Biotech stocks can offer significant upside because they have high-growth potential if their drug candidates succeed in trials or gain FDA approval. For long-term biotech investors who can accept the risk of clinical-stage drugmakers, Eledon (ELDN) and Acumen (ABOS) are exciting opportunities to look at. However, given that they are penny stocks, they might be suitable for investors with a high-risk appetite.

Eledon Pharmaceuticals (ELDN)

Eledon Pharmaceuticals is a clinical-stage biotech company focused on immunology, particularly immunomodulation for transplantation (organs and cells), with some work in autoimmune and neurodegenerative diseases. The company's inclusion in the Russell 3000 and Russell 2000 indices in June increased its visibility at a time when Eledon is approaching multiple clinical catalysts.

Valued at $154.5 million, ELDN stock has dipped 37% year-to-date (YTD) but has surged 114% over the last two years.

Following an organ or cell transplant (e.g., kidney, islet cells for Type 1 diabetes, xenotransplants from animal donors), the patient's immune system often rejects the transplant, resulting in damage or failure. Eledon aims to prevent organ transplant rejection and cure autoimmune illnesses by regulating the CD40-CD40L immunological pathway. Its lead asset, tegoprubart, is an investigational anti-CD40L antibody that is intended to provide efficient immunosuppression without depleting lymphocytes.

At the World Transplant Congress in August 2025, Eledon presented positive findings from the ongoing trials, reinforcing the safety and efficacy profile of tegoprubart. There were no reports of mortality, graft loss, drug-related tremor, infection, or new-onset diabetes among the 32 trial participants. Eledon ended Q2 with $107.6 million in cash, cash equivalents, and short-term investments, which it expects to fund operations through the end of 2026.

In November, the business plans to present the topline results of its Phase 2 BESTOW kidney transplantation study. According to NIH estimates, rejection rates range from 33% to 69% among kidney transplant candidates. Success in this trial might establish tegoprubart as a next-generation cornerstone in transplant immunosuppression. Furthermore, tegoprubart holds great therapeutic potential in solid organ transplantation, cell transplantation, xenotransplantation, and autoimmune illnesses such as amyotrophic lateral sclerosis (ALS).

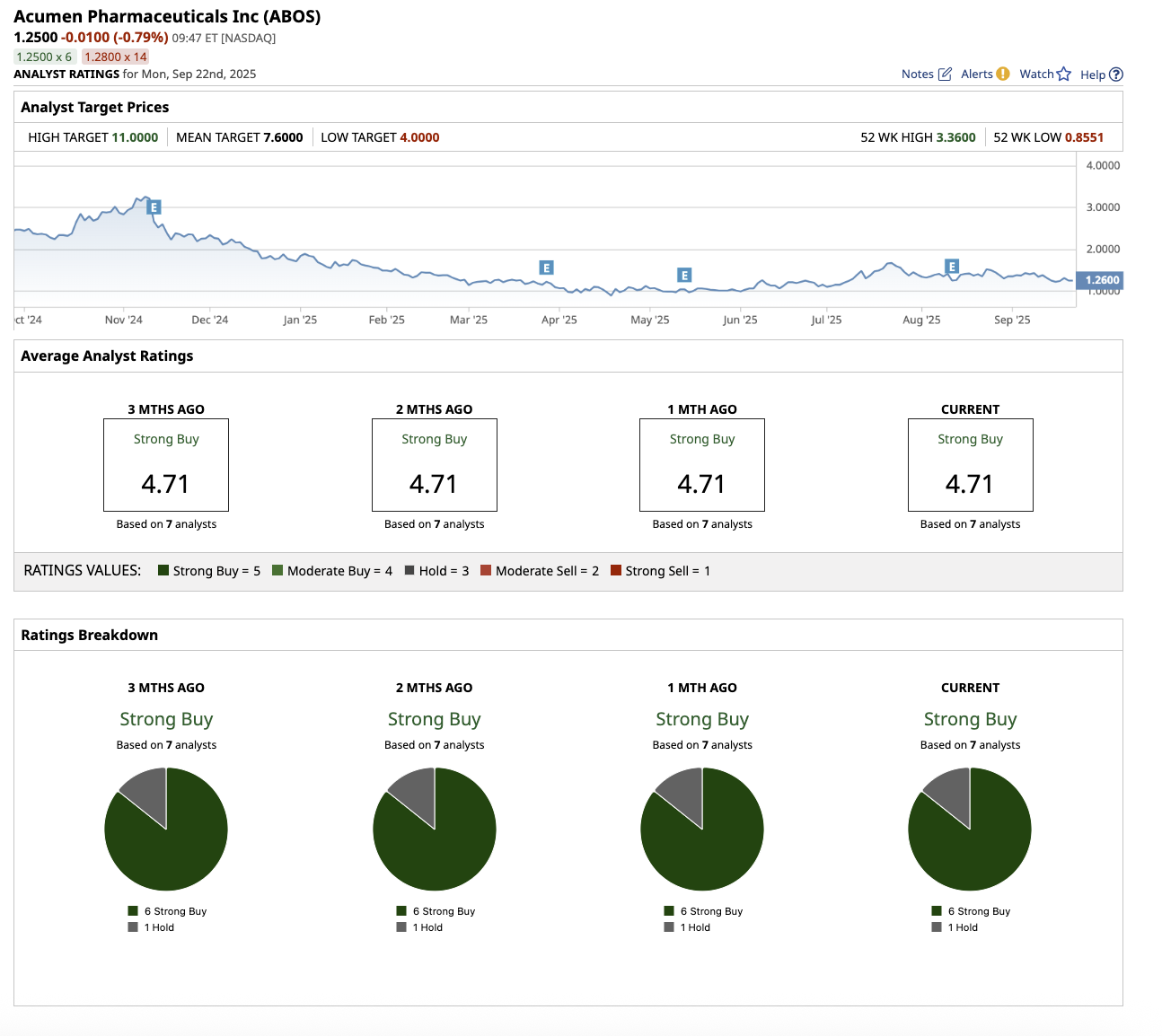

What Does Wall Street Say About ELDN Stock?

This is probably why Eledon holds a “Strong Buy” rating on Wall Street. Out of the eight analysts who cover the stock, seven rate it a “Strong Buy,” and one rates it a “Hold.” The mean target price for ELDN stock is $9.50, which is 265.4% above current levels. The Street-high estimate of $12 implies upside of 361.5% over the next 12 months.

Acumen Pharmaceuticals (ABOS)

Acumen Pharmaceuticals is a clinical-stage biotech company that has attracted Wall Street's attention for its sole focus on creating next-generation treatments for individuals with early Alzheimer's disease (AD). Valued at $79.3 million, ABOS stock has fallen 25% YTD, compared to the S&P 500 Index’s ($SPX) gain of 12.5%.

Acumen believes soluble amyloid-beta oligomers (AβOs) are early, toxic species in Alzheimer’s disease that contribute substantially to the disease process. Their lead candidate is sabirnetug (ACU193), a humanized monoclonal antibody that binds exclusively to amyloid-beta oligomers. Acumen's ongoing Phase 2 ALTITUDE-AD trial is testing sabirnetug in patients with early Alzheimer's, including those with mild cognitive impairment or mild dementia owing to AD. The company anticipates topline data in late 2026, with the trial aimed at comparing the efficacy, safety, and tolerability of sabirnetug to placebo. Importantly, the FDA has granted sabirnetug Fast Track status, indicating its potential to address a critical unmet need in early-stage Alzheimer's disease.

Beyond sabirnetug, Acumen is expanding its portfolio with the Enhanced Brain Delivery (EBD) program. In July 2025, Acumen announced a collaboration and license agreement with JCR Pharmaceuticals to combine their AβO-selective antibodies and JCR's patented blood-brain barrier-penetrating technology, J-Brain Cargo. Acumen had $166.2 million in cash, cash equivalents, and marketable securities at the end of the second quarter, which it expects to sustain operations into early 2027.

According to projections from Alzheimer's Disease International, the number of individuals living with dementia, notably Alzheimer's disease, will be over 78 million in 2030 and 139 million in 2050. Acumen is well-positioned to transform Alzheimer's treatment, with a cash runway that extends through 2027 and two big milestones on the horizon.

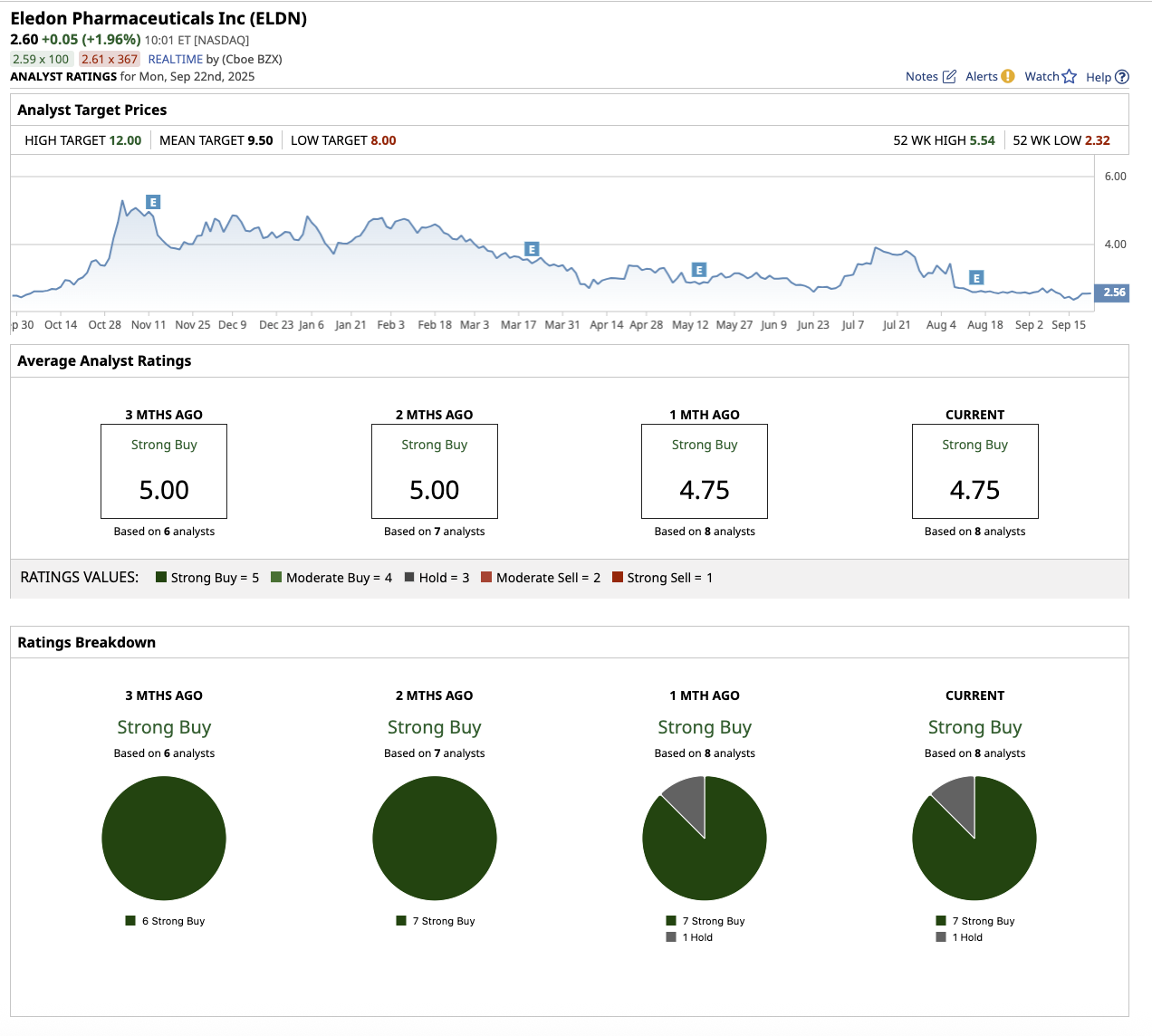

What Does Wall Street Say About ABOS Stock?

Overall, on Wall Street, ABOS stock is a “Strong Buy.” Out of the seven analysts who cover the stock, six rate it a “Strong Buy,” and one rates it a “Hold.” The mean target price for the stock is $7.6, which is 508% above current levels. The Street-high estimate of $11 implies upside of 780% over the next 12 months.