Papa John’s (PZZA) is a leading American pizza delivery and carryout restaurant chain. The company emphasizes the use of high-quality ingredients, making fresh dough from six simple ingredients and using real mozzarella cheese and vine-ripened tomato sauce. The business model includes franchised and company-owned stores, focusing on carryout and delivery with some dine-in options.

Founded in 1984, with its headquarters in Louisville, Kentucky, the company operates approximately 6000 stores across 50 countries.

Papa John's Shows Mixed Performance

PZZA stock has seen dramatic stock movements in recent weeks. The stock gained 25% over the past five days, driven by upbeat earnings and optimism in food delivery trends. However, its 52-week return is down 2%, reflecting ongoing volatility and competitive pressures. For the last six months, Papa John’s shares have climbed 70%, while year-to-date (YTD) performance stands at 28%, outpacing the Nasdaq Composite’s ($NASX) 17%.

Recent upticks contrast with longer-term financial challenges and profit pressures, making its recovery uneven versus broader market trends.

Papa John’s Beats Analysts

Papa John’s reported its Q2 2025 results on Aug. 7, posting total revenue of $529.2 million, which beat analyst expectations by 2.6%. Adjusted earnings per share came in at $0.41, surpassing consensus estimates of $0.34 by 20.6%.

Despite this, net income declined to $10 million, down from $13 million the prior year, reflecting margin pressures amidst increased marketing and operational expenses. Global system-wide restaurant sales climbed 4% year-over-year (YoY) to $1.26 billion, led by a 4% rise in international comparable sales and a 1% increase in North America.

Digging deeper into the financials, Papa John’s adjusted EBITDA for the quarter was $52.6 million, down $6.3 million from Q2 2024, primarily due to higher costs and investments supporting growth initiatives. Free cash flow for the first half of 2025 improved to $37 million, up $24 million YoY due to better working capital management. The company's liquidity remained stable, with $36 million reported for the quarter and approximately $500 million available, including credit facilities; however, leverage remains a watch point for future acquisitions.

Dividends paid out were $15.3 million, with the next quarterly dividend set at $0.46 per share.

For full-year 2025, Papa John’s reaffirmed its outlook, raising guidance for international comparable sales to 2% to 4% growth while expecting flat to 2% growth in North America. The company projects system-wide sales to rise 2% to 5%, maintaining its target for adjusted EBITDA in the $200 million to $220 million range, and plans for up to 200 new restaurant openings worldwide.

Improved Bid for Papa John’s

Papa John’s International soared 18% following news that Apollo Global Management made a $64-per-share offer to acquire the company and take it private, as reported by StreetInsider. This bid builds on earlier takeover speculation, including June reports of a joint offer from Apollo and Irth Capital Management, a Qatari-backed investment fund, valuing the company at around $2 billion.

Papa John’s, while maintaining its policy of not commenting on market rumors, is no stranger to acquisition talks, with persistent headlines about buyout interest throughout the year. Past coverage has included speculation around both private equity and Qatari involvement in potential bids, reflecting ongoing investor interest in the pizza brand amid sector-wide M&A activity.

Should You Look for a Slice of Papa John’s?

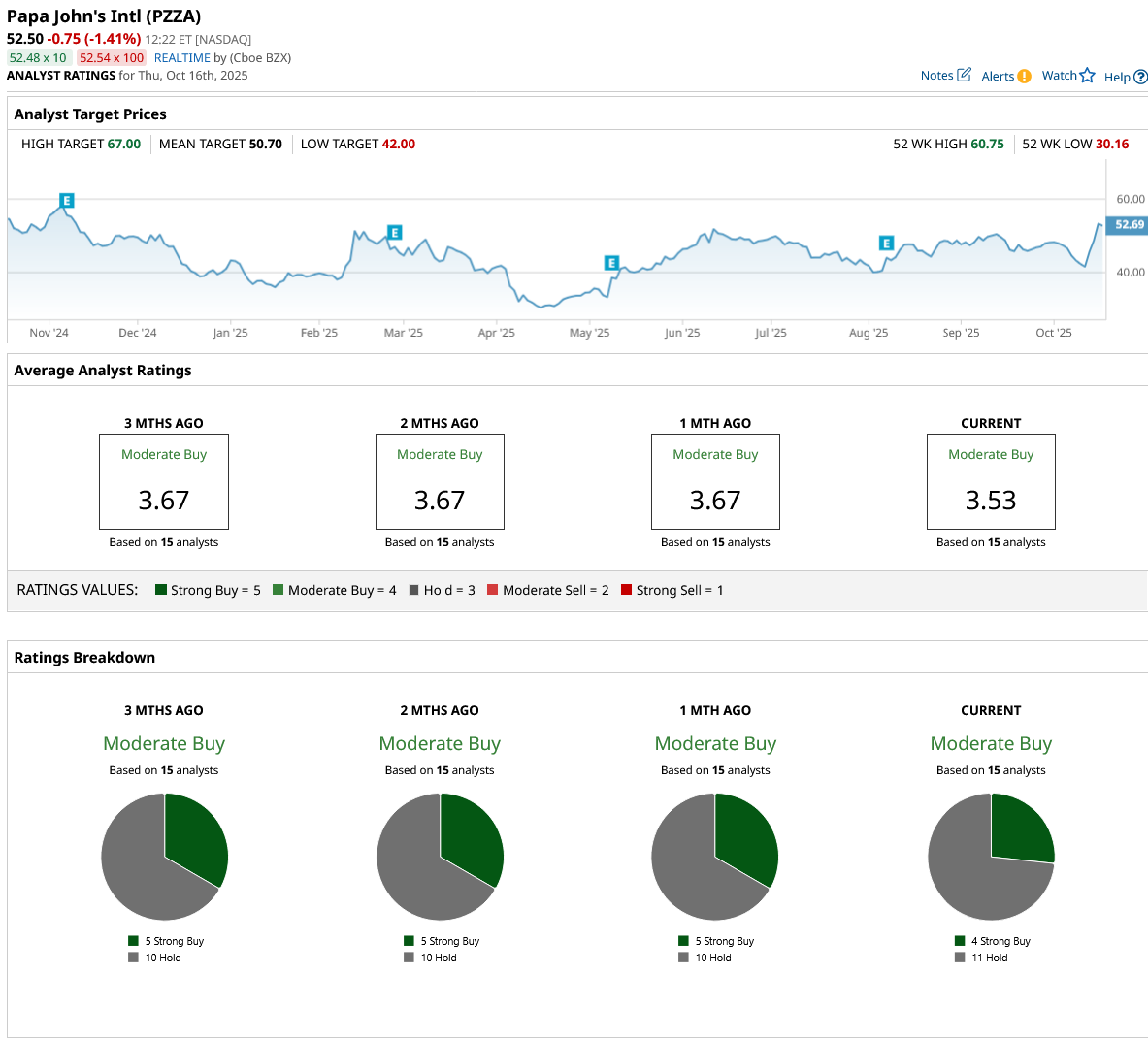

Papa John’s recent takeover speculation has left investors divided. While the reported $64 per share offer from Apollo Global Management implies an upside of about 20%, PZZA stock’s consensus rating remains a “Moderate Buy” with an average price target of $50.70, indicating potential downside from current market pricing.

It has been rated by 15 analysts so far, receiving four “Strong Buy” ratings and 11 “Hold” ratings.