The biotechnology industry is undergoing a profound transformation, fueled in large part by advances in artificial intelligence (AI). AI integration in biotech is speeding up research, improving drug discovery, and improving patient outcomes.

AI enables biotech companies to bring new and effective treatments to market faster. Wall Street seems particularly excited about two of these AI-focused clinical-stage biotech companies, with consensus estimates calling for enormous long-term potential.

Let's look at why Wall Street analysts believe that both Acumen Pharmaceuticals (ABOS) and Eledon Pharmaceuticals (ELDN) are "strong buys" with the potential to increase by 361% or more over the next 12 months.

Acumen Pharmaceuticals

Acumen Pharmaceuticals (ABOS) is a clinical-stage biotech company that has garnered significant attention for its novel approach to treating the underlying cause of neurodegenerative diseases, and specifically Alzheimer's disease (AD).

Valued at $154.4 million, Acumen stock has fallen 31.3% year-to-date (YTD), compared to the S&P 500 Index’s ($SPX) gain of 17.1%.

Acumen focuses on targeting toxic amyloid-beta oligomers, which are a major cause of Alzheimer's pathology. The company's lead candidate, ACU193, is a monoclonal antibody designed to selectively target toxic forms of amyloid-beta oligomers, which are believed to cause neurodegeneration as seen in Alzheimer's patients.

In the second quarter, Acumen announced that it has begun enrolling subjects in the global Phase 2 study of sabirnetug (ACU193), which will test the "clinical efficacy and safety of sabirnetug for the treatment of early AD."

In addition, the company dosed the first patient as part of the "Phase 1 study to support a subcutaneous dosing option" for sabirnetug. The company expects the study's top-line results in the first quarter of 2025.

Acumen Pharmaceuticals, as a clinical-stage biotech company, has not yet generated revenue from product sales. It can only begin making money once ACU193 is approved and commercialized. Acumen has partnered with Lonza to commercialize sabirnetug, if and when it is approved.

The net loss for the second quarter stood at $20.5 million. At the end of the second quarter, it held $281.4 million in cash, cash equivalents, and marketable securities. The company believes that its liquidity position will be sufficient for operational purposes until the first half of 2027.

Alzheimer's disease is expected to affect nearly 14 million people in the United States alone by 2060. Acumen Pharmaceuticals, with its innovative approach, is well-positioned to capture a portion of this market, particularly if ACU193 proves effective in clinical trials. However, before considering ABOS, investors should be willing to take the risk of investing in clinical-stage biotech companies, which may be unprofitable for years before a product hits the market.

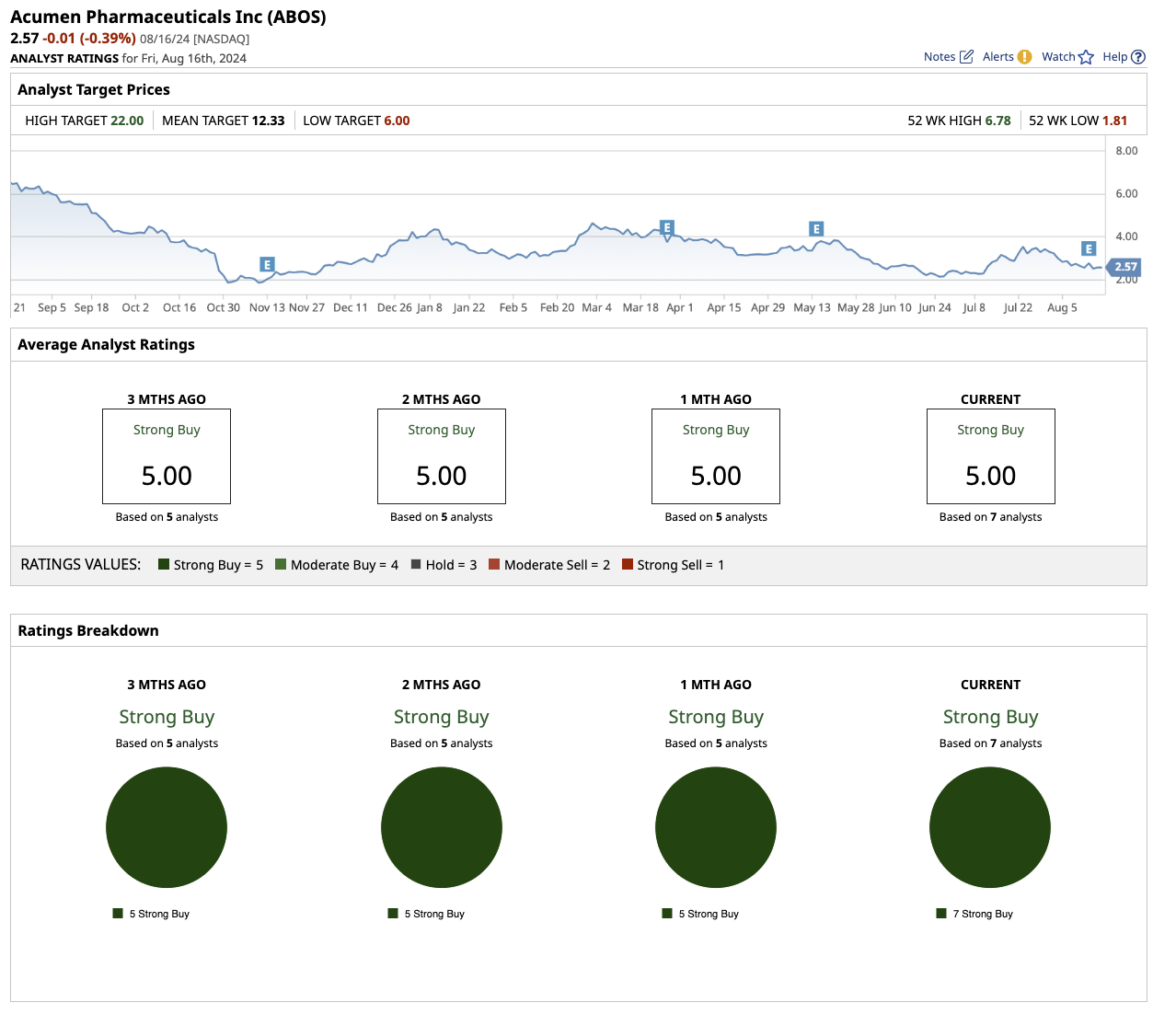

What Does Wall Street Say About ABOS Stock?

Overall, Acumen stock is a “strong buy” on Wall Street. Of the seven analysts that cover the stock, all of them rate it a “strong buy.” The average target price of $12.33 implies an upside potential of 361.7% over the next 12 months. The Street-high estimate for Acumen is $22.

Eledon Pharmaceuticals

Eledon Pharmaceuticals (ELDN), another clinical-stage biotech company, has piqued Wall Street's interest with its commitment to developing innovative treatments for patients suffering from life-threatening immune-related diseases. Eledon's candidates are focused on meeting unmet needs in transplantation, autoimmune diseases, and rare neuromuscular disorders.

Valued at $67.7 million, Eledon stock has gained 47.2% YTD, outpacing the overall market.

Tegoprubart (also known as AT-1501) is the company's lead product candidate, a novel next-generation anti-CD40L antibody. It is intended to prevent organ rejection in transplant patients, treat autoimmune diseases, and offer therapeutic options for rare neuromuscular disorders, such as amyotrophic lateral sclerosis (ALS).

On Aug. 8, the company announced its preliminary second-quarter results. It has completed enrollment of the 80th participant in the ongoing Phase 2 BESTOW trial of tegoprubart for the prevention of kidney transplant rejection. Eledon expects to complete enrollment by the end of 2024.

NIH estimates that the rejection rates range from 33% to 69% in kidney transplant candidates, which is the most transplanted organ worldwide. If tegoprubart completes clinical trials successfully, it could provide a new approach to immunosuppression, improving patient outcomes and capturing a sizable market share.

Moreover, Eledon is also investigating the use of tegoprubart to treat autoimmune and neurodegenerative diseases such as ALS. The success of tegoprubart for these conditions could open up new markets for the company, providing numerous growth opportunities.

Investors have shown interest in Eledon because of the promising potential of tegoprubart and the significant unmet medical needs it addresses. Eledon's performance, like that of many other early-stage biotech stocks, is heavily influenced by the results of its ongoing and upcoming clinical trials. The company recorded a net loss of $10.3 million in the first quarter.

The company has not disclosed its net losses for the second quarter. However, it ended the second quarter with $83.6 million in cash and cash equivalents, which included $50 million raised through private financing. The company believes the cash balance will last until December 2025.

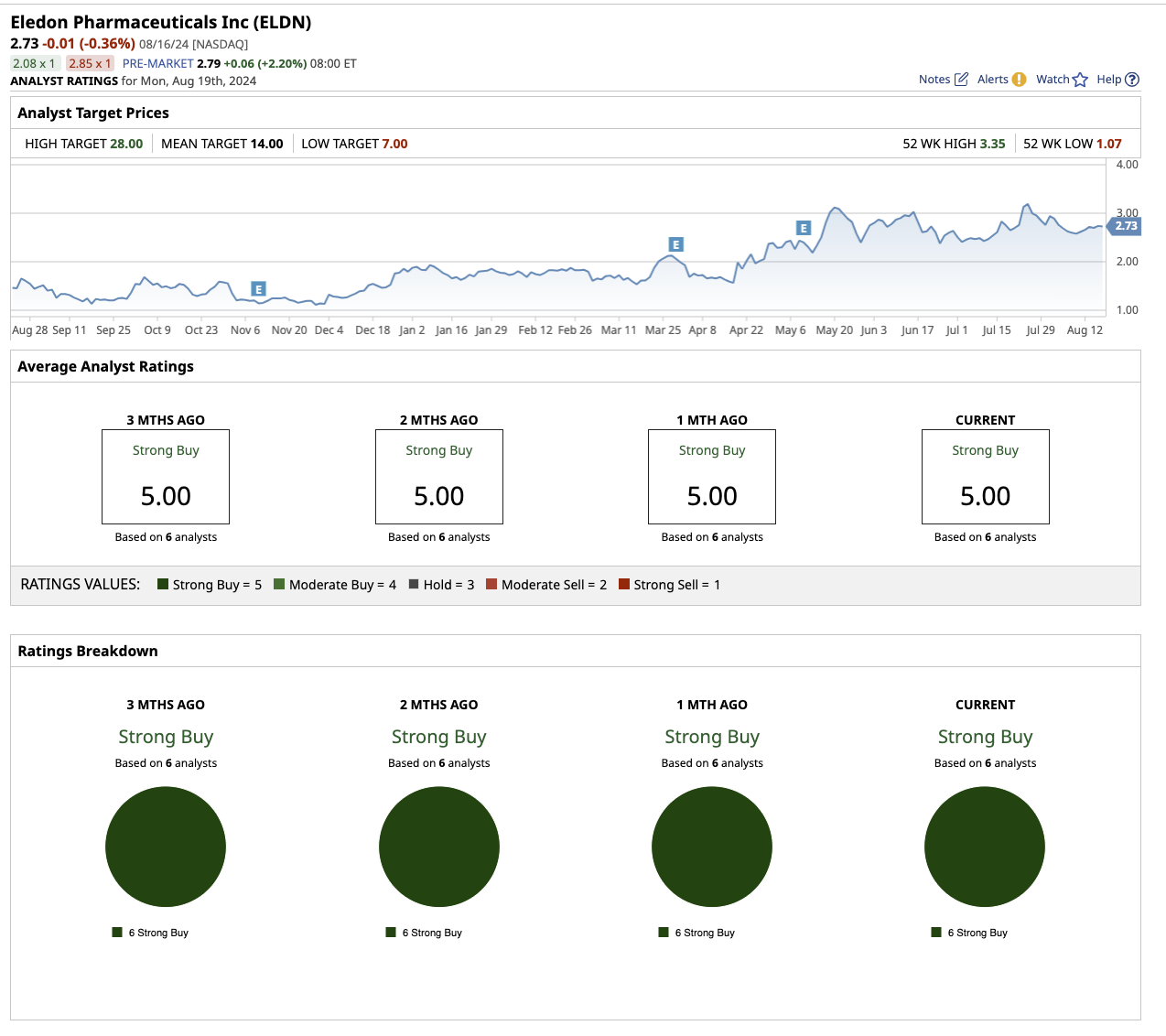

What Does Wall Street Say About ELDN Stock?

Overall, on Wall Street, Eledon stock is a “strong buy.” Of the six analysts that cover the stock, all of them rate it a “strong buy.” The mean target price of $14 implies an upside potential of 420.4% over the next 12 months. The Street-high estimate for Eledon stock is $28.

The Key Takeaway

While Acumen and Eledon face risks typical of early-stage biotech companies, they also offer significant upside potential for those willing to navigate the uncertainties of the clinical development stages. Furthermore, as penny stocks, both are extremely volatile and will appeal to investors with a high risk tolerance.

On the date of publication, Sushree Mohanty did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.