Today, we’re looking at two covered call examples on Futu Holdings stock.

Futu Holdings (FUTU) is up 45.70% in the last three months and is currently showing an implied volatility of 54.19%.

Using options, we can generate an income from high volatility stocks via a covered call strategy.

FUTU Covered Call Example

Let’s look at two different covered call examples on FUTU stock. The first will use a monthly expiration and the second will use a six-month expiration.

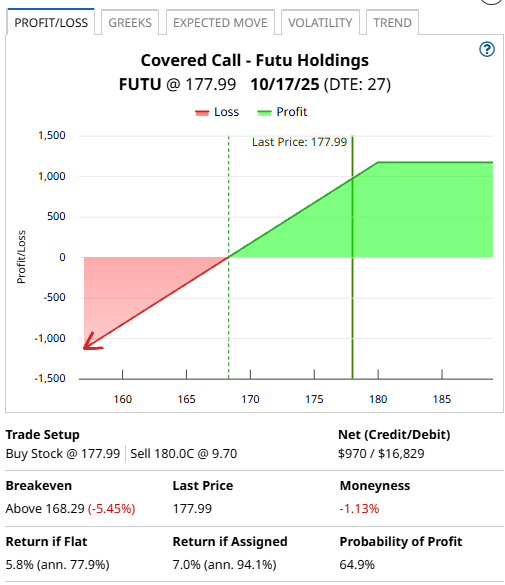

Let’s evaluate the first FUTU covered call example.

Buying 100 shares of FUTU would cost around $17,800. The October 17, 180-strike call option was trading around $9.70, generating $970 in premium per contract for covered call sellers.

Selling the call option generates an income of 5.8% in 27 days, equalling around 77.9% annualized. That assumes the stock stays exactly where it is. What if the stock rises above the strike price of 180?

If FUTU closes above 180 on the expiration date, the shares will be called away at 180, leaving the trader with a total profit of $7.0%, which is 94.1% on an annualized basis.

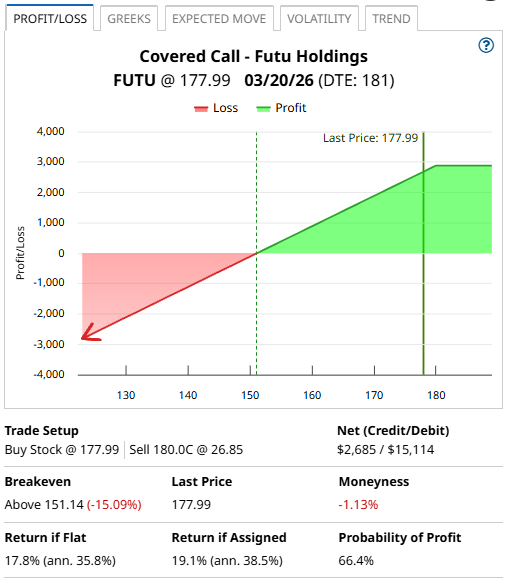

Instead of the October 17 call, let’s look at selling the March 180-strike call instead.

Selling the March 180-strike call option for $26.85 generates an income of 17.8% in 181 days, equalling around 35.8% annualized.

If FUTU closes above 180 on the expiration date, the shares will be called away at 180, leaving the trader with a total profit of 19.1%, which is 38.5% on an annualized basis.

Of course, the risk with the trade is that the FUTU might drop, which could wipe out any gains made from selling the call.

Barchart Technical Opinion

The Barchart Technical Opinion rating is a 88% Buy with a Strengthening short term outlook on maintaining the current direction.

Long term indicators fully support a continuation of the trend.

Relative Strength just crossed above 50%. The market is indicating support for a bullish trend.

The next earnings release is set for late November.

Company Description

Futu Holdings Limited is a technology company which offers a digitized brokerage platform.

It is primarily engaged in the online brokerage services and margin financing services.

The Company provides investing services through its digital platform, Futu NiuNiu, an integrated application accessible through any mobile device, tablet or desktop.

Futu Holdings Limited is based in New York.

Of the 11 analysts following the stock, 8 rate it as a Strong Buy, 1 as a Moderate Buy and 2 as a Hold.

Covered calls can be a great way to generate some extra income from your core portfolio holdings.

Please remember that options are risky, and investors can lose 100% of their investment. This article is for education purposes only and not a trade recommendation. Remember to always do your own due diligence and consult your financial advisor before making any investment decisions.