/Tesla%20car%20with%20symbol%20by%20Michael%20Fortsch%20via%20Unsplash.jpg)

Where is Tesla (TSLA) stock headed next?

That’s a popular question these days. Especially right after an earnings report that was viewed as a miss, and in which CEO Elon Musk’s comments hinted that he is thinking beyond the auto sector, toward rocket ships and artificial intelligence.

This is nothing new. It should surprise no one that a visionary like Musk is going to have a lot on his mind. But shareholders are running out of patience for his continued spats with the U.S. government and missed deadlines.

This sets up the company to continue to be a political and market football. A punching bag for some, a relentless dream of long-term riches for others. Some investors are fired up about TSLA stock. About everything Tesla related. All the time. More power to them! This is capitalism, after all.

And part of that is making decisions based on what investing research process each of us develops. In my case, just show me the chart.

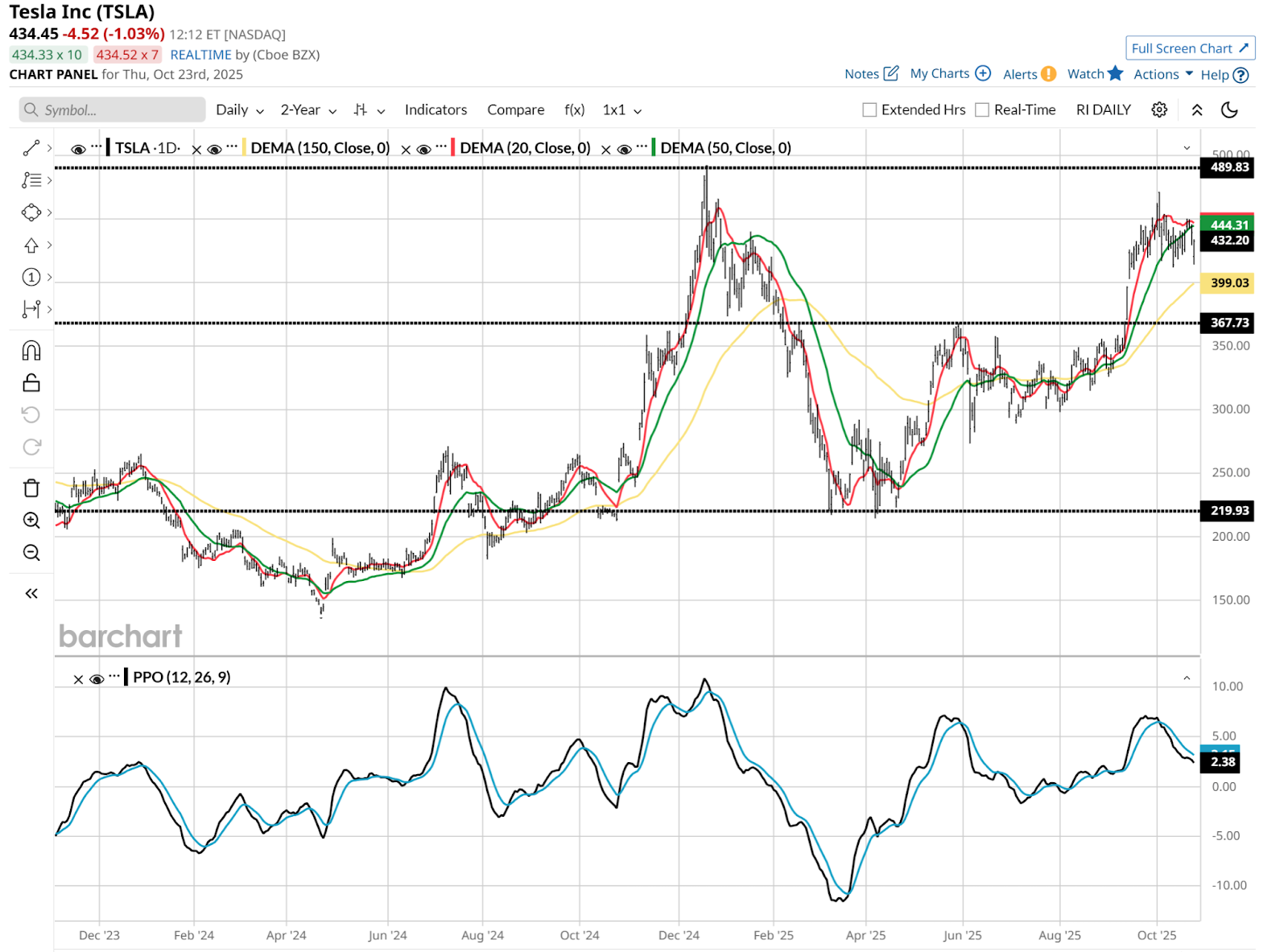

In the case of TSLA, in daily price form, this looks like a stock in the process of “rolling over.”

What does that mean? Exactly what you think it does. It has rallied hard, from $220 in April to $300 in August, and $470 in October before stagnating, then dipping. Some “buy the dip” action ensued, as it typically does.

What Indicators Will Drive TSLA Stock Now?

Now, however, there are two early signs this could be the end of that run for a while. The 20-day moving average and Percentage Price Oscillator (PPO), at the top and bottom of this chart respectively, are the first places my eyes go. Regardless of time frame.

The 20-day in red has had as many “false starts” around the current price level as a Miami Dolphins offensive lineman. But that’s a high perch to rally from, so the odds favor the downside as the next move of consequence.

The PPO is giving a stronger hint. That black line crossing down through the light blue line is a prompt for further downside action. Look back to June’s decline, as well as January of this year, and July 2024. To me, that’s the same type of pattern, except that currently, TSLA is earlier in the process.

Will Tesla Rally from Here?

Does it surprise you to hear me say that TSLA could easily go up from here, and maybe substantially?

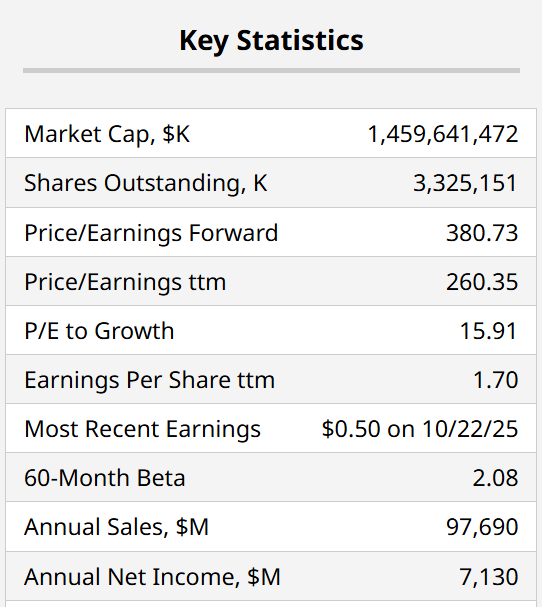

This is probably the largest-cap “meme stock” I know of, based on its ability to trade ever-higher than its valuation. Not by a little, either. A nearly 16x PEG Ratio is quite rich. Not as rich as Elon Musk, but rich nonetheless.

How to Analyze TSLA, or Any Other Stock

One mistake I see newer investors make, no matter how smart, precise, and logical they are about stock analysis, is that investing is not simply about “buy or sell.” It is about “how much to own, if any.”

And it is about developing a repeatable process around that, which considers not only each security, but how well it plays with the others in the portfolio you've created and manage for yourself. Process over picks.

So with TSLA, the question is less about “own it or not” but how much. In my own case, I’m not currently involved, though I trade it on and off. That is, I actively rotate my “position size” within my overall portfolio that is allocated to TSLA.

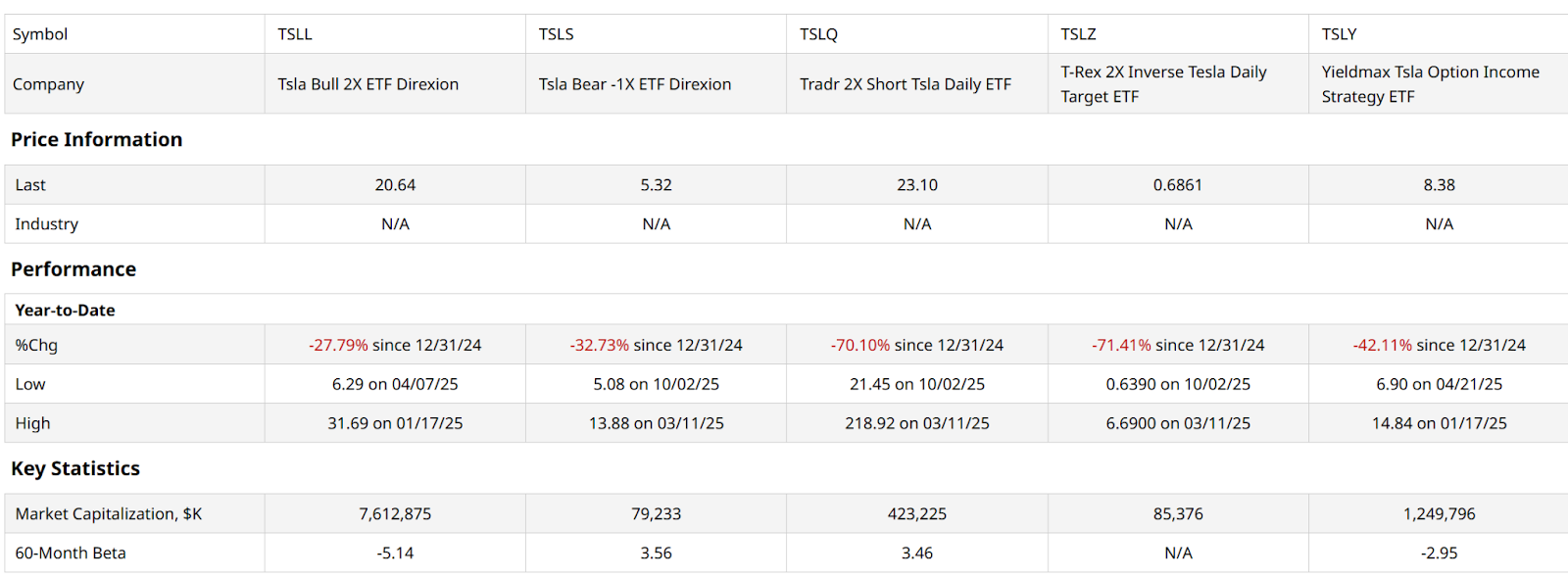

That can be through owning the stock, call or put options, or some of the inverse and leveraged ETFs on it, shown above. When we see just how many ways there are to try to profit from TSLA, regardless of direction, the question of do you or don’t you is more about who you are as an investor.

One thing we can count on: TSLA will provide a volatile stock to own in a wide range of ways.

Rob Isbitts, founder of Sungarden Investment Publishing, is a semi-retired chief investment officer, whose current research is found here at Barchart, as well as on Substack.