Article created by: Indrė Lukošiūtė

Trying to make ends meet in the cost of living crisis can feel truly daunting. Especially when you don’t really have a financial backup plan.

Nearly six in 10 Americans don't have enough savings to cover a $500 or $1000 unplanned expense, the new Bankrate report showed. But the surge of inflation is not going anywhere. In fact, economists say that 2023 is likely to be remembered for the sharpest drop in household incomes on record.

I joined a Buy Nothing Group on Facebook and the gifting community has been amazing. I was able to furnish a room in my apartment from gifted items.

For frugal financial advice, here are a few that help me.

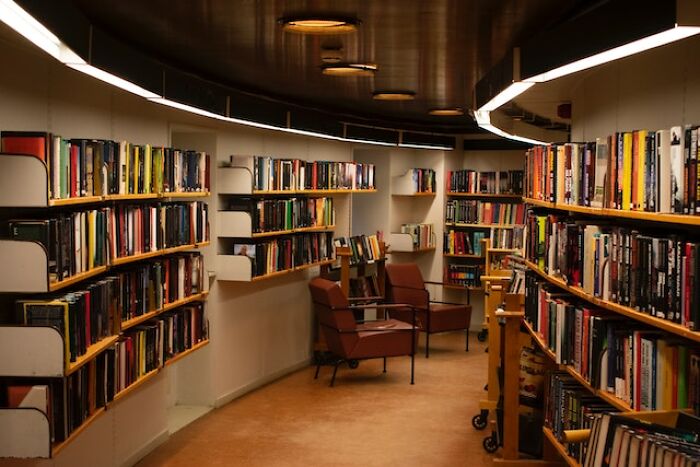

It’s kind of a Holy Grail in this sub already, but can’t be reiterated enough - use your local library, if you can!

Create wishlists or leave the item in your cart for at least a day or two when you want to buy something online. This form of “window shopping” helps curb impulse purchases and if it is an items you actually want, you might get a discount code from the site.

Set up text or email notifications on all your accounts for any withdrawals more than $0.01. Bank account, debit cards, credit cards, etc. It helps you catch items you may be missing if you aren’t tracking your expenses already (like a streaming service you never use!) and will alert you to fraud much quicker as well.

As soon as my car was paid off, I took half the payment I was making and put it into a 'car savings account' to be used on repairs of my car or hopefully build up to the point that replacing my vehicle was relatively painless. Eventually, the repair for the car was not worth it and I still was able to get a decent trade in value for it, combined with my savings, my monthly budget didn't change at all.

When interest rates were low, I refinanced the house. Rather than a cash out like all of the cool people were doing, I just changed it to a 15 year instead of a 30 year mortgage. I will save well over 6 figures in interest, my payments really didn't change by much. Also, the equity is there if I need it for emergencies but I am not paying interest on money I don't need to borrow.

Make one day a week where you don’t spend any money for anything.

I make my own bread. I probably eat way too much of it but I use the no knead method and it’s easy.

My entire house has been supplied by thrift store and Craigslist finds: dishes, area rugs, sheets $2, dressers $25, bed $100, toaster $5, blender $5, pots and pans $75, towels $2.50 ea, kitchen table and chairs $25, silver ware $8, etc.

All items match, coordinate, function and/or are quality made. Tons of fun finding them, memories and feelings of treasures found linger as I am surrounded by them. I’ve found them most of the time within a days outing in search of each one. Because they are in such good shape, I imagine they are from people moving, or donated during estate liquidation ext.

Seriously, Americans have so much stuff there is no need to buy new.

I balance my accounts daily. It takes 5 minutes max, and it helps me see exactly what's coming and going, what's expected, and where I'm at. It makes keeping on track really, really, easy.

I bought a steel coffee filter so I could stop buying paper ones (honestly a petty amount of money to save but hey it’s also better for the environment), clipped more coupons from both digital and online sources, invested more money.

I started selling a bunch of stuff on eBay/FB market place and really digging into my “am i ever reallllyyyy guna use/wear this?”

Unsubscribing from sale notifications worked really well for me

If I'm considering an impulse purchase I really think about if and how much I'd use it, where I'd keep it, and if I actually need it

To avoid allowing myself to purchase unnecessary things, I made a note on my phone with links to everything I wanted to buy. Occasionally I would spend a long time saving up for those things. Often times, months would pass and when I had money to buy something from the list, I decided I didn’t really want it anymore. This has meant I only buy something extra for myself once every couple of months. This helped my self control, my wallet, and gave me perspective on what’s important.

Item 5 in your list reminded me of something an old colleague told me about: have an annual house maintenance calendar full of lots of preventative jobs to do at specific points through the year.

Usual things like clearing out your gutters, jet washing the patio, etc, life admin tasks like renewing annual insurance policies, but then also things I'd never think about doing like pulling all the furniture/storage boxes etc away from external walls every autumn/spring to check for damp/mold.

I can't say I've actually put anything as regimented as this in place myself 😅 but it sounds like a good idea!

Using a credit union instead of a bank. Game changing in terms of low / no fees and low / no minimum balance.

If an article of clothing you like loses a button or gets a small tear or the hem comes undone, your dry cleaner will probably fix it for a couple of dollars. This is way better than throwing it out or waiting months / years until you get around to mending it yourself for free. For plain buttons, they probably have a close match if you lost it, or there may be hidden extra buttons sewn in. If the buttons are more custom color or shape, move a matching button from the bottom and replace the bottom button with a close match.

Just googling “website coupon code” whenever I am about to make a purchase that has a coupon code space to enter. Just bought lift tickets to ski and saw that section. Opened a new browser and searched for it. Found one that gave me $25 off. It worked and took me about 3 minutes to find.

For me I have a really bad issue with buying cheap (and sometimes expensive) snacks whilst on my lunch break. Like I’ll go to the market by my job for a bag of chips and get a $2 bag sometimes because it’s $2…whatever, y’know?

Well, that adds up. Especially if I’m already planning on buying a lunch.

So on days where I grab the bag but then decide to put it back on the shelf, I immediately move that $2 to my savings. It definitely adds up over time, especially if it’s a more expensive snack like a $5 bag of chips, or a $8 pastry. If I could theoretically afford it in that moment, then I can definitely afford to send that money to my savings.

Here’s my 11 tips:

1. learning the names of basic over the counter medications (example: acetaminophen, ibuprofen, Dimenhydrinate) and then reading labels and buying the generic version (store brands)

2. Using natural products for skin care instead of spending tons of $$$ on “beauty” products that have toxic ingredients to boot (example of basics: vitamin E and Witch-Hazel)

3. Buy classic well made pieces of clothing that I can wear in many ways and take care of them and they last for years instead of 10x more pieces that are trendy and cheaply made and fall apart. Granted this is difficult now. I have kept good clothes, outerwear and footwear for decades and I shop second hand, vintage and also sew and alter.

4. Buy all of my shelf stable pantry and other household items at a bulk store.

5. Meal plan and make leftover meals and actually eat leftovers. I like them. Many dishes taste better the next day. Looking up recipes for what you have on hand is great for this too.

6. Rarely (as in once in a blue moon if I am super stuck on long trips and have no choice) eat fast food or at take-out junk food places. I’ve been doing this all my life because firstly I don’t like it (was raised on healthy food and find it gross) and secondly it’s a massive waste of money. I bring homemade wherever I go if I need to eat during the day in a small lunch cooler or heatables. I worked for years with people that spent a small fortune ordering out. If you add it up over the course of a week or month, it’s insane how much it costs.

7. I schedule my driving around for errands to be done all in one day or in chunks on a couple of spread out days and plan my route so I am not driving around multiple times all over the place more than I have to. This saves not only gas money but on my time which is actually frugally precious to me and wear and tear on my vehicle and just annoyance and these days adding to possible accidents from all the crazy drivers.

8. I do like some of the good things like certain foods and drinks but I find that there’s not much of a difference between an $8 bottle of wine and a $30+ bottle. So, if I want wine, I am perfectly good with one of the more cheapy labels that I know I like the taste of. I rarely go out socially where I would order a drink and will stick to one or two at most. And funnily enough, (or maybe because of that - was more of the party animal in my 20s- I still have a blast.

9. I also like to keep a nice home. Frugal doesn’t mean cheap or shoddy to me. But, I am not caught up with “designer” products. Those are actually just marketing ploys. I keep an eye out at discount stores and major box retailers for home goods, especially after major holidays for items that I might need to replace. For example, I found a set of stemless wine glasses with pine trees and elk theme at a discount store nearby for $6. The same or similar at a trendy place would cost probably 5x as much or more. I got them because we have breakage, though (I have developed Parkinson’s and can’t use the stemmed ones) not just because it was a deal.

10. Always put some untouchable money aside for emergencies and retirement, starting even in our late twenties with 2 little kids. We were both always self employed - my husband as his own business owner and me after being a SAHM working independently in the arts, so it was tight. But, it made a huge difference.

11) We love books and spent so much on them over the course of our lives, but they have gotten ridiculous in price since long ago and they add to clutter. We sold all of our paperbacks and gave most of the hardbacks away except for my resource books and cookbooks and history classics.

My husband gets all his books from the local library and I only use Audible or read for free online.

I chose one day a month to treat myself with a fancy coffee/ fast food- whatever. This way I could not just randomly decide today was the day and then forget and do it another day and before you know it you’ve spent $100 on dunkin. So one a month. When I got more financially secure I’d choose 2 and now I am at Fridays. On Fridays I can buy a drink or a treat.

This does not include takeout food necessary for a meal. These are treats that are highly unnecessary and a waste of money…… but for some reason people love to do it

As a formerly homeless and currently disabled single mother, I know about making ends meet. I suggest always making a shopping list and always sticking to it. Planning meals within your budget is vital. My food budget is less than $3-5 a day total for my entire family. Parents, if you too are plagued with worry about feeding your kids what's worked for me, is "fasting for the future."

When "fasting for the future " it's highly suggested to skip at least 2 meals a day, while always eating any and all leftover scraps from the meals being skipped ...but still above all else always still being fed regularly the children to reduce waist and ease hunger /hypoglycemia when "fasting for the future " , as I call it. Fasting for the future will ultimately result in fatigue and malnutrition, but think of the growing children and their health and development, the choice becomes clear. So compensate yourself by budgeting in at least $10+ monthly for yourself minimum, as you will need it. Remember, you can't pour from an empty cup as a parent, so always eat the scraps. No matter how meager. Trust me. Rice and beans are filling and nutrient dense. Dried beans soaked overnight and simmered with a meat bone can be Devine. ONLY purchase produce in season. Oatmeal, pancakes, peanut butter, and jelly are also great low-cost meals overall. Call 211 for local free food centers and utilize them as much as possible

Think 3 times before spending. Do I need this? Is this a smart purchase? Will I get buyers' remorse? Purchase mixes and bake at home to save money. Or even better learn to cook from scratch. Choose recipes with very few ingredients to avoid expensive meals. Or plan meals around what you have on hand. Googling, for example, " corn, beans, and canned chicken recipe," and peruse your culinary options. Thinking and planning ahead are essential.

Other options to save money are simply not to spend money. Look for free swap style rummage sales like junk in the trunk, etc. Go on free local facebook pages. Utilize any and all resources from non-profit organizations. By wearing the same clothing, even though you lost 60 pounds, you can save a ton of money. We survive off of less than $1k month for a family of 4. I'm wearing my boots another winter even though there are holes in the bottom of them where the heel has worn down and my socks get wet. That's $50+ saved for an emergency or another expense.