/AI%20(artificial%20intelligence)/Businessman%20touching%20the%20brain%20working%20of%20Artificial%20Intelligence%20(AI)%20Automation%20by%20Suttiphong%20Chandaeng%20via%20Shutterstock.jpg)

Artificial intelligence (AI) has quickly emerged as a powerful force reshaping industries, markets, and daily life. However, with so many companies using the term “AI” in their story, investors must distinguish between hype and genuine long-term opportunities. While countless names compete for attention, these two AI-focused companies stand out for their scale, strategy, and long-term growth potential.

AI Stock #1: Arista Networks

Arista Networks (ANET), valued at $166.9 billion, focuses on designing and selling high-performance networking solutions for demanding environments such as large-scale data centers, cloud and AI computing infrastructures, and enterprises.

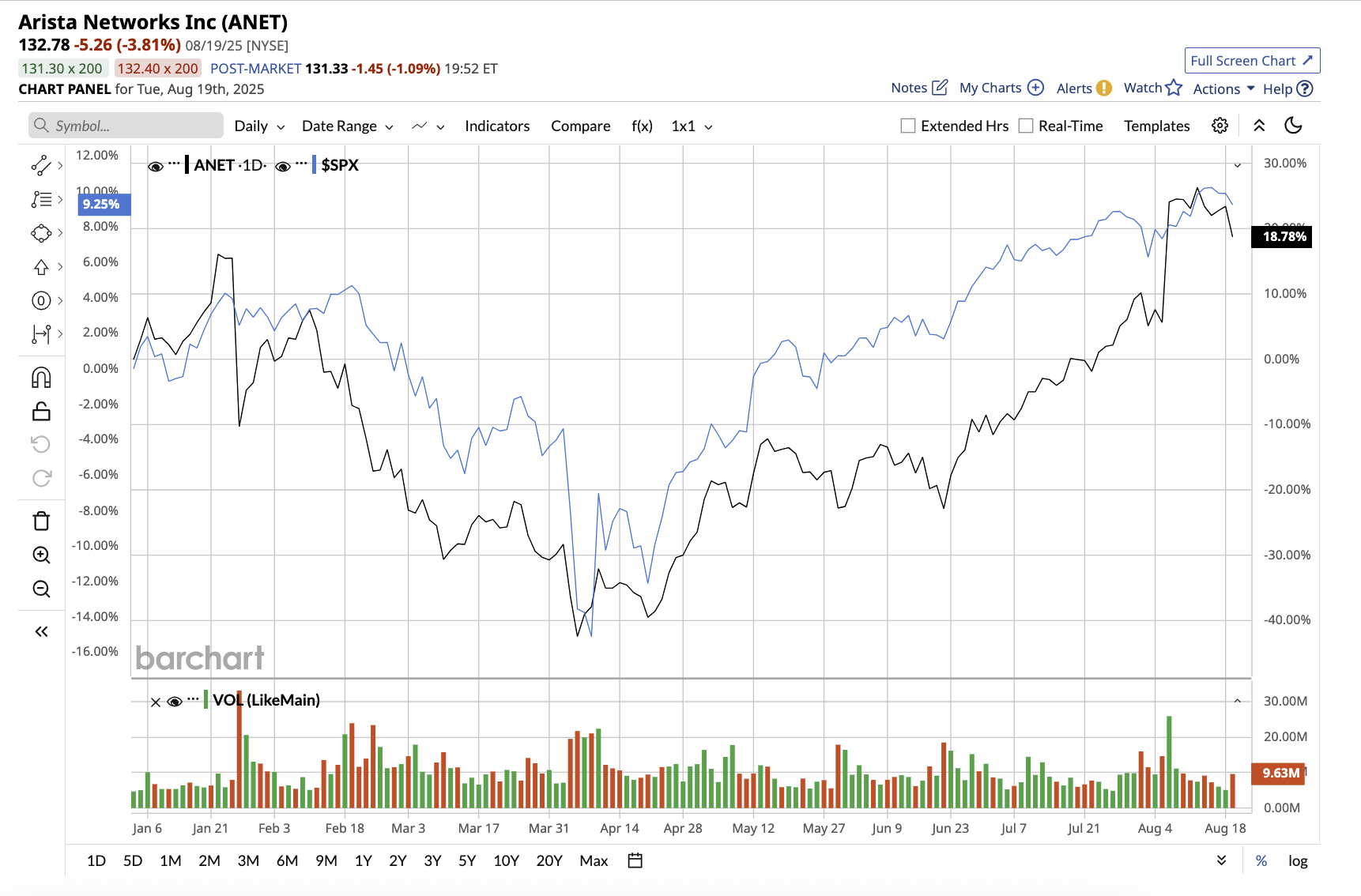

Arista stock has surged 17.3% year-to-date and 46.5% for the past 52 weeks, outperforming the broader market gain.

Arista continues to ride the AI wave and cloud networking demand. In the second quarter, Arista reported $2.2 billion in revenue, exceeding its forecast by $100 million and representing a 30.4% increase year over year. Software and service renewals accounted for 16.3% of total revenue, demonstrating the company’s growing recurring revenue base. Gross margins increased to 65.6% driven by effective supply chain execution and inventory management. International markets accounted for 21.8% of revenue, with EMEA leading the way, followed by the Americas at 78.2%. Net income per share came in at $0.73, up 37.7% from the prior year.

Much of Arista’s momentum stems from its role as the networking backbone for AI workloads. The company has aggressively expanded into AI data center networking, which it estimates will generate $1.5 billion in additional revenue by 2025. Arista’s flagship EtherLink portfolio, which launched in 2024, now includes over 20 products and has quickly established itself as the most comprehensive AI networking solution. The company had $8.8 billion in cash and investments at the end of the quarter. The company also repurchased $196 million of stock, leaving $1.4 billion available under its share buyback program.

Given its strong first half, Arista has increased its full-year 2025 revenue forecast from $8.2 billion to $8.75 billion, representing a 25% year-over-year increase. This upward revision reflects increasing demand in the AI, cloud, and enterprise segments. CEO Jayshree Ullal described the current situation as a “once-in-a-lifetime opportunity” to establish a pure-play networking leader at the heart of the AI and cloud revolution. Looking ahead, the CEO outlined a bold vision for Arista 2.0, which is to increase revenue from $5.8 billion in 2023 to $10 billion by 2026. This growth trajectory, she emphasized, is based on three pillars: customer trust, continuous innovation, and strong leadership.

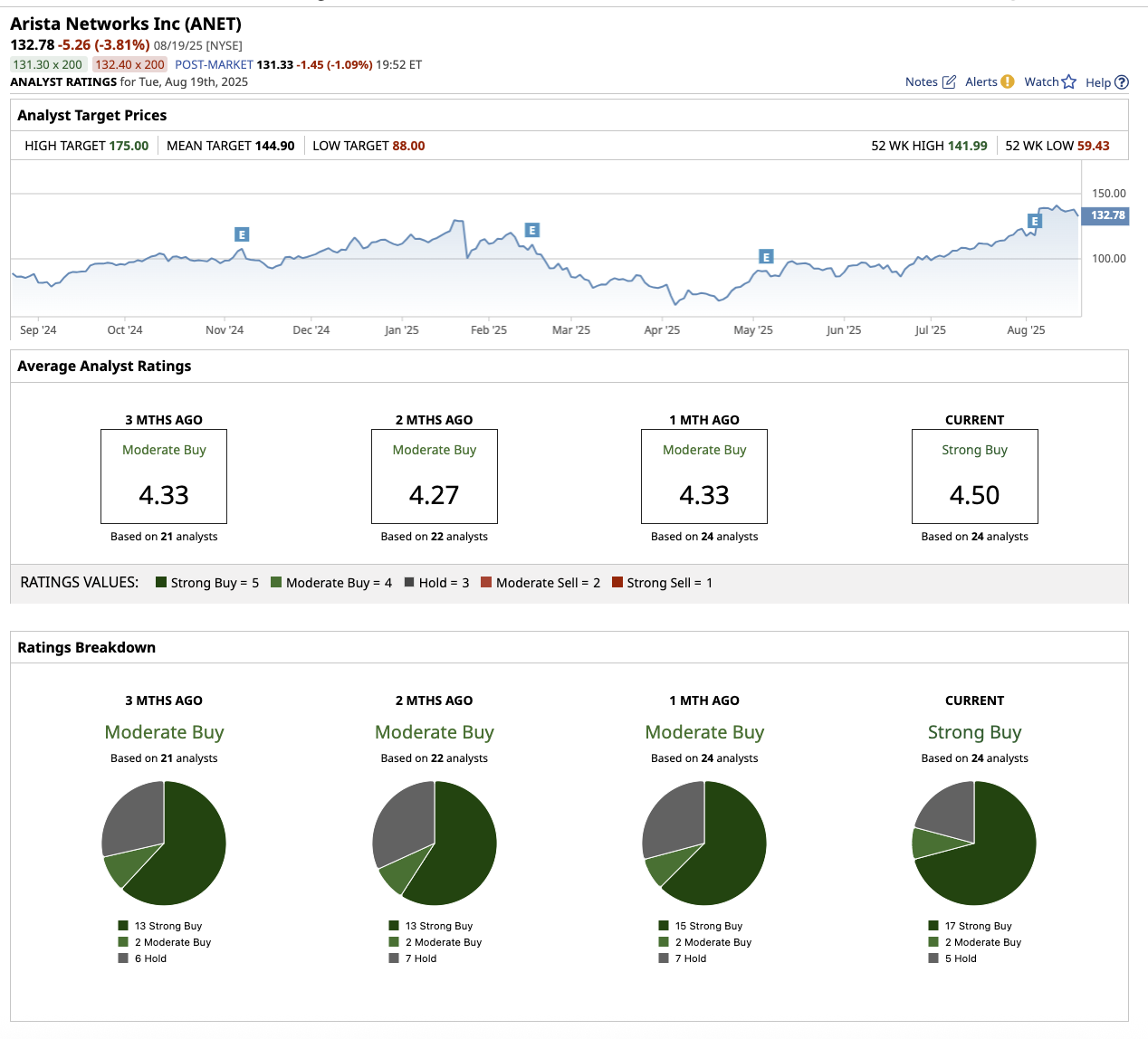

On Wall Street, Arista stock has moved from an overall “Moderate Buy” rating a month ago to a “Strong Buy” now. Of the 24 analysts covering the stock, 17 rate it as a “Strong Buy,” two as a “Moderate Buy,” and five recommend a “Hold.” The stock’s average target price of $144.90 suggests a potential upside of 9.1% from current levels, while the highest price estimate of $175 indicates a possible 31.8% rally over the next 12 months.

AI Stock #2: Super Micro Computer

Valued at $25.8 billion, Super Micro Computer (SMCI), often called Supermicro, is a U.S.-based tech company that designs and manufactures high-performance servers, storage systems, and data center hardware. Supermicro has been in the spotlight since last year’s accounting manipulation allegations and financial filing delays.

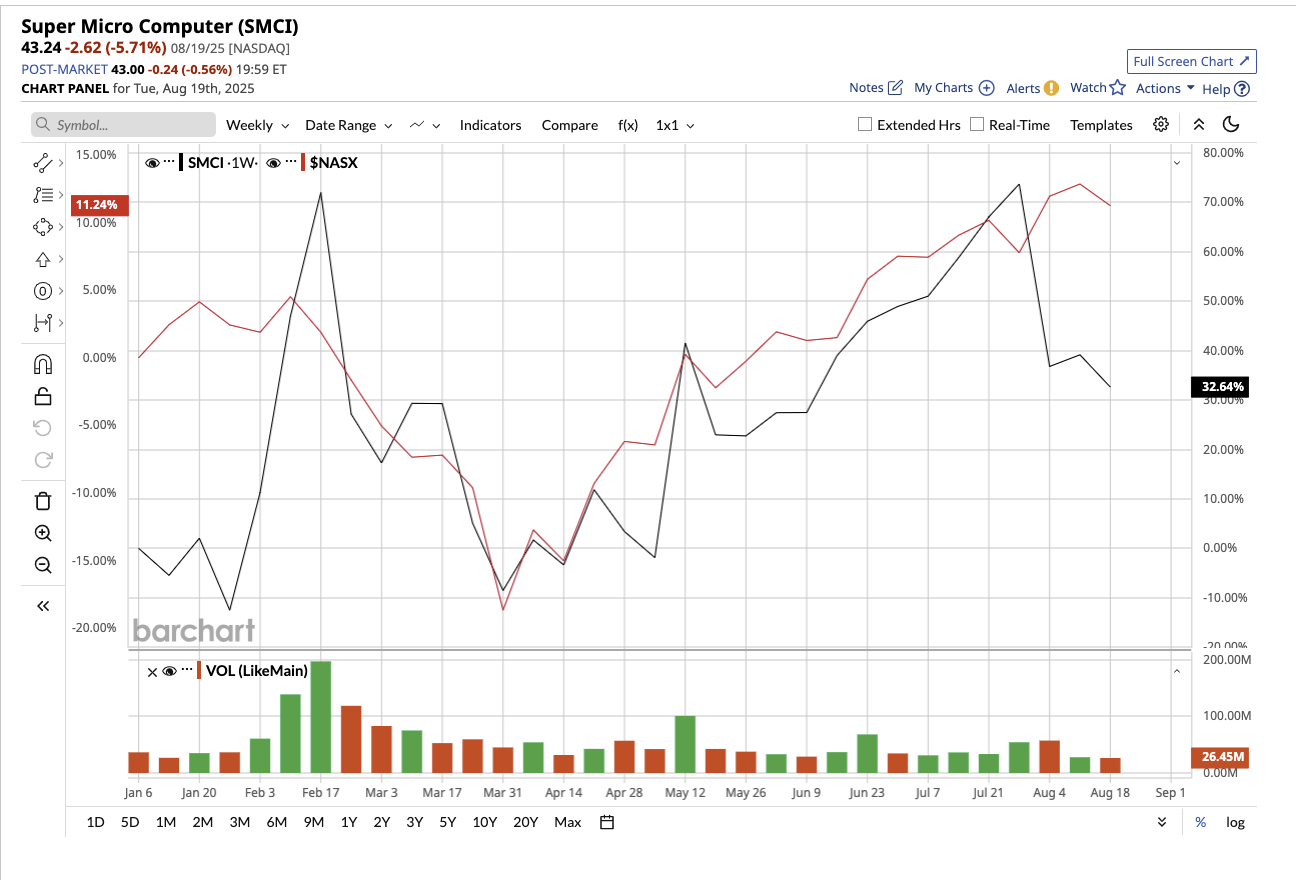

However, its recent fourth quarter and full-year fiscal 2025 results show a company gradually attempting to regain lost trust. SMCI stock has gained 38% year-to-date, compared to the tech-heavy Nasdaq Composite Index’s ($NASX) gain of 11.2%.

Fiscal 2025 was not without growing pains for the company, ranging from late filings to customer-driven specification changes. However, Supermicro’s ability to pivot, scale, and innovate has cemented its position as a market leader in high-performance computing infrastructure. The company achieved a staggering 47% year-over-year revenue growth, totaling $22 billion in sales. The number of large-scale “plug-and-play” direct customers has doubled, rising from two in fiscal 2024 to four in fiscal 2025. Management expects this figure to rise further in fiscal 2026.

Supermicro’s success is driven primarily by its leadership in AI-optimized platforms and systems. The company’s close collaboration with semiconductor leaders such as Nvidia (NVDA) and Advanced Micro Devices (AMD) keeps it a top choice for enterprises and hyperscale cloud providers looking to deploy AI infrastructure. Despite these accomplishments, Supermicro’s adjusted earnings fell to $2.06 per share from $2.12, owing primarily to tariff impacts.

While hyperscale AI demand will continue to grow, Supermicro is strategically expanding into enterprise IT, IoT, and telecommunications to balance its portfolio and enter new markets. The company has reduced its ambitious revenue target of $40 billion for fiscal 2026, which it set at the start of the year. However, its new fiscal 2026 guidance anticipates another year of explosive growth, potentially $33 billion in sales, a 50% increase over fiscal 2025.

Supermicro’s ability to innovate quickly, scale globally, and deliver integrated data center solutions in the face of headwinds demonstrates its resilience, making it one of the few AI picks that cannot be overlooked.

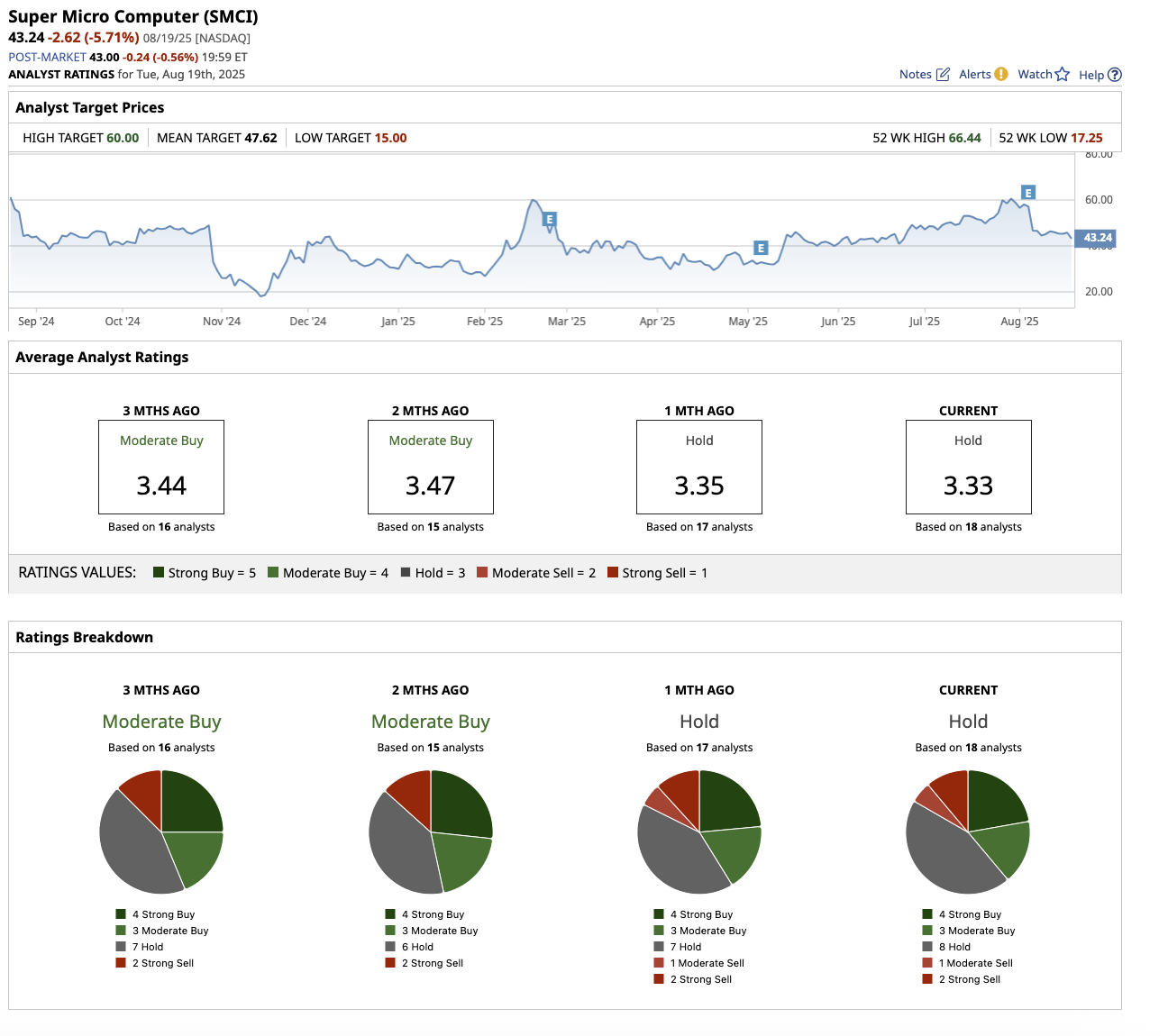

On Wall Street, overall, SMCI stock holds a consensus rating of “Hold.” Among the 18 analysts covering the stock, four rate it as a “Strong Buy,” three as a “Moderate Buy,” eight as a “Hold,” one says it is a “Moderate Sell,” and two rate it as a “Strong Sell.” The stock’s average price target of $47.62 indicates potential 10.1% upside from current levels. Meanwhile, the highest price estimate of $60 suggests the possibility of a 38.7% surge over the next 12 months.