Penny stocks, which are deemed highly volatile, are shares of small companies that trade at a low price. They usually trade under $5 per share in the U.S. Penny biotech stocks, in particular, are typically early stage companies that specialize in drug development, medical devices, or cutting-edge therapies such as gene editing or immunotherapy. The majority of them do not yet have commercially available products.

However, a successful clinical trial or FDA approval can cause these stocks to skyrocket. Here are two penny biotech stocks that Wall Street is optimistic about.

Penny Stock #1: Adverum Biotechnologies

With a market cap of $94.6 million, Adverum Biotechnologies (ADVM) is a clinical-stage biotechnology company that develops gene treatments for serious ocular illnesses. The company’s mission is to help people retain vision while minimizing or eliminating the need for frequent treatments. Adverum’s main focus is on wet age-related macular degeneration (AMD), which is the leading cause of blindness in older adults.

ADVM stock has dipped 1.5% year-to-date, underperforming the broader market gain.

Its lead candidate is ixoberogene soroparvovec (ixo-vec), a gene therapy that is given as a single intravitreal injection. Instead of patients receiving recurrent anti-VEGF injections (now administered every 4-8 weeks to control wet AMD), ixo-vec delivers a genetic sequence that allows the eye to generate a therapeutic protein (aflibercept) for long-term treatment. The company is currently conducting an ARTEMIS Phase 3 trial for the same, with enrollment expected to wrap up in the first quarter of 2026 and top-line data due in the first half of 2027.

CEO Laurent Fischer, M.D., emphasized, “The progress in ARTEMIS, along with growing enthusiasm among specialists, supports our confidence in Ixo-vec as a best-in-class therapy.”

Adverum also plans to present two-year follow-up results from the LUNA Phase 2 trial in the fourth quarter of 2025. These findings are expected to support Ixo-vec’s potential for long-term safety and efficacy in wet AMD patients. Furthermore, the company is planning to launch AQUARIUS, its second Phase 3 research, in the fourth quarter of 2025, subject to funding.

As a clinical-stage biotech company, Adverum reported a net loss of $49.2 million in the second quarter. At the end of Q2, cash, cash equivalents, and short-term investments totalled $44.4 million, which the company expects to support operations into the fourth quarter of 2025. Management stated that surveys have revealed a growing enthusiasm for gene therapy in wet AMD. Notably, nearly half of 1,000 retina specialists chose gene therapy as the most promising pipeline innovation, more than doubling the number who preferred tyrosine kinase inhibitors (TKIs). Ixo-vec has received FDA Fast Track and RMAT designations, as well as EMA PRIME and the U.K. Innovation Passport. This suggests that if the therapy is approved, it will have considerable market potential.

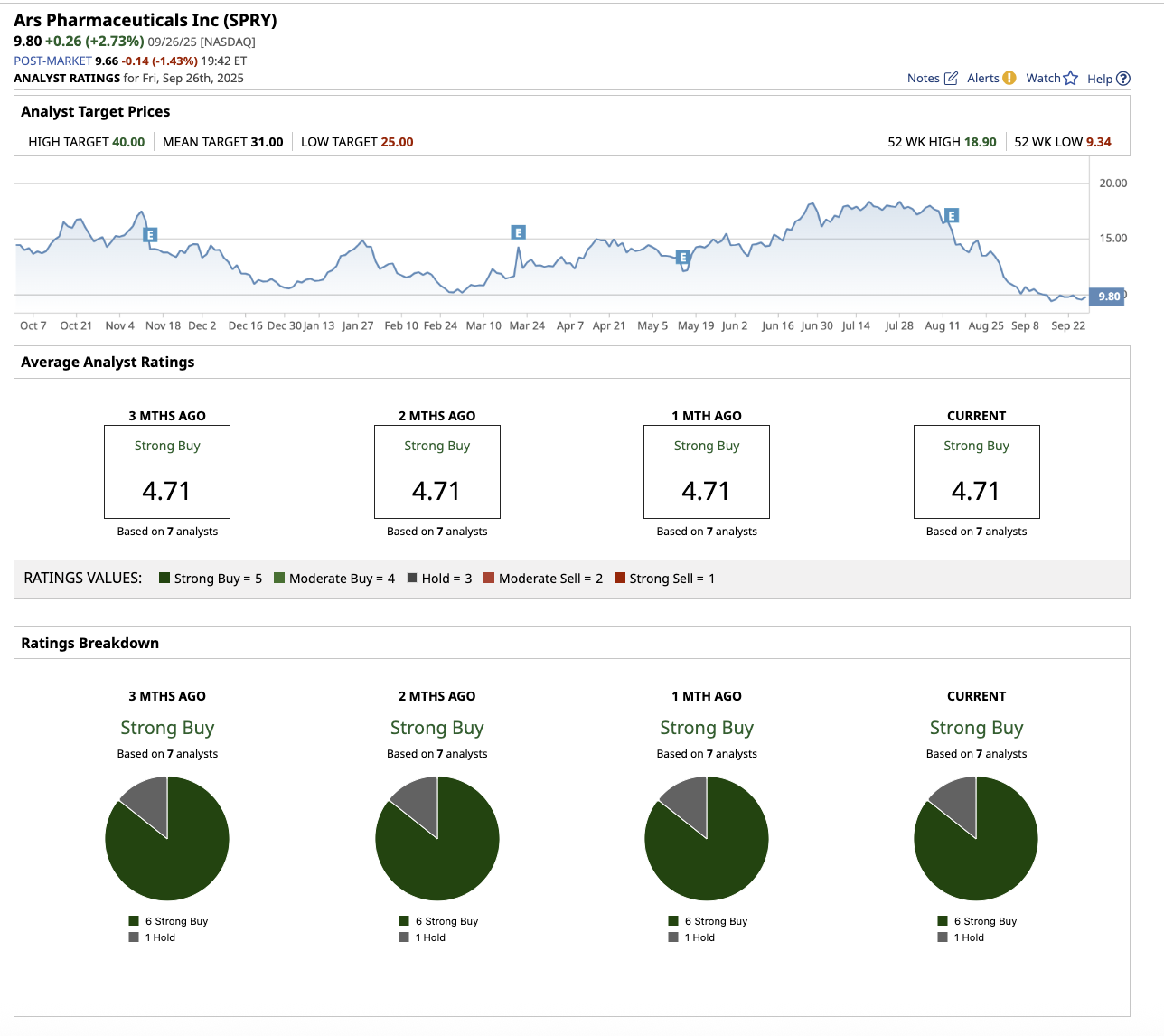

This is probably why Wall Street is optimistic about Adverum stock, rating it as a “Strong Buy.”

Among the seven analysts that cover the stock, five rate it a “Strong Buy,” and two say it is a “Hold.” Its average target price of $19.50 suggests the stock can climb by 332.4% from current levels. Its Street-high estimate of $33 implies the stock has upside potential of 631.7% from current levels.

Penny Stock #2: Ars Pharmaceuticals

With a market cap of $968.5 million, ARS Pharmaceuticals (SPRY) (also known as ARS Pharma) is a biotech company that focuses on treatments for severe allergic reactions, especially anaphylaxis. The company’s flagship product, neffy (also known as ARS-1), is the first and only FDA- and EU-approved needle-free intranasal epinephrine spray. It is an emergency treatment for Type I allergic responses (foods, drugs, insect bites, etc.), which can result in life-threatening anaphylaxis.

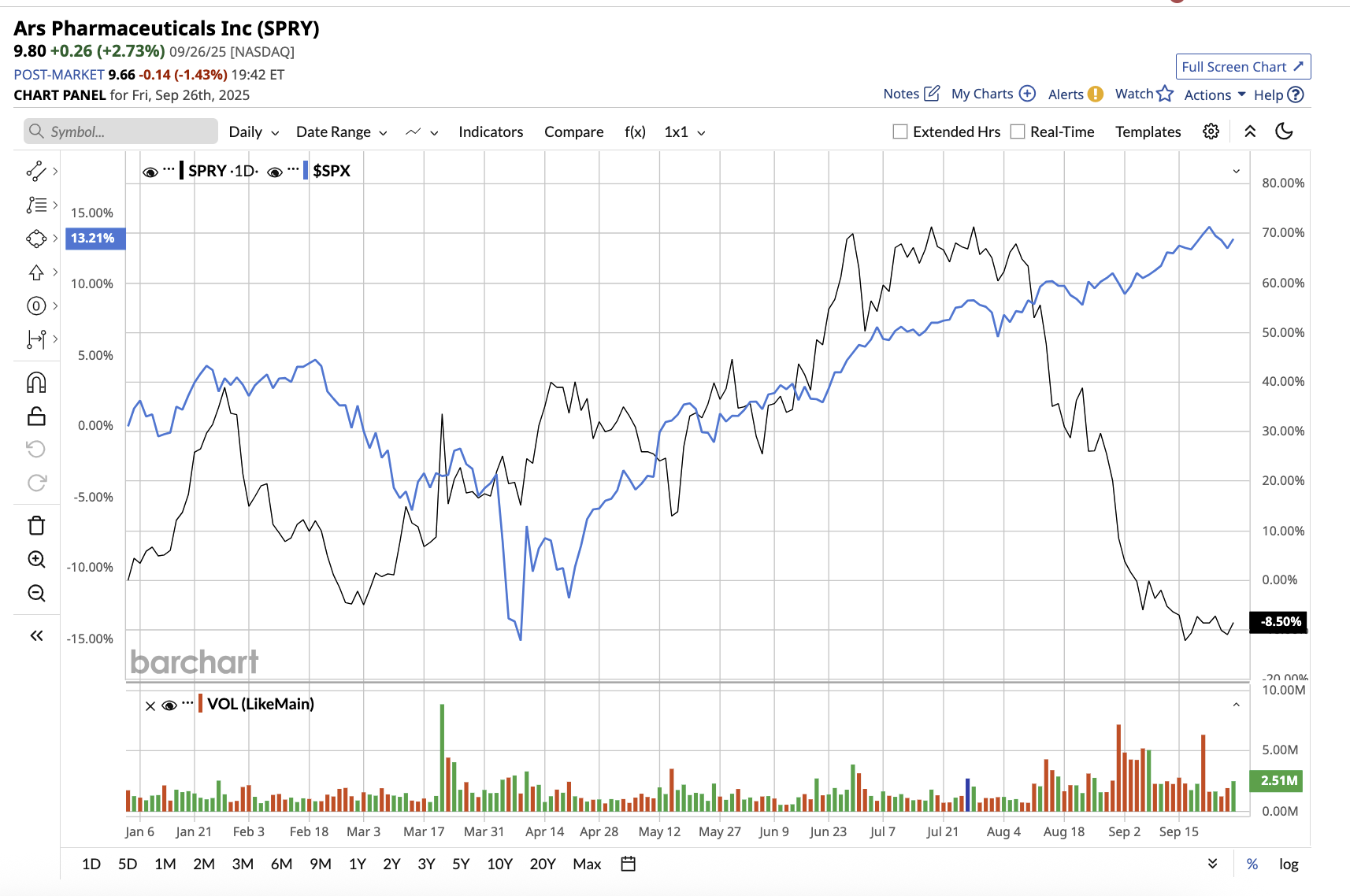

ARS stock is down 7.9% year-to-date, compared to the overall market gain.

In the second quarter, management pointed out that neffy’s commercial launch in the U.S. is accelerating due to significant prescription growth, expanded payor access, and strong sales execution. The company posted $15.7 million in total revenue, including $12.8 million in U.S. net product sales of neffy. With its licensing deal with ALK-Abello, ARS is expanding EURneffy’s global footprint. Additional contributions included $2.6 million in milestone revenue from EURneffy’s launch in Germany and $300,000 in supply revenue from collaborations.

Furthermore, submissions for neffy in Canada, Japan, and Australia are expected by the end of 2025, with approval in China coming in the first half of 2026. Despite this revenue growth, ARS recorded a net loss of $44.9 million, or $0.46 per share, mostly due to significant investments in commercialization and marketing.

Beyond anaphylaxis, ARS is broadening its pipeline with the launch of a Phase 2b trial to evaluate intranasal epinephrine (ARS-2) in chronic spontaneous urticaria, a disorder that affects an estimated 2 million people in the U.S. alone. ARS anticipates receiving top-line findings from the trial in the first half of 2026. For now, ARS remains well-capitalized, with $240.1 million in cash, cash equivalents, and short-term investments at the end of Q2. Management expects this funding to last at least the next three years, allowing for both commercial expansion and pipeline development.

Epinephrine auto-injectors have long been considered the standard of treatment. ARS Pharma’s mission is to make it easier for patients and caregivers to treat allergic responses swiftly and reliably by removing hurdles such as needle phobia, device portability, and hesitancy in an emergency.

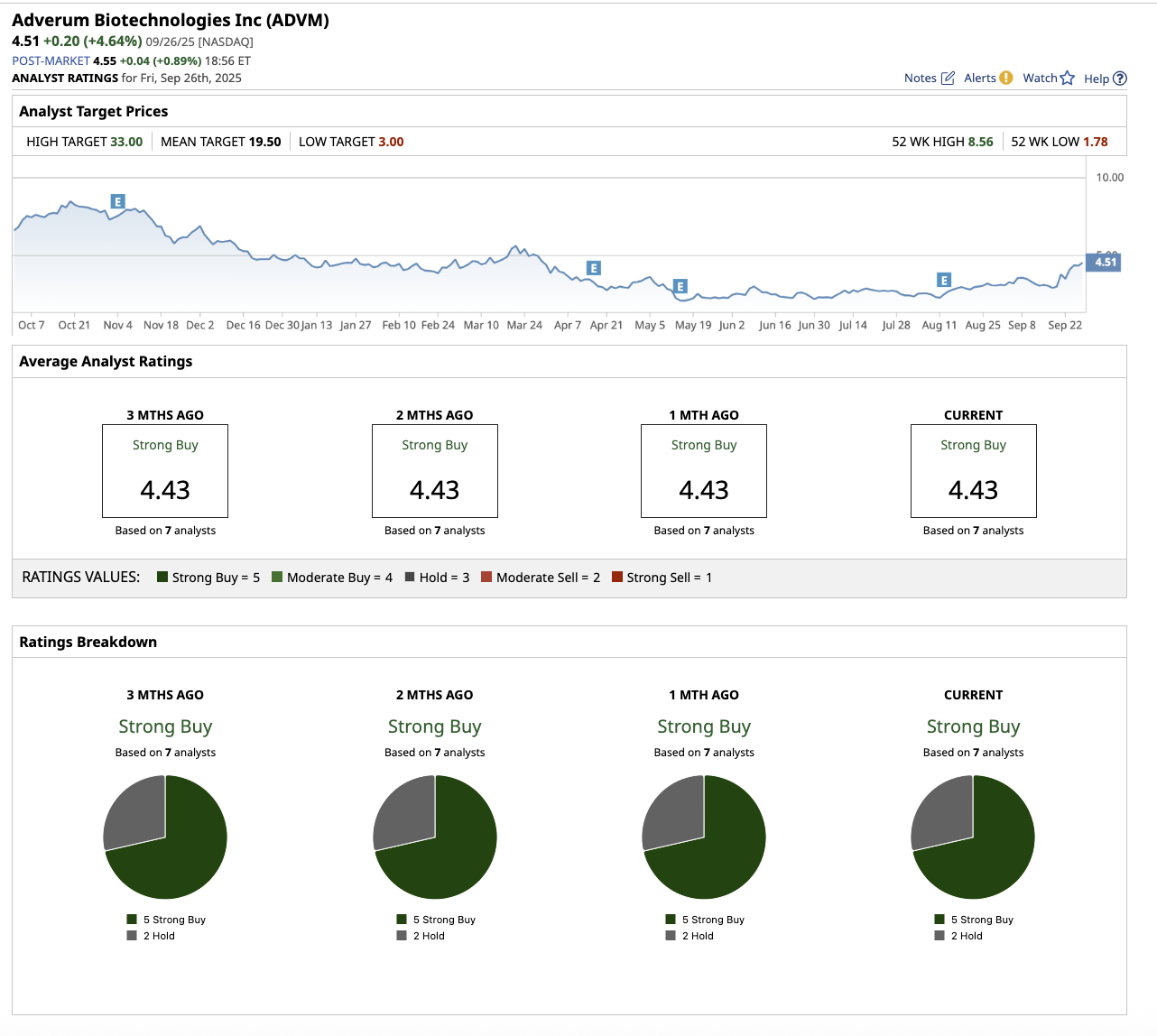

This optimism that neffy could become a new standard of care has analysts bullish about ARS’s future.

Overall, ARS stock is rated as a “Strong Buy.” Among the seven analysts that cover the stock, six rate it a “Strong Buy,” and one says it is a “Hold.” Its average target price of $31 suggests the stock can climb by 216.3% from current levels. Its Street-high estimate of $40 implies the stock has upside potential of 308% from current levels.