Two steel companies are making quite a splash in Benzinga’s Edge Stock Rankings, with their growth metrics seeing significant spikes over the past week alone.

The Two Steel Stocks Poised For A Breakout

Benzinga’s Edge Stock Rankings assign scores to stocks based on their Value, Momentum, Growth and Quality. The Growth score is calculated based on the pace at which revenue and earnings have grown historically, with equal importance given to both long-term trends and immediate performance.

See Also: Factory Slowdown Meets AI Frenzy: ETFs Caught Between Old Steel And New Silicon

The steel sector as a whole has been dealing with significant volatility and uncertainties in recent months, but two companies in this sector are hinting at a turnaround.

1. Vallourec ADR

French steel products maker, Vallourec SA (OTC:VLOWY) saw a big jump in its Growth scores, rising from 38.34 to 74.64, or 36.3 points within a span of a week.

Vallourec's growth momentum has been fueled by a series of financial and strategic wins. The company eliminated its net debt earlier than expected, a milestone that strengthens its balance sheet and frees up cash flow for reinvestment. The stock has done well, despite a softer-than-expected second-quarter performance by the company.

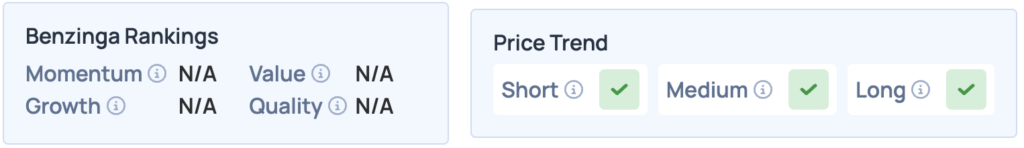

In addition to its high Growth scores, the stock has a favorable price trend in the short, medium and long-term. Click here to see how it compares with peers in the steel industry.

2. Posco Holdings Inc.

South Korean steel-maker, Posco Holdings Inc. (NYSE:PKX) has seen a significant turnaround in recent months, primarily driven by its battery-materials pivot, which includes lithium, nickel, and cathode/anode production for EVs, eyeing a 32% CAGR over the next three years.

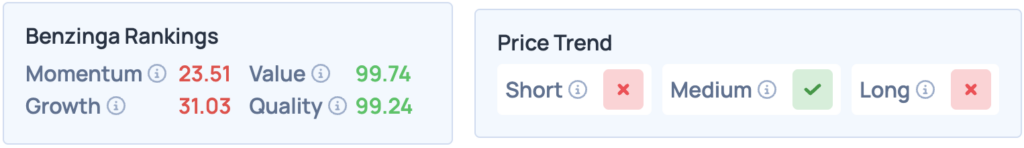

The stock saw a 27.6 point jump in Benzinga Edge rankings, from 3.43 to 31.03 over the past week alone. While it still scores poorly, the magnitude of improvement is certainly notable.

According to Benzinga’s Edge Stock Rankings, the stock still scores poorly on Momentum and Growth, but does well on Value and Quality. It has a favorable price trend in the medium term. Click here for deeper insights into the stock, its peers and competitors.

Read More:

Image Via Shutterstock