Finding a location to retire in — one that won’t drain your nest egg early — is a major part of retirement planning. It is almost as important as saving for the retirement itself. What good is a beautiful retirement city if it drains your savings accounts and portfolio halfway through your retirement?

Check Out: How Far $750,000 in Retirement Savings Plus Social Security Goes in Every State

Learn More: 7 Luxury SUVs That Will Become Affordable in 2025

With that in mind, GOBankingRates has analyzed recent data to discover the cheapest American cities for retirement (minimum 150,000 population and 10% seniors). It is not cheap to retire in the West, where the most affordable city ranked 59th overall. From Peoria to Albuquerque, here are the 20 cheapest places to retire in the West.

20. Peoria, Arizona

- Population 65+: 19.6%

- Monthly cost of living (with mortgage): $4,881

- Livability: 77

While Peoria isn’t the cheapest city in Arizona, it’s loaded hiking trails, beautiful mountains, the gorgeous Lake Pleasant and the sprawling Pioneer Living History Museum. There is always something to do or somewhere to go during your retirement in Peoria.

Also See: How Long $1 Million in Retirement Will Last in Every State

Discover More: Here’s the Cost of Living in Every State

19. Tempe, Arizona

- Population 65+: 10.8%

- Monthly cost of living (with mortgage): $4,838

- Livability: 78

Tempe has plenty to do — with Arizona State University ballgames, theatrical performances and concerts being regular occurrences. It also has a warm climate, the Tempe Town Lake and two large golf courses. Also, Arizona doesn’t tax Social Security, and carries a flat income tax rate of 2.5%.

Explore More: Here’s How Much You Need To Earn To Be ‘Rich’ in Every State

18. Lancaster, California

- Population 65+: 12.0%

- Monthly cost of living (with mortgage): $4,808

- Livability: 69

With very low cost of living (lower than 49% of California), close SoCal cities like Los Angeles, Anaheim and San Diego, and beautiful desert environs, Lancaster is a lovely and convenient place to settle down.

17. San Bernardino, California

- Population 65+: 10.2%

- Monthly cost of living (with mortgage): $4,804

- Livability: 58

Thanks to the fact that San Bernardino County is huge (over 20,000 square miles), with plenty of room to grow, housing is relatively affordable in San Bernardino. While still expensive by national standards (+24%), home prices in San Bernardino are cheaper than all but two California towns in the study.

16. Modesto, California

- Population 65+: 14.4%

- Monthly cost of living (with mortgage): $4,700

- Livability: 65

Modesto is a medium-sized metropolis with big-city amenities but small-town vibes. It’s cheap compared to the rest of California (though still about 8% more expensive than the rest of America) and features fairly low (again, for California) housing prices.

15. Stockton, California

- Population 65+: 13.0%

- Monthly cost of living (with mortgage): $4,683

- Livability: 59

California is a rather expensive state, but affordable living is still possible in cities like Stockton. The city has a downtown marina, a number of festivals and street fairs throughout the year and seemingly endless walking trails and parks for active retirees.

14. Tacoma, Washington

- Population 65+: 14.6%

- Monthly cost of living (with mortgage): $4,681

- Livability: 78

In addition to being surrounded by a wealth of natural beauty — and only a short jaunt away from Mount Rainier National Park — Tacoma is suffused with a vibrant culture and arts scene, with museums and multiple music festivals throughout the year. The city is also very affordable compared to other big cities in Washington, making it a prime retirement spot.

13. Las Vegas

- Population 65+: 15.6%

- Monthly cost of living (with mortgage): $4,668

- Livability: 82

Las Vegas offers low-cost luxury living, thanks to no state income taxes, affordable healthcare and, of course, a great deal of entertainment for the aging thrill seeker.

12. Eugene, Oregon

- Population 65+: 17.7%

- Monthly cost of living (with mortgage): $4,581

- Livability: 78

Eugene is a city that serves all kinds of budgets and — thanks to Oregon’s lack of sales tax — keeps prices low.

11. Mesa, Arizona

- Population 65+: 17.2%

- Monthly cost of living (with mortgage): $4,565

- Livability: 81

Mesa is one of the most affordable suburbs in all of Arizona. It’s a very diverse city, from private communities with golf courses and lakes to plentiful outdoor activities such as trails and parks.

Read More: How Far $500,000 in Retirement Savings Plus Social Security Goes in Every State

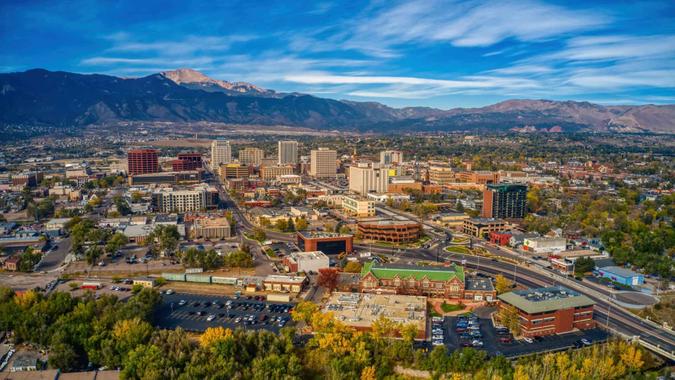

10. Colorado Springs, Colorado

- Population 65+: 14.7%

- Monthly cost of living (with mortgage): $4,488

- Livability: 79

Compared to other big cities in Colorado like Denver, Colorado Springs has a fairly affordable real estate market. Those affordable prices come with a suburban vibe, rich culture and beautiful, snowcapped landscapes.

9. Phoenix

- Population 65+: 11.9%

- Monthly cost of living (with mortgage): $4,449

- Livability: 76

Somewhat surprisingly, despite being the state capital and arguably the most well-known big city in the state, Phoenix boasts an average home value that’s slightly lower than the average home price throughout the state. Phoenix also has its own international airport, warm and sunny weather throughout most of the year, and over 200 golf courses for active seniors to work on their short games.

8. North Las Vegas, Nevada

- Population 65+: 12.0%

- Monthly cost of living (with mortgage): $4,448

- Livability: 76

Not only does North Las Vegas get over 300 days of warm, sunny weather per year, the city has a very affordable real estate market (much more so than the remainder of Las Vegas Valley). Further, Nevada has no state income tax.

7. Glendale, Arizona

- Population 65+: 13.1%

- Monthly cost of living (with mortgage): $4,407

- Livability: 76

Compared to the rest of Arizona’s bigger cities, Glendale features a cheap housing market.

Read Next: The Money You Need To Save Monthly To Retire Comfortably in Every State

6. Salem, Oregon

- Population 65+: 15.3%

- Monthly cost of living (with mortgage): $4,339

- Livability: 79

Oregon has no state sales tax, which means that expenses there are somewhat less than other states. Additionally, Salem’s housing market is cheaper than other big cities in Oregon, making the city one in which retired seniors can easily save their nest eggs.

5. Bakersfield, California

- Population 65+: 10.8%

- Monthly cost of living (with mortgage): $4,257

- Livability: 57

Bakersfield housing is more affordable than the national average, and far, far cheaper than such expensive California cities as San Francisco and Los Angeles. Bakersfield’s average income is somewhat lower than surrounding cities, thus keeping the housing market comparatively inexpensive for retirees looking for California retirement settings.

4. Fresno, California

- Population 65+: 12.1%

- Monthly cost of living (with mortgage): $4,252

- Livability: 63

Fresno’s cost of living is less than the rest of California’s. The city is also well-placed, only a few hours from both San Francisco and Los Angeles, and boasts a rich cultural diversity, making it a lovely spot to send one’s golden years.

For You: Cutting Expenses for Retirement? Here’s the No. 1 Thing To Get Rid of First

3. Spokane, Washington

- Population 65+: 16.4%

- Monthly cost of living (with mortgage): $3,987

- Livability: 81

Spokane is one of the most affordable cities on the West Coast, with a tight-knit community and a bevy of outdoor recreational opportunities.

2. Tucson, Arizona

- Population 65+: 15.8%

- Monthly cost of living (with mortgage): $3,771

- Livability: 72

Tucson may be the state’s second-biggest city, but it feels like a small town. The city has a healthy culture of museums, art galleries and concert venues, as well as a number of hiking and biking trails in the desert terrain that surrounds the city.

1. Albuquerque, New Mexico

- Population 65+: 17.2%

- Monthly cost of living (with mortgage): $3,691

- Livability: 72

Albuquerque enjoys a low cost of living compared to the rest of the United States, with a relatively inexpensive housing market, low property taxes and reasonable healthcare prices. The city is the largest in New Mexico, with a powerhouse economy that helps fuel the state. That healthy economy, coupled with beautiful western vistas, makes Albuquerque a great place for retirees to settle down.

Methodology: GOBankingRates identified cities with populations of at least 150,000, with at least 10% of the population age 65 and over. Other data was sourced from the U.S. Census American Community Survey, Sperling’s BestPlaces, the Bureau of Labor Statistics Consumer Expenditure Survey, AreaVibes, Zillow Home Value Index for December 2024 and the Federal Reserve Economic Data. All data was collected on and is up to date as of Feb. 18, 2025.

More From GOBankingRates

This article originally appeared on GOBankingRates.com: 20 Cheapest Places To Retire in the West in 2025