/EV%20in%20showroom%20by%20Robert%20Way%20via%20Shutterstock.jpg)

Nio (NIO), which closed the past four years in the red and was in the red for 2025 as well, has seen a remarkable turnaround. The stock has not only turned positive for the year but has done so in style with YTD gains of over 70%. NIO is up a cool 130% over the last six months as the Chinese electric vehicle (EV) company defied naysayers with its strong operating performance.

Nio Has Impressed with Its Performance This Year

In some ways, 2025 is shaping up to be a lot like 2020 for NIO. That year, there were apprehensions over Nio’s survival after the company gave a “going concern” warning, which is often a prelude to bankruptcy. But the stock made a comeback to rise over 1,100%. Similarly, this year, there were concerns about whether NIO could scale up deliveries and move up the ladder. The company had launched several new models in the previous two years, which failed to gain momentum, and it seemed trapped in the endless loop of stagnant deliveries, fluctuating (but low) vehicle margins, and cash burn.

However, it’s been a different story of late, and Nio delivered over 30,000 vehicles each in August and September, with shipments rising to new record highs in both these months, led by the strong sales of its L90 SUV that it markets under the Onvo brand. Last month, it also commenced deliveries of its luxury third-generation ES8 SUV.

Thanks to the economies of scale, higher deliveries have also flown to the company’s bottom line, and its gross margin improved to 10% in Q2 2025 as compared to 9.7% in the corresponding quarter last year. In absolute terms, it reported a gross profit of $264.9 million in Q2, 12.4% higher than Q2 2024 and over twice what it generated in Q1 2025. However, while Nio’s net losses have narrowed, its Q2 2025 adjusted loss per share of $0.32 was a tad higher than consensus estimates.

NIO Expects Deliveries to Rise Significantly in Q4

While Nio’s Q2 earnings were tepid at best, the guidance was quite upbeat, and it forecast deliveries of 150,000 in Q4. For context, the company delivered 72,056 vehicles in the second quarter and 87,071 in the third quarter.

Management expects vehicle gross margins to rise to between 16% and 17% in the final quarter of the year, compared to 10.3% in Q2. Moreover, it reiterated its previous guidance of achieving breakeven on adjusted profits in Q4.

NIO Stock Forecast

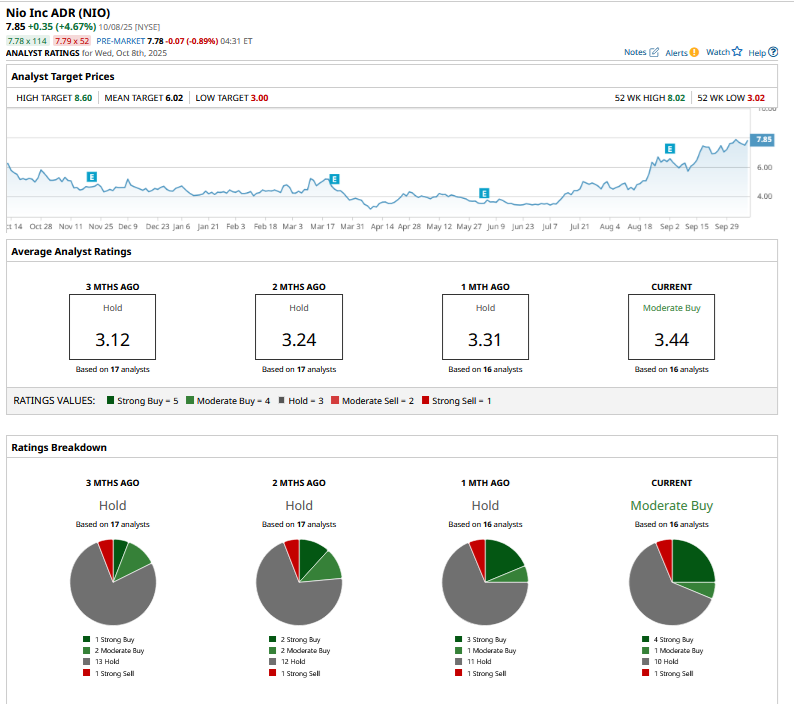

Nio has managed to win over some fence sitters with its strong execution, and the stock is now rated as a “Strong Buy” or “Moderate Buy” by 5 analysts, while the corresponding number three months back was 3. Its consensus rating has also moved up one notch from “Hold” to “Moderate Buy” over the period, even as the stock currently trades above its mean target price of $6.02.

However, I believe that analysts haven’t yet caught up with Nio’s price action, given the breathtaking rally over the last three months. Analysts have been gradually raising Nio’s target price, though, and last month, Citi raised its to a Street-high of $8.60. We should see more adjustments as Nio continues to impress with execution.

Is Nio Stock Still a Buy, and Can It Rise to $10 in 2025?

Currently, no analyst has a double-digit target price on Nio, and it would need to rise around 27% to reach $10, at which point its market cap would be $24.5 billion. Now, there are several ways to look at that number. The valuation would seem stretched compared to legacy automakers and is around half of Ford’s (F) market cap. However, it would still be a fraction of Tesla’s (TSLA) market cap that recently touched $1.5 trillion. As a sidenote, Nio’s market cap was over $100 billion at its peak in early 2021.

On a relative basis, analysts expect Nio’s revenues to rise 42% to $17.84 billion in 2026, and if the stock were to rise to $10, its 2026 price-sales ratio would still be under 1.4x, which does not look exorbitant.

I have been in the bullish camp when it comes to Nio and will continue to stay invested despite the sharp rally from the 2025 lows, as I believe it has a strong chance to move to $10 price levels if the company can deliver on the Q4 targets and sentiments toward Chinese stocks continue to improve.