Three apparel manufacturers are beginning to lose steam, as their Growth score nosedives in Benzinga’s Edge Stock Rankings, within the span of a week.

3 Apparel Stocks With Dropping Growth Metrics

The Growth metric in Benzinga’s Edge Rankings is calculated based on the pace at which revenue and earnings expand in a company, with importance given to both long-term trends and immediate performances.

See Also: 2 Restaurant Chain Stocks That Are Getting Increasingly Cheaper: Value Scores Hit Fresh High

Oftentimes, a major drop in the growth score of a stock indicates that it has just had a bad quarter, affecting its compounded annual growth rate, and thus lowering its standing relative to other stocks.

1. Oxford Industries Inc.

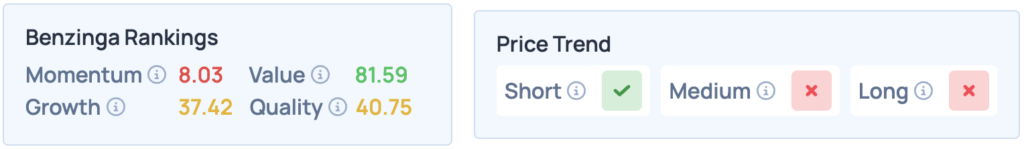

Oxford Industries Inc. (NYSE:OXM), the parent company of Tommy Bahama and Lilly Pulitzer, has faced deteriorating growth metrics driven by disappointing top-line performance and tempered forward guidance.

The company reported a decline in multiple sales channels, with full-price retail, e-commerce, wholesale, and outlet, all posting year-over-year drops. Management guidance also pointed to lower revenue and earnings growth going forward, leading to its Growth score dropping from 74.29 to 37.42.

The stock scores poorly across the board in Benzinga’s Edge Rankings, but does well on Value, and has a favorable price trend in the short term. Click here for deeper insights into the stock, its peers and competitors.

2. LightInTheBox Holding Co. Ltd.

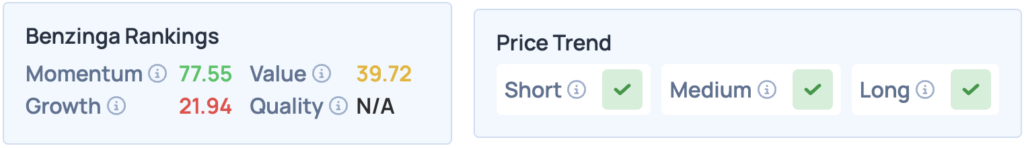

Singapore-based Lightinthebox Holding Co. Ltd. (NYSE:LITB) saw its Growth score drop from 46.95 to 21.94 in Benzinga’s Edge Rankings, following its steep and sustained revenue declines in recent quarters.

While the company has made strides in improving gross margins through better product mix and operational efficiency, these improvements are being dwarfed by the sheer scale of the top-line deterioration.

According to Benzinga’s Edge Stock Rankings, the stock scores high on Momentum, and has a favorable price trend in the short, medium and long terms. Click here for more insights into the stock.

3. Unifi Inc.

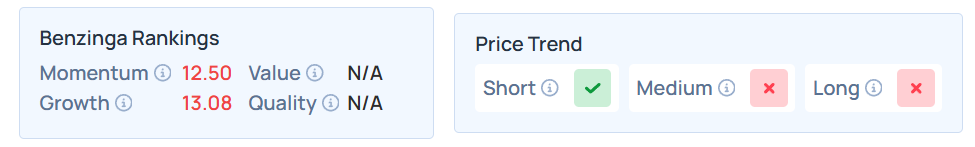

Unifi Inc. (NYSE:UFI), the maker of REPREVE recycled fibers, has seen its Growth Score crater 18.65 points, from 31.72 to 13.08, amid declining revenue, margin compression, and worsening segment performance.

Between weak fundamentals and the strategic costs of ongoing manufacturing consolidation, Unifi's near-term growth outlook has deteriorated sharply, pulling its Growth Score down with it. The REPREVE product line, once a bright spot, also saw its mix fall to 30% of net sales from 34% the year prior.

Read More:

Photo Courtesy: FOTOGRIN on Shutterstock.com