The market continues to show some encouraging signs and if that continues, bull put spread trades could do well.

To execute a bull put spread, an investor would sell a naked put and then buy a further out-of-the-money put to create a spread.

A bull put spread is considered less risky than a naked put, because the losses are capped thanks to the bought put.

The following trades are short-term and high risk, so should only be considered by experienced option traders.

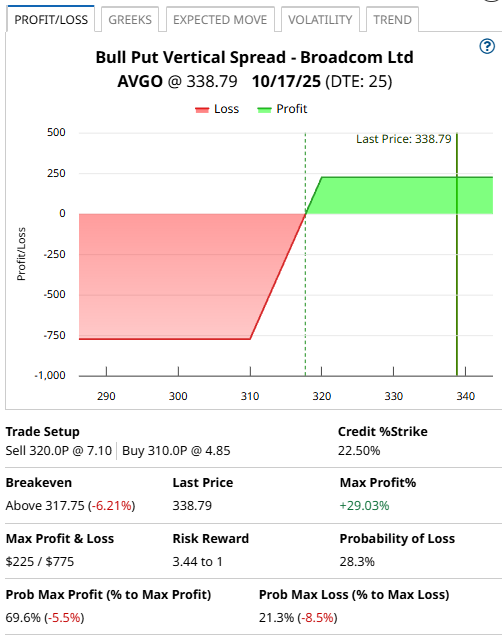

AVGO Bull Put Spread Example

Broadcom (AVGO) is pulling back, but is still above the 21, 50 and 200-day moving averages and is showing a 100% Buy rating with a Strengthening short term outlook on maintaining the current direction.

Selling the October 17 put with a strike price of $320 and buying the $310 put would create a bull put spread.

This spread was trading for around $2.25 yesterday. That means a trader selling this spread would receive $225 in option premium and would have a maximum risk of $775.

That represents a 29.03% return on risk between now and October 17 if AVGO stock remains above $320.

If AVGO stock closes below $310 on the expiration date the trade loses the full $775.

The breakeven point for the bull put spread is $317.75 which is calculated as $320 less the $2.25 option premium per contract.

In terms of a stop loss, if the stock dropped below $320, I would consider closing early for a loss.

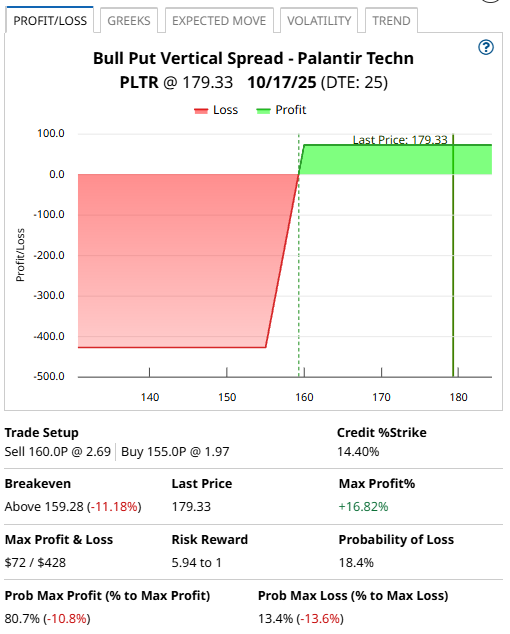

PLTR Bull Put Spread Example

Palantir (PLTR) stock has been on fire lately and is rated a 100% Buy with a Strongest short term outlook on maintaining the current direction.

Selling the October 17 put with a strike price of $160 and buying the $155 put would create a bull put spread.

This spread was trading for around $0.72 yesterday. That means a trader selling this spread would receive $72 in option premium and would have a maximum risk of $428.

That represents a 16.82% return on risk between now and October 17 if PLTR stock remains above $160.

If PLTR closes below $155 on the expiration date the trade loses the full $428.

The breakeven point for the bull put spread is $159.28 which is calculated as $160 less the $0.72 option premium per contract.

In terms of a stop loss, if the stock dropped below $165, I would consider closing early for a loss.

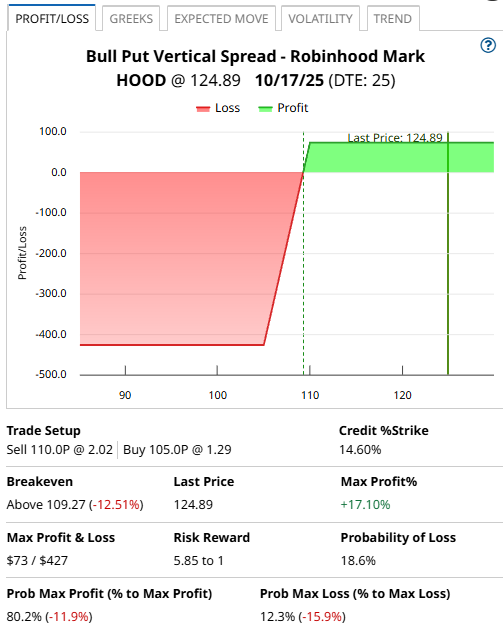

HOOD Bull Put Spread Example

Robinhood Markets (HOOD) is also in a strong uptrend, is rated a 100% Buy with a Strongest short term outlook on maintaining the current direction.

Selling the October 17 put with a strike price of $110 and buying the $105 put would create a bull put spread.

This spread was trading for around $0.73 yesterday. That means a trader selling this spread would receive $73 in option premium and would have a maximum risk of $427.

That represents a 17.10% return on risk between now and October 17 if HOOD stock remains above $110.

If HOOD closes below $105 on the expiration date the trade loses the full $427.

The breakeven point for the bull put spread is $109.27 which is calculated as $110 less the $0.73 option premium per contract.

In terms of a stop loss, if the stock dropped below $115, I would consider closing early for a loss.

Please remember that options are risky, and investors can lose 100% of their investment.

This article is for education purposes only and not a trade recommendation. Remember to always do your own due diligence and consult your financial advisor before making any investment decisions.