Two leading U.S.-based retailers witnessed big spikes in their Growth metrics in Benzinga’s Edge Stock Rankings over the past week alone, hinting at a renewed momentum and a major turnaround.

Retail Stocks Witness Spike In Growth Metrics

The Growth score in Benzinga’s Edge Rankings is assessed based on the pace at which revenue and earnings have grown historically, with equal focus on both short and long-term trends.

Over the past week, two well-known retail stocks have witnessed a significant spike in their Growth metrics, indicating a strong quarterly performance, leading to a better compounded annual growth rate.

1. Costco Wholesale Corp.

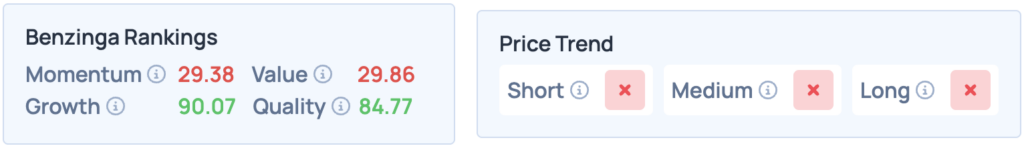

Leading warehouse retail chain, Costco Wholesale Corp. (NASDAQ:COST), witnessed a surge in its Growth score, rising from 57.41 to 90.06 within the span of a week.

This can be attributed to the company’s strong recent fourth-quarter performance, when it reported a beat on analyst consensus estimates on the top and bottom lines. In addition, Costco is actively expanding its warehouse footprint, with over 30 new openings planned, giving further runway to its revenue base.

The stock scores high on Growth and Quality, but does poorly in Momentum and Value. It also has an unfavorable price trend in the short, medium and long terms. Click here for deeper insights into the stock, its peers and competitors.

2. Village Super Market Inc.

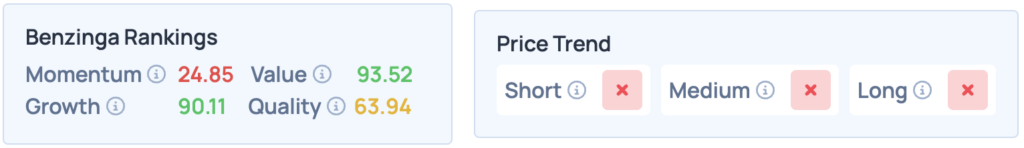

New Jersey-based Village Super Market Inc.’s (NASDAQ:VLGEA) Growth score rose from 58.47 to 90.1 within just a week, primarily driven by strong earnings growth during its most recent quarter, alongside expansion in its net profit margins in the face of tariffs, trade wars and other macroeconomic uncertainties.

Despite the modest top-line growth, this expansion in margins has allowed the company to turn around its bottom line, leading to higher Growth rankings.

According to Benzinga’s Edge Stock Rankings, the stock scores high on Growth and Value, but fares poorly in Momentum and Quality. It also has an unfavorable price trend in the short, medium and long terms. Click here for deeper insights into the stock, its peers and competitors.

Read More:

Photo courtesy: Steve Travelguide via Shutterstock