Amidst the current market volatility fueled by tariff disputes and economic uncertainties, certain high-yield dividend stocks have defied the odds, delivering impressive year-to-date returns that exceeded those of the S&P 500 Index ($SPX). These stocks boast robust dividend histories and show promising growth potential. This dual strength suggests they offer investors a reliable source of steady income from dividends and opportunities for substantial capital appreciation.

Given this backdrop, let’s delve into two high-yield dividend stocks outpacing the broader market.

Dividend Stock #1: Altria

Altria (MO) remains an attractive choice for income investors, thanks to its consistent dividend growth and shareholder-friendly initiatives. It has consistently rewarded its shareholders with higher dividend payments and share repurchases. The company’s core strength lies in its diversified portfolio of smokeable and smoke-free products and its leadership in the U.S. tobacco space.

The company’s iconic brands, such as Marlboro, Copenhagen, and Black & Mild, continue to perform well, while innovative offerings such as on! and NJOY are gaining traction among adult consumers. These products are central to Altria’s long-term strategy. Moreover, the company is expanding its footprint in the high-margin, smoke-free segment.

In August 2024, Altria raised its dividend by 4.1%, marking the 59th increase in 55 years. Backed by a strong balance sheet and a keen focus on operational efficiency, the company aims to maintain this momentum, targeting mid-single-digit dividend growth through 2028. This is expected to be supported by a similar rise in adjusted earnings per share (EPS) over the same period.

Meanwhile, Altria’s operational efficiency efforts, including streamlining processes and embracing artificial intelligence (AI), further strengthen its growth outlook.

With a diversified product portfolio, a long history of rewarding shareholders, and visibility over future dividend growth, Altria is a top income stock.

While analysts currently assign Altria a “Hold” rating, the stock’s appeal is clear for dividend investors. It boasts a robust dividend yield of 7% and has delivered a strong performance in 2025, climbing approximately 11.5% year-to-date. This outpaces the broader S&P 500, which has seen a decline of 6.6% over the same period.

Dividend Stock #2: Verizon

Verizon (VZ) is an attractive stock for investors seeking a steady dividend and high. In 2024, the communications giant increased its quarterly distribution by 1.9%, marking its 18th consecutive year of dividend growth. This increase brings Verizon’s forward yield to approximately 6.5%.

Verizon’s solid cash flows support its payouts. In 2024, Verizon paid $11.2 billion in dividends and generated an operating cash flow of $36.9 billion.

Verizon’s core mobility and broadband segments are well-positioned for growth in 2025. It’s speeding up broadband rollout efforts organically and through the pending acquisition of Frontier (FYBR). At the same time, Verizon is tapping into future technologies, including its AI Connect offerings and satellite partnerships that enable free global texting. These initiatives could open new revenue streams and extend its reach.

The company’s network continues to be a key asset. Its C-band spectrum deployment remains ahead of schedule, targeting coverage of 80% to 90% of planned sites by year-end. With aggressive 5G Advanced rollouts and enhancements to its spectrum portfolio, Verizon is strengthening its position as a network leader.

Verizon also reported strong broadband growth, adding 339,000 subscribers in Q1 2025, driven by its dual fixed wireless and fiber strategy. The company aims to reach 8 million to 9 million fixed wireless access subscribers by 2028. Its private networks segment is also scaling, and the company closed a significant number of deals in Q1 2025.

Moreover, Verizon’s balance sheet continues to be a key strength of its business. Notably, it has less than $700 million in unsecured debt maturities remaining in 2025. This provides a clear pathway for meaningful debt reduction ahead of the closing of the Frontier transaction, in alignment with its capital allocation strategy.

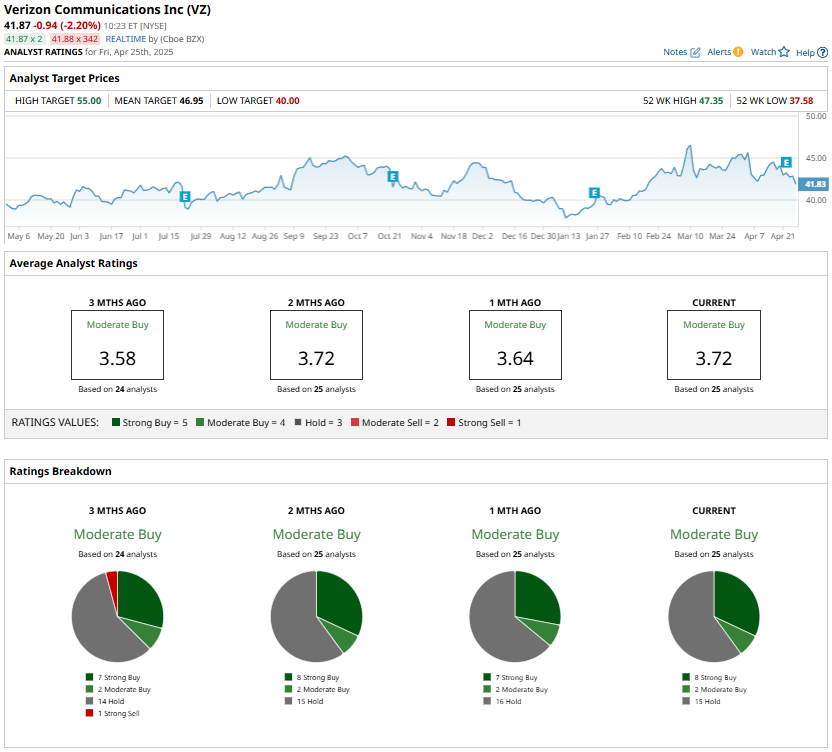

Verizon stock has outpaced the broader market this year, delivering a year-to-date gain of 4.9%. While Wall Street analysts currently rate the stock as a “Moderate Buy,” it remains an attractive option for income investors due to its high dividend yield and potential for steady long-term growth.