Snowflake (SNOW) was a strong performer yesterday rising 3.11% for the day and setting a new 52-week high.

Snowflake is a cloud-based data platform that enables organizations to store, manage, and analyze large volumes of data across multiple public cloud environments.

Its architecture separates compute from storage, allowing scalable, on-demand performance for data warehousing, data lakes, engineering, and secure data sharing

The Barchart Technical Opinion rating is a 100% Buy and ranks in the Top 1% of all short term signal directions.

Long term indicators fully support a continuation of the trend.

Rather than just buying the stock, savvy traders can use the options market to find smart ways to trade Snowflake stock without risking too much capital.

Today, we’re going to look at a couple of bull call spread trades on Snowflake stock.

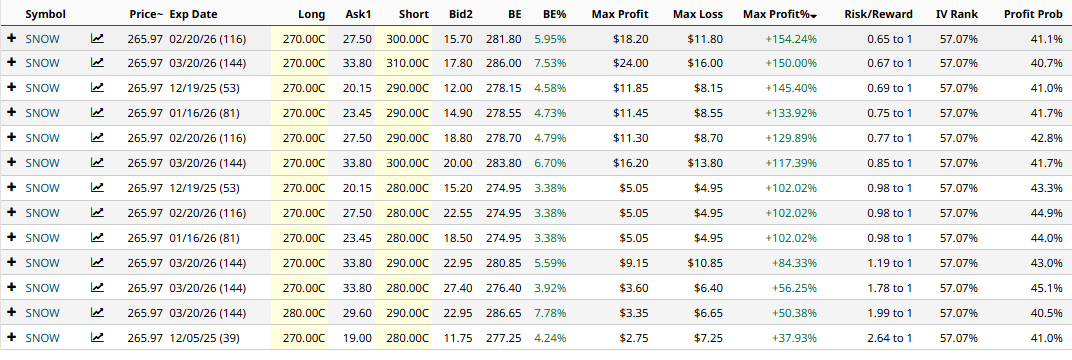

Here are the parameters for finding some bull call spread trade ideas on SNOW.

- Symbol equals SNOW

- Break Even Probability above 40%

- Moneyness -10% to 0%

- Days to expiration 30 to 150

Here are the results of that particular screener:

Let’s analyze some of these ideas.

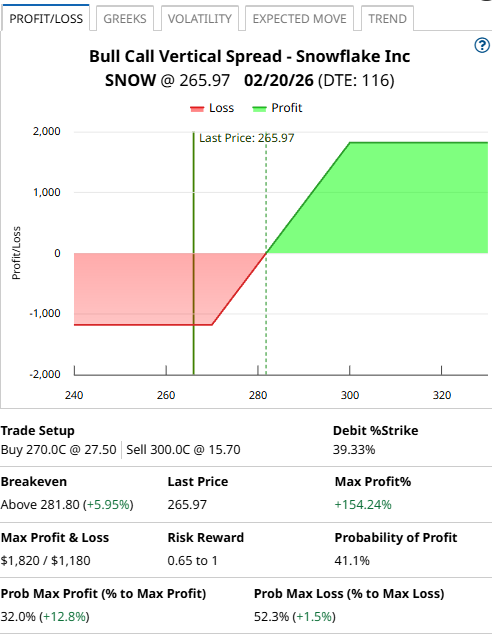

Bull Call Spread 1: February 20th 0$270 – $300 Bull Call Spread

As a reminder, A bull call spread is a bullish defined risk option strategy. To execute a bull call spread an investor would buy a call option and then sell a further out-of-the-money call.

Let’s use the first line item as an example. This bull call spread trade involves buying the February 20th expiry $270 strike call and selling the $300 strike call.

Buying this spread costs around $11.80 or $1,180 per contract. That is also the maximum possible loss on the trade. The maximum potential gain can be calculated by taking the spread width, less the premium paid and multiplying by 100. That give us:

30 – 11.80 x 100 = $1,820.

If we take the maximum gain divided by the maximum loss, we see the trade has a return potential of 154.24%.

The probability of profit is 41.1%, although this is just an estimate and does not indicate the probability of achieving the maximum profit.

The spread will achieve the maximum profit if SNOW closes above $300 on February 20. The maximum loss will occur if SNOW closes below $270 on February 20, which would see the trader lose the $1,180 premium on the trade.

The breakeven point for the Bull Call Spread is $281.80 which is calculated as $270 plus the $11.80 option premium per contract.

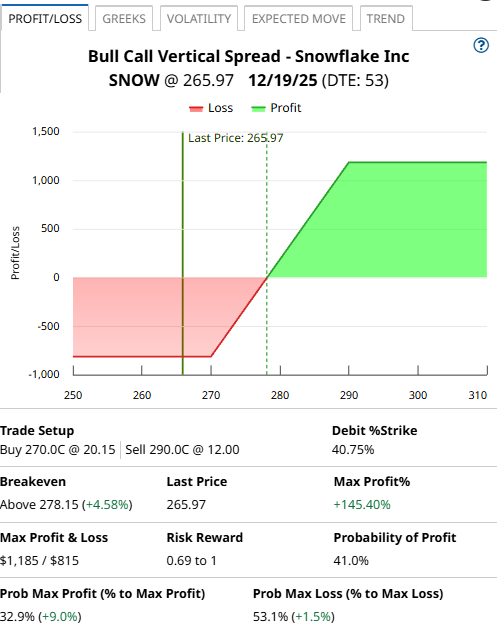

Bull Call Spread 2: December 19th $270 – $290 Bull call Spread

The next example is on the third line and involves buying the $270 December 19th call and selling the $290 call.

Buying this spread costs around $8.15 or $815 per contract. That is also the maximum possible loss on the trade. The maximum potential gain can be calculated by taking the spread width, less the premium paid and multiplying by 100. That give us:

20 – 8.15 x 100 = $1,185.

If we take the maximum gain divided by the maximum loss, we see the trade has a return potential of 145.40%.

The probability of profit is 41.0%, although this is just an estimate and does not indicate the probability of achieving the maximum profit.

Mitigating Risk

With any option trade, it’s important to have a plan in place on how you will manage the trade if it moves against you.

For a bull call spread, setting a stop loss of 50% of the premium paid is a good idea. In the first SNOW example above, that would be a loss of around $590. For the second example, the stop loss would be around $410.

Traders may also consider a stop loss if SNOW breaks below key support at $255.

Please remember that options are risky, and investors can lose 100% of their investment. This article is for education purposes only and not a trade recommendation. Remember to always do your own due diligence and consult your financial advisor before making any investment decisions.