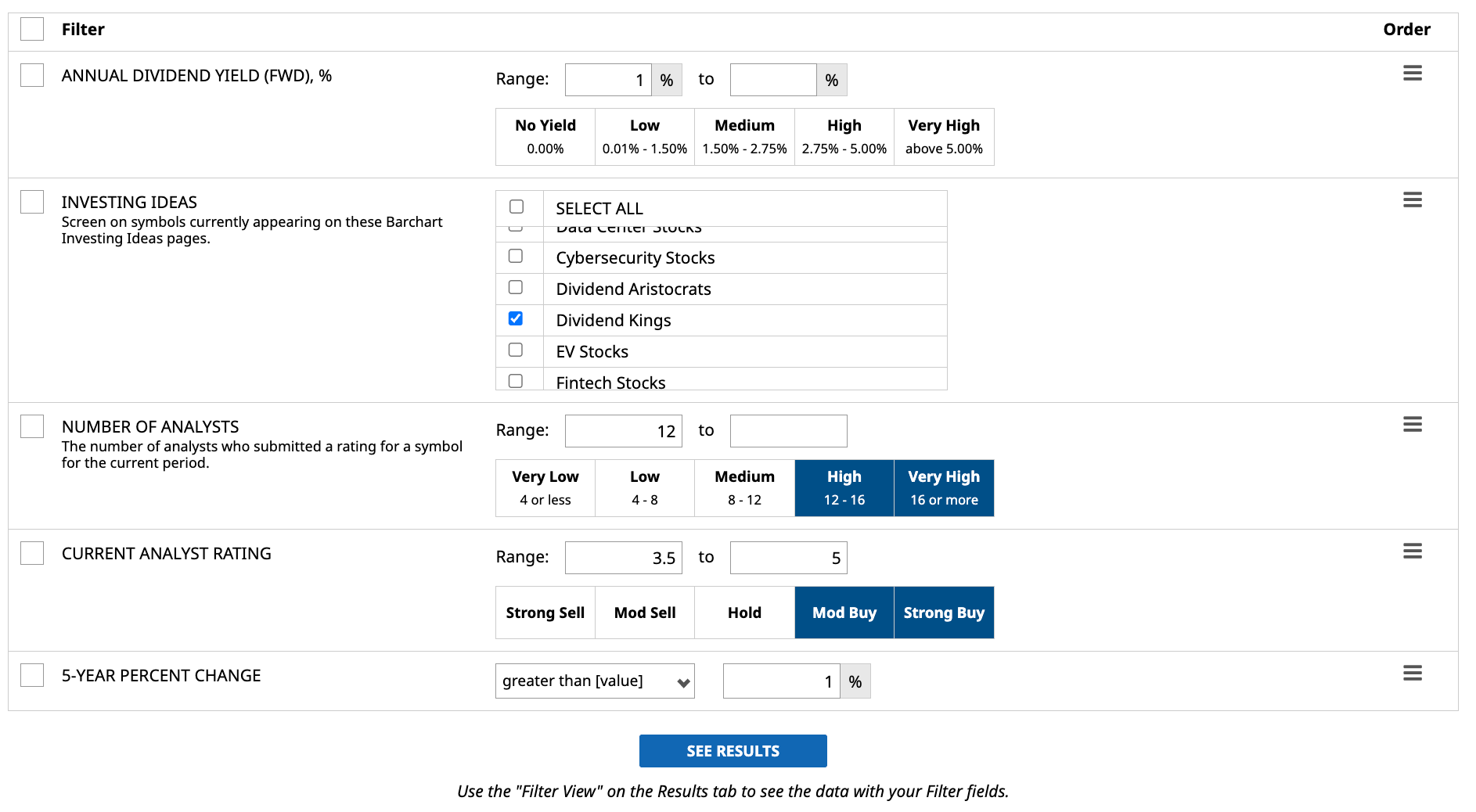

I used Barchart’s Stock Screener to find the highest-yielding companies on my watchlist.

- 5-Year Percent Change: Left blank to be sorted from highest to lowest

- Annual Dividend Yield (FWD), %: To filter only companies paying at least 1%.

- Number of Analysts: 12 or higher. A higher number suggests greater confidence in the consensus.

- Current Analyst Rating: 3.5 – 5. Moderate to Strong Buy, particularly those that are expected by Wall Street to perform well

- Investing Ideas: Dividend Kings, or companies that have exhibited consistent resilience and strong performance.

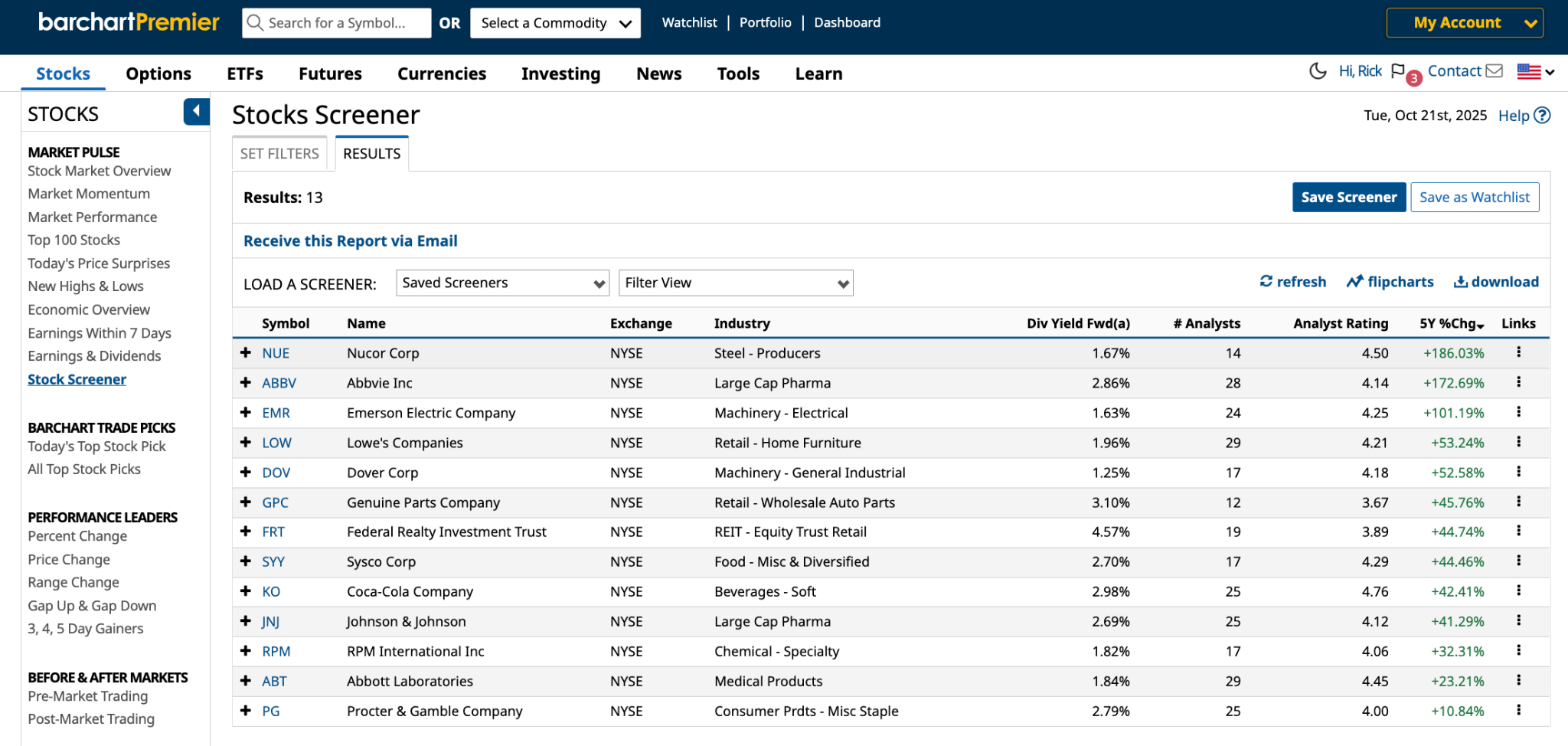

I hit “See Results” and got 13 companies. I’ll cover three of them, from the highest to the lowest in terms of their stock performance over the last five years.

Let’s kick off this list with the first Dividend King:

Nucor Corp (NUE)

The first Dividend King on this list is Nucor Corp, the largest steel producer here in the United States, with over 300 operating facilities. It is also the largest recycler of scrap metal in North America. The company is behind a variety of steel and steel products, such as raw steel, sheet steel, rebar, and more. It was founded in 1940 and is now headquartered in Charlotte, North Carolina.

Last month, Nucor announced its earnings guidance for the third quarter of 2025, in which it expected profits of $2.05 to $2.15 per share. It also shared that it rewards shareholders through buybacks and dividends that total nearly $ 1 billion year-to-date.

Now that I touched on earnings, Nucor's most recent quarterly financials reported sales increasing 4.7% year-over-year to $8.5 billion. However, net income was down 6.5% from the same quarter last year to $603 million, which is most likely due to margin compression and higher input costs.

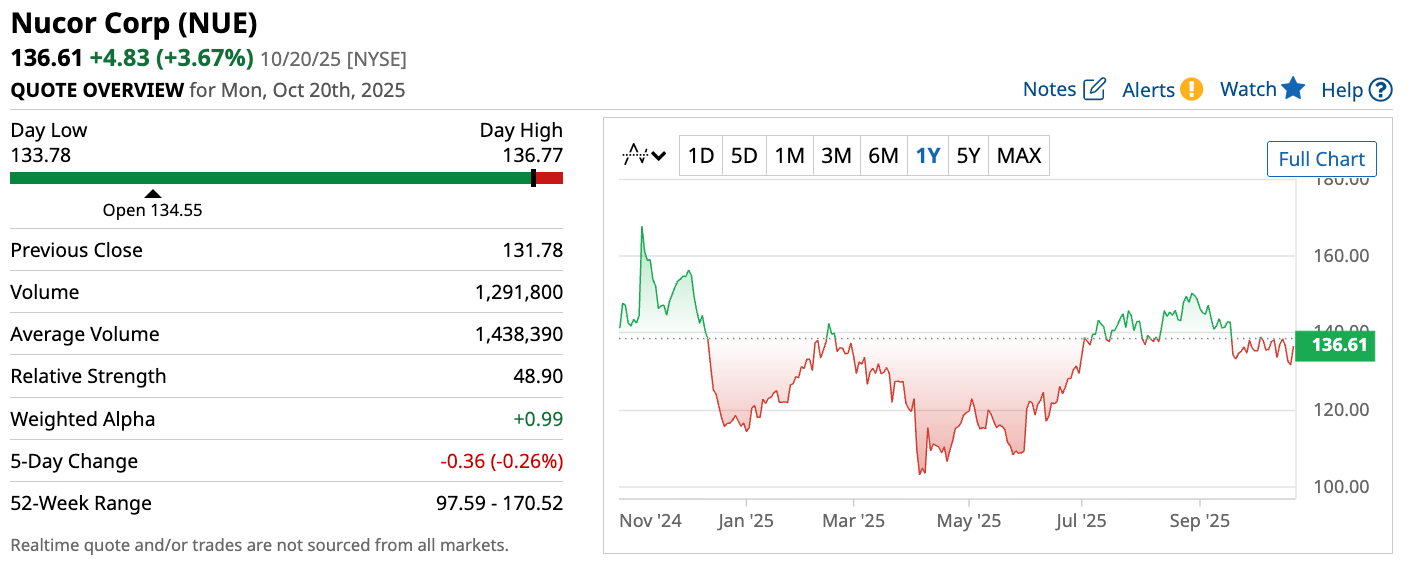

NUE stock trades around $136 and pays a forward annual dividend of $2.20, translating to a yield of ~1.6%. Its 5-year Dividend Growth is 35.63% and the stock is up 186% over the last five years.

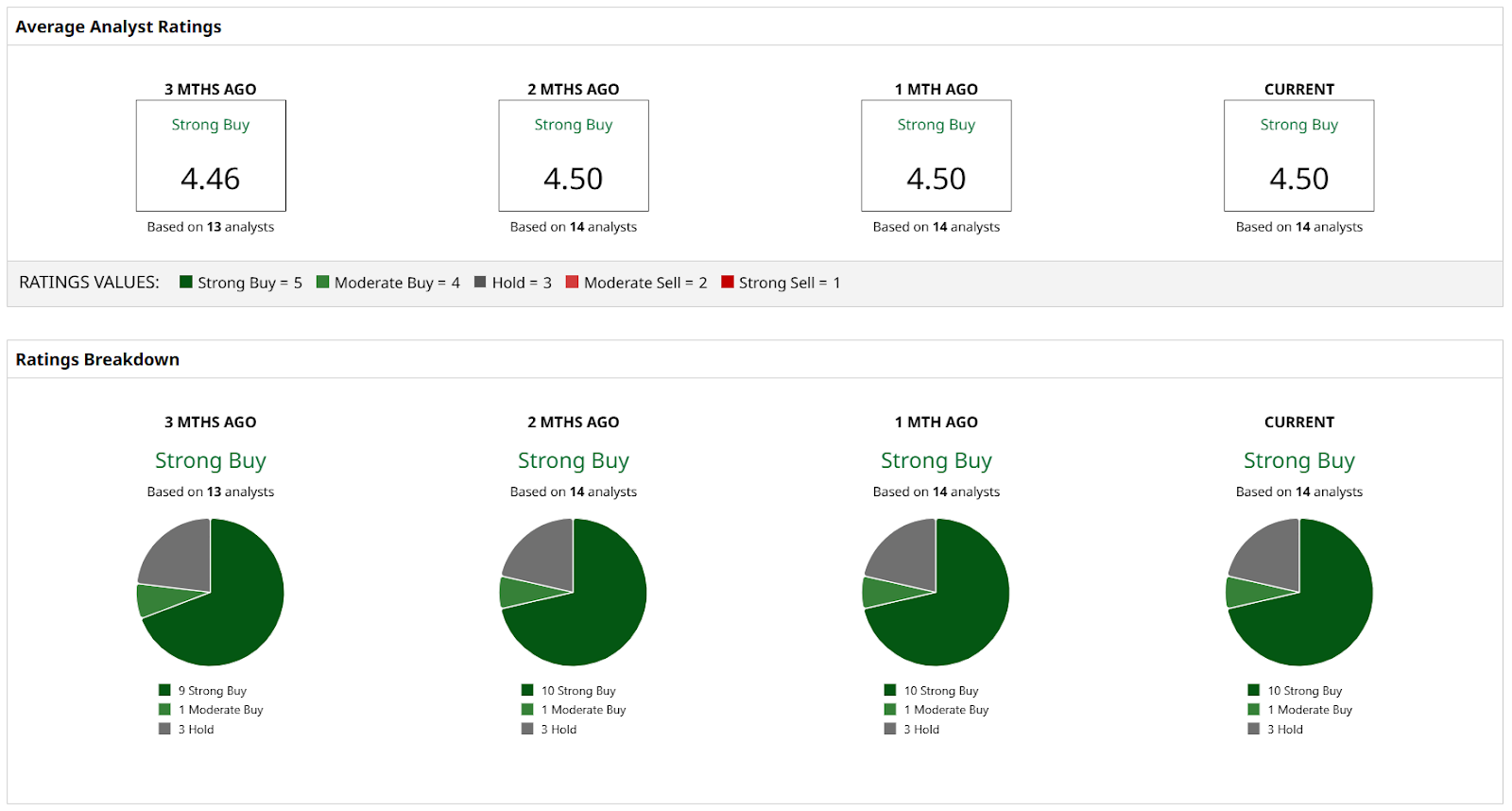

A consensus among 14 analysts rates the stock a “Strong Buy” with a score of 4.5/5. Similar to AbbVie, analysts are expecting Nucor to outperform.

Abbvie Inc. (ABBV)

AbbVie Inc. is a biopharmaceutical company that develops and manufactures medicines and solutions for different health issues related but not limited to immunology, oncology, neuroscience, and eye care. It was founded in 2012 as a spin-off from Abbott Laboratories.

Just last week, AbbVie announced the completion of its acquisition of Gilead Sciences' bretisilocin, which is an advanced psychedelic that is in Phase 2 trials for major depressive disorder. This move highlights AbbVie's strong commitment to treatments in mental health.

In its most recent quarterly financials, AbbVie reported sales rose 6.6% year-over-year to $15.4 billion, while its net income was down 31.5% from the same quarter last year to $938 million. The company's profit fell mainly due to higher costs and the continued decline in Humira sales, but it is something that AbbVie can recover from.

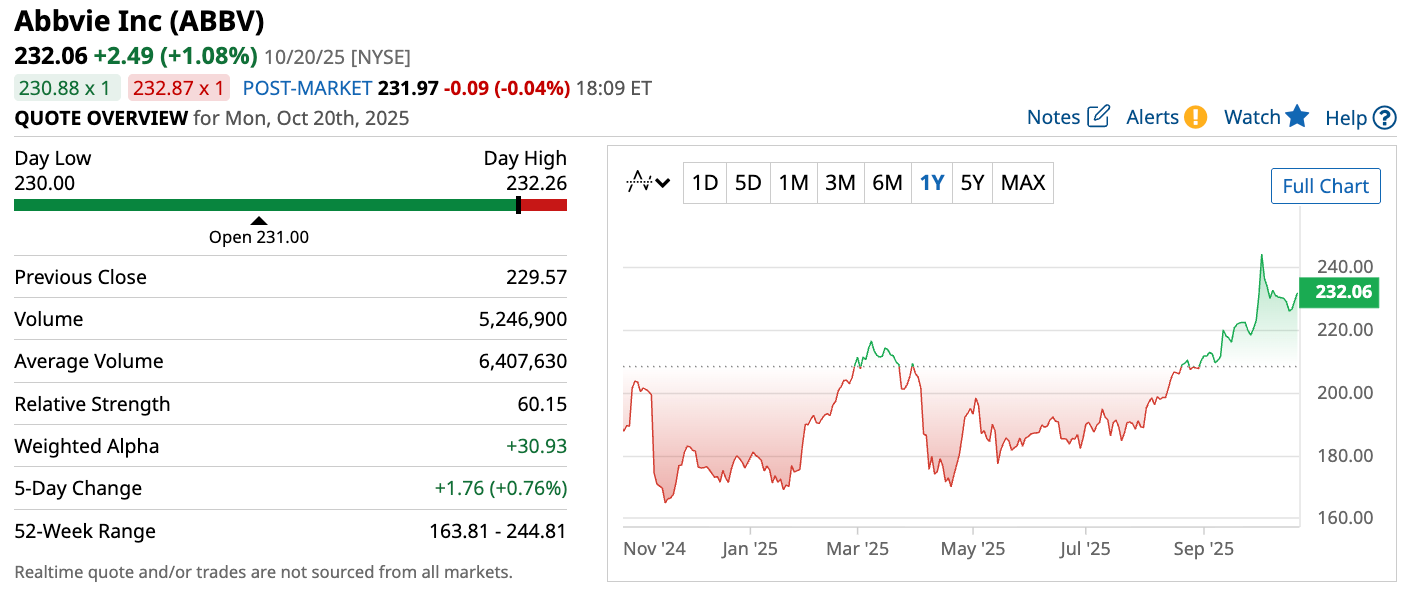

AbbVie stock is trading around $232, and it pays a forward annual dividend of $6.56, translating to a yield of about 2.8%. Its 5-year Dividend Growth is 44.86% while its stock is up over 173% over the last five years.

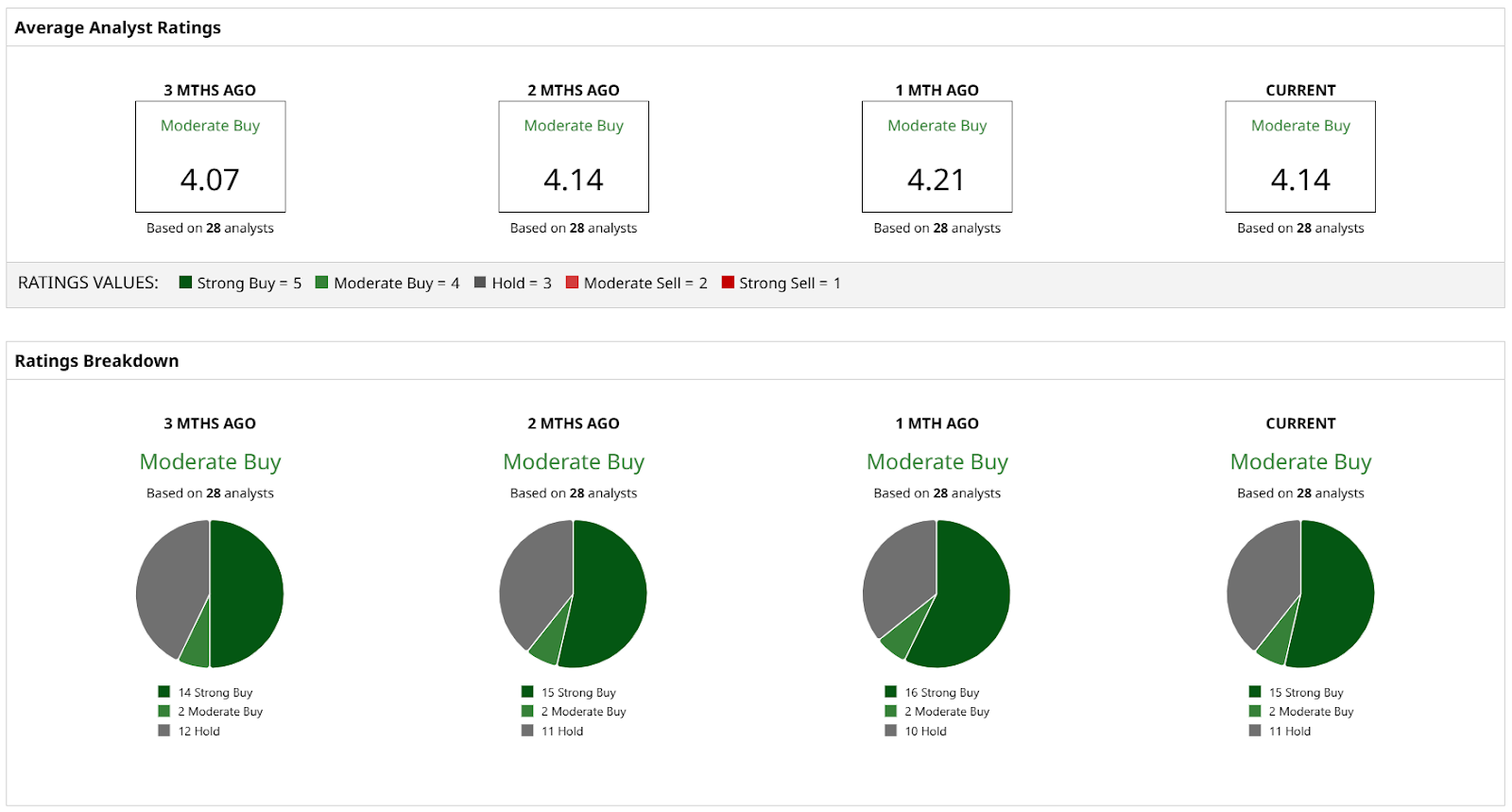

A consensus among 28 analysts rates the stock a “Moderate Buy” with a score of 4.14/5. No analysts suggested a sell, meaning the company is generally expected to perform well.

Emerson Electric Company (EMR)

The last Dividend King on my list is Emerson Electric Company, a multinational whose products and services include technology, software, and engineering. Founded in 1890, Emerson Electric is now a global leader in automation solutions, including control systems and intelligent devices.

Just last month, Emerson Electric announced the completion of a multi-year modernization project for Salt River Project's hydroelectric dams in Arizona, which reduced maintenance costs by 30% and troubleshooting time by half, generally improving operational efficiency that supports renewable energy demands.

The company’s most recent financials reported sales were up 3.9% year-over-year to $4.56 billion, with net income rising 78.1% from the same quarter last year to $586 million.

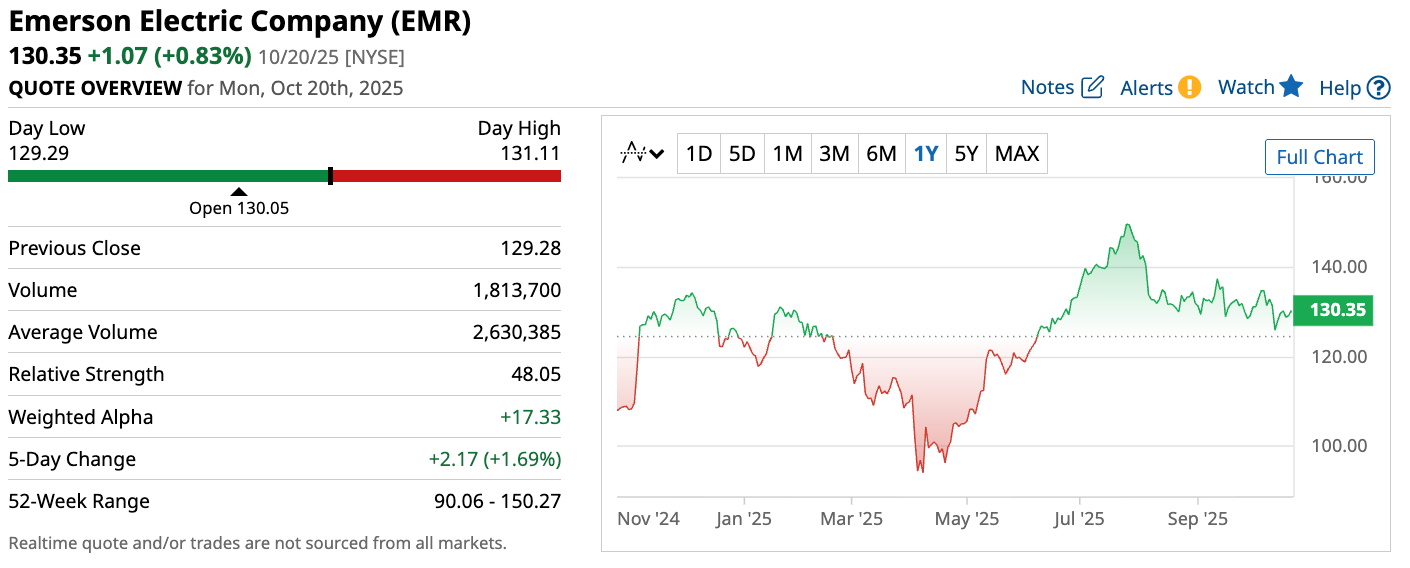

EMR stock trades at around $130 and the company pays a forward annual dividend of $2.11, which translates to a yield of ~1.6%. Over the last five years, the stock is up over 10%, lower than AbbVie and Nucor, but still a strong performer with steady long-term growth and resilience.

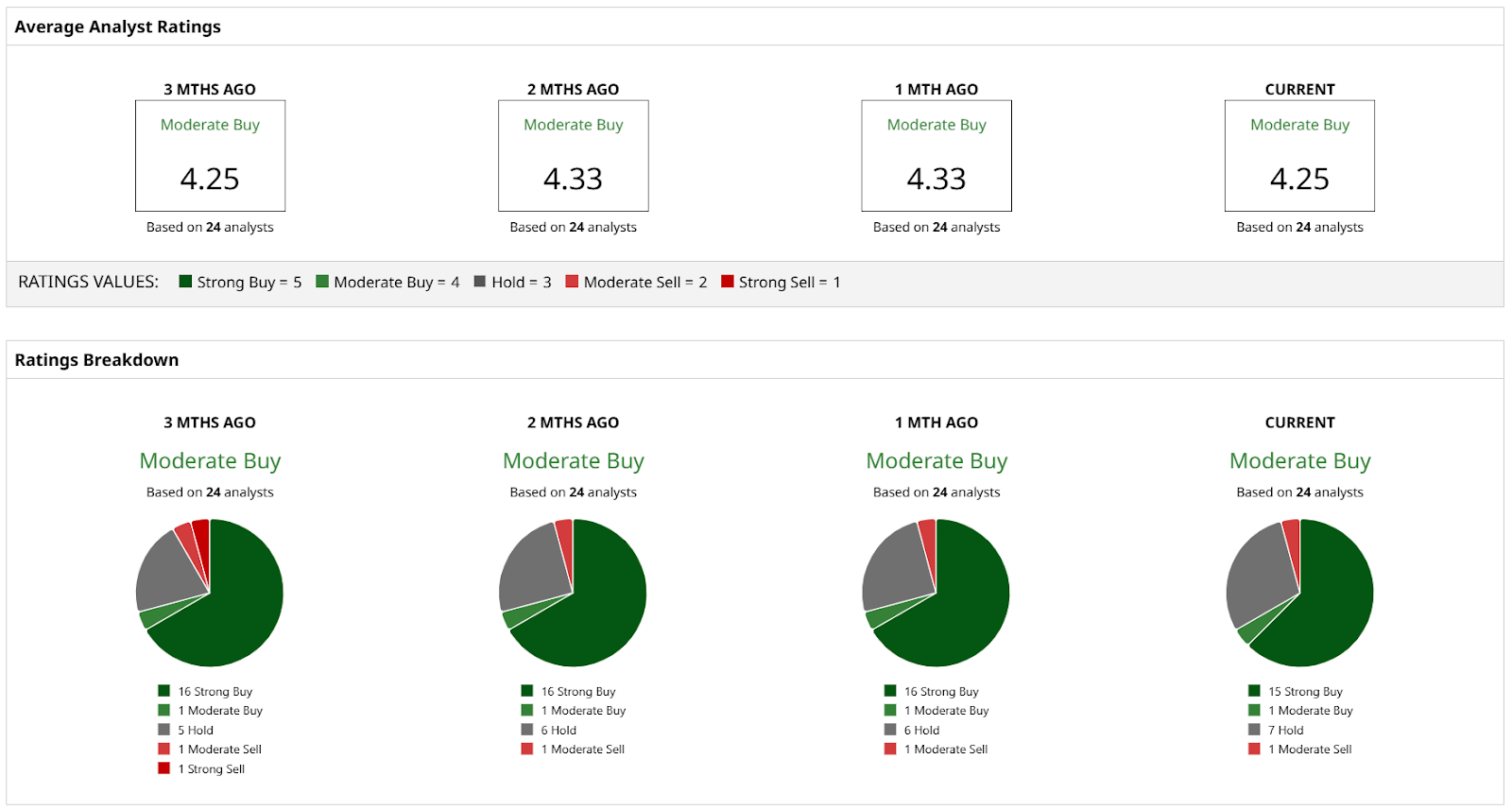

A consensus among 24 analysts rates EMR stock a “Moderate Buy” with a score of 4.25/5. One analyst rated the stock a moderate sell, which is likely due to concerns over slow near-term growth and valuation pressures from the company's recent share price performance.

Final Thoughts

There you have it, three Dividend Kings that topped long-term strength, steady growth, and consistent shareholder value. These companies show discipline and resilience, but remember that it does not make them immune to headwinds. As an investor, you should watch out for shifts, rising costs, and external pressure that can test a company's momentum, even for the most reliable ones.

On the date of publication, Rick Orford did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.