Three BlackRock fixed-income closed-end funds experienced notable declines in their quality rankings this week, pushing each into the market's bottom decile for operational efficiency and financial health. This shift comes as U.S. Treasury yields have been declining, causing changes across the credit markets.

What Does Quality Ranking Mean?

According to the Benzinga Edge’s Stock Ranking methodology, the quality score is a percentile-based measure that evaluates a fund's operational efficiency and financial health on a relative basis, factoring in historical profitability and key fundamental indicators compared to peers.

3 BlackRock Funds Deteriorate In Quality Ranking

The marked deterioration across these three BlackRock funds, namely, BlackRock Credit Allocation Income Trust (NYSE:BTZ), BlackRock Debt Strategies Fund Inc. (NYSE:DSU), and BlackRock Corporate High Yield Fund Inc. (NYSE:HYT), underscores the current challenges plaguing credit sectors, exposing vulnerabilities just as traditional safe havens lose favor amid fluctuating yields.

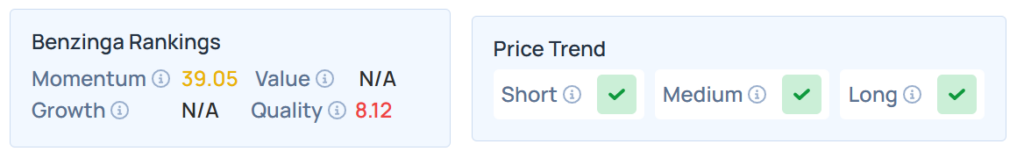

Blackrock Credit Allocation Income Trust

- BTZ entered the week with a quality percentile score of 14.9 but ended at just 8.12, representing a week-on-week collapse of 6.78 points.

- The fund has gained 5.43% year-to-date, and it was down -0.09% over a year.

- It maintains a stronger price trend over the short, medium, and long terms with a moderate momentum ranking. Additional performance details are available here.

See Also: 4 Tech Stocks That Look Overpriced — Do You Own One?

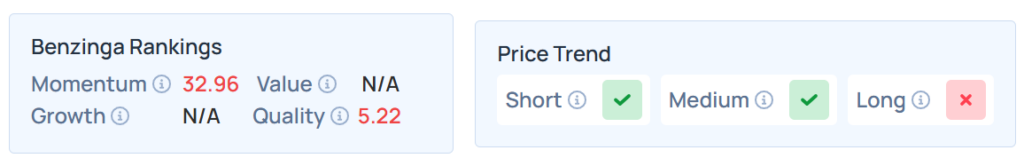

BlackRock Debt Strategies Fund Inc.

- DSU’s fall was even steeper, dropping from a prior percentile ranking of 20.05 to 5.22, a week-on-week change of 14.83 points.

- Lower by 2.21% YTD, the fund was down 3.63% over the year.

- With a poor momentum ranking, this fund maintained a stronger price trend over the short and medium terms but a weaker trend in the long term. Additional performance details are available here.

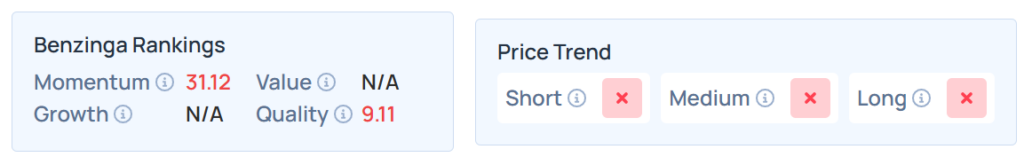

Blackrock Corporate High Yield Fund Inc.

- HYT also succumbed to market forces, moving from a previously modest score of 16.74 down to 9.11, a weekly decline of 7.63 percentile points.

- The fund has declined by 3.13% YTD and 5.05% over the year.

- It had a weak price trend in the short, medium, and long terms and a poor momentum ranking. Additional performance details are available here.

With all three funds now ranking among the market's lowest deciles for quality, investors may seek alternatives that offer stronger balance sheet resilience and higher fundamental quality in an increasingly selective and challenging market landscape.

Price Action

The 10-year Treasury bond yielded 4.03% and the two-year bond was at 3.53%. Whereas the long-term 30-year bond was yielding 4.65% as of the publication of this article.

The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, rose in premarket on Tuesday. The SPY was up 0.18% at $662.10, while the QQQ advanced 0.29% to $593.40, according to Benzinga Pro data.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga

Photo: Shutterstock