The Tax deadline is today April 18th, You'll recall that the 2022 tax deadline changed due to the federally celebrated Emancipation Day on April 15, 2022.

TheStreet has been providing tax tips from leading professionals including Jeffrey Levine, CPA and tax expert from Buckingham Strategic Wealth, and Lisa Greene-Lewis, CPA and expert for TurboTax.

Our TurboTax Live experts look out for you. Expert help your way: get help as you go, or hand your taxes off. You can talk live to tax experts online for unlimited answers and advice OR, have a dedicated tax expert do your taxes for you, so you can be confident in your tax return. Enjoy up to an additional $20 off when you get started with TurboTax Live.

Tax Tips for Last-Minute Tax Filers

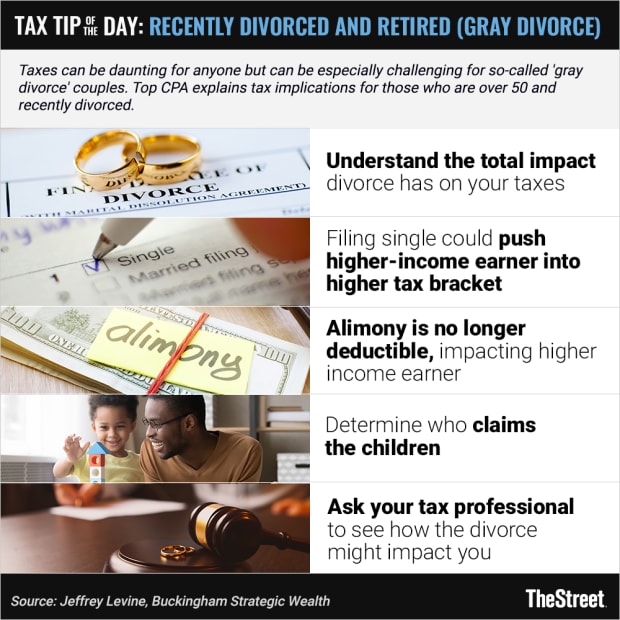

Tax Tips for Recently Divorced and Retired (Gray Divorce)

Taxes can be daunting for anyone but can be especially challenging for so-called 'gray divorce' couples. Jeffrey Levine, CPA and tax expert from Buckingham Strategic Wealth says couples over 50 should::

- Understand the total impact divorce has on your taxes

- Filing single could push the higher-income earner into a higher tax bracket

- Alimony is no longer deductible, impacting the higher income earner

- Determine who claims the children

- Ask your tax professional to see how the divorce might impact you

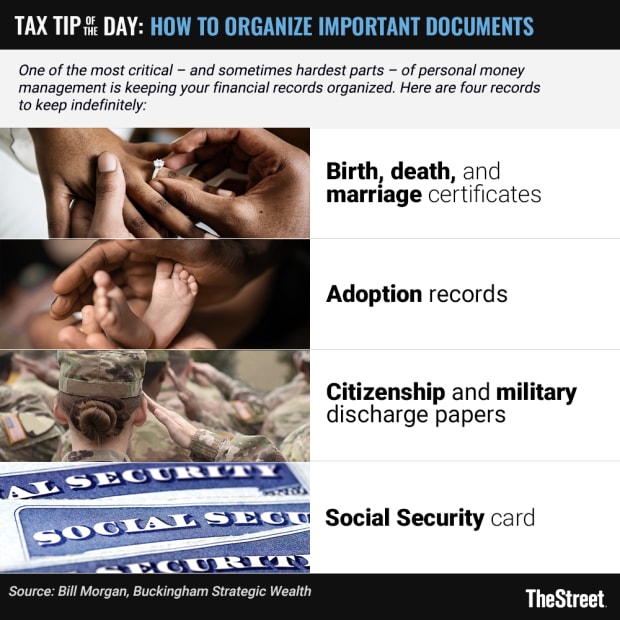

Tax Tips: How to Organize Important Documents

One of the most critical – and sometimes hardest parts – of personal money management is keeping your financial records organized. Here are four records to keep indefinitely:

- Birth, death, and marriage certificates

- Adoption records

- Citizenship and military discharge papers

- Social Security card

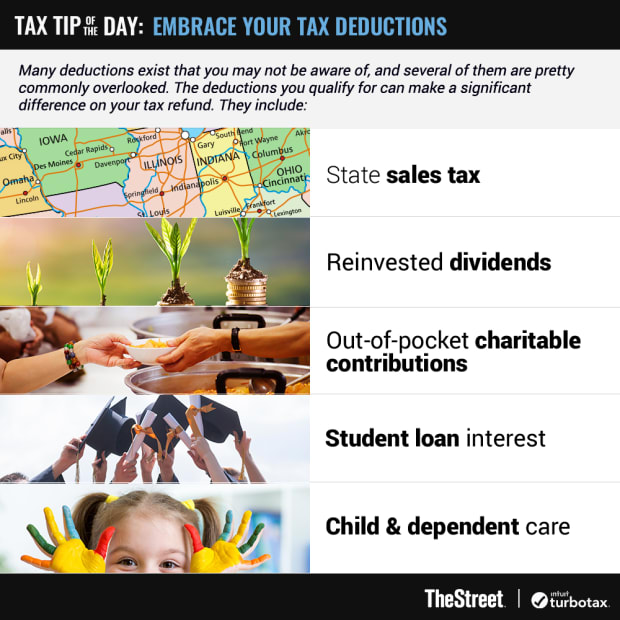

Embrace Your Tax Deductions

Many deductions exist that you may not be aware of, and several of them are pretty commonly overlooked. The deductions you qualify for can make a significant difference in your tax refund. They include:

- State sales tax

- Reinvested dividends

- Out-of-pocket charitable contributions

- Student loan interest

- Child and dependent care

Recommended Read: Standard Deduction vs. Itemized Deductions: Which Is Better?

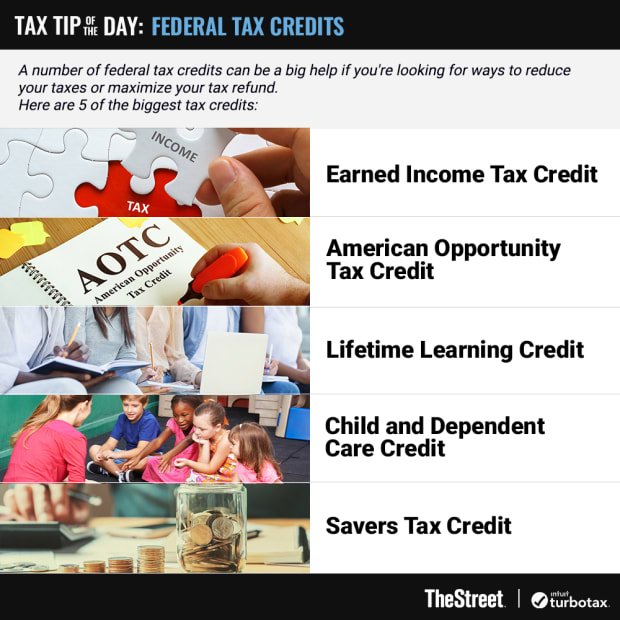

Federal Tax Credits

A number of federal tax credits can be a big help if you're looking for ways to reduce your taxes or maximize your tax refund. Here are 5 of the biggest tax credits:

- Earned Income Tax Credit

- American Opportunity Tax Credit

- Lifetime Learning Credit

- Child and Dependent Care Credit

- Savers Tax Credit

Recommended Read: How to Report FAFSA College Money on a Federal Tax Return

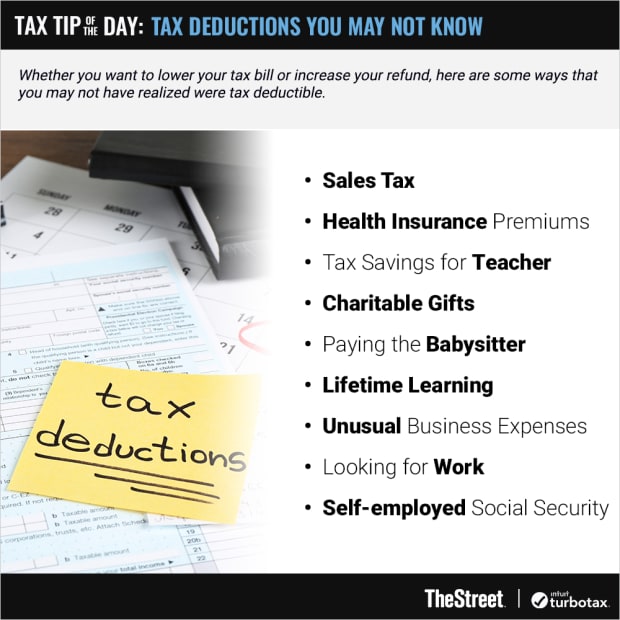

Tax Deductions You May Not Know

Whether you want to lower your tax bill or increase your refund, here are some ways that you may not have realized were tax-deductible.

- Sales Tax

- Health Insurance Premiums

- Tax Savings for Teachers

- Charitable Gifts

- Paying the Babysitter

- Lifetime Learning

- Unusual Business Expenses

- Looking for Work

- Self-employed Social Security

Recommended Reads:

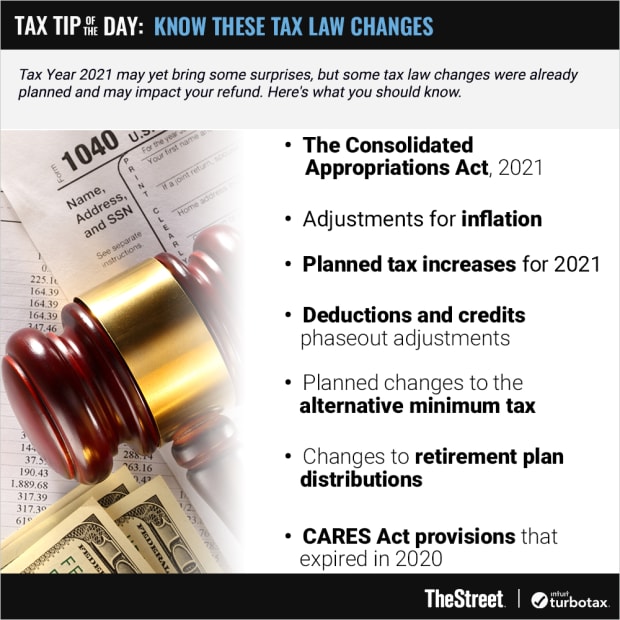

Know These Tax Law Changes

Tax Year 2021 may yet bring some surprises, but some tax law changes were already planned and may impact your refund. Here's what you should know.

- The Consolidated Appropriations Act, 2021

- Adjustments for inflation

- Planned tax increases for 2021

- Deductions and credits phaseout adjustments

- Planned changes to the alternative minimum tax

- Changes to retirement plan distributions

- CARES Act provisions that expired in 2020

Recommended Read: Managing Your Retirement Account and Taxes During Economic Uncertainty

Short-Term vs. Long-Term Capital Gains

Not all capital gains are treated equally. The tax rate can vary, and knowing the difference is beneficial.

- Short-term capital gains: Profits you make from selling assets you’ve held for a year or less

- Long-term capital gains: gains from assets you’ve held for longer than a year

Recommended Read: 5 Things You Should Know about Capital Gains Tax

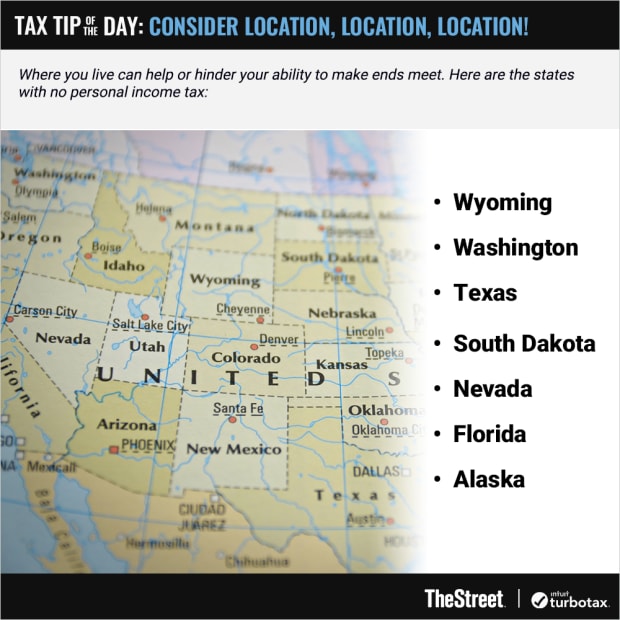

Consider Location, Location, Location!

Where you live can help or hinder your ability to make ends meet. Here's a roundup of the highest and lowest taxes by state. Here are the states with no personal income tax:

- Wyoming

- Washington

- Texas

- South Dakota

- Nevada

- Florida

- Alaska

Recommended Read: Are State Tax Refunds Taxable?

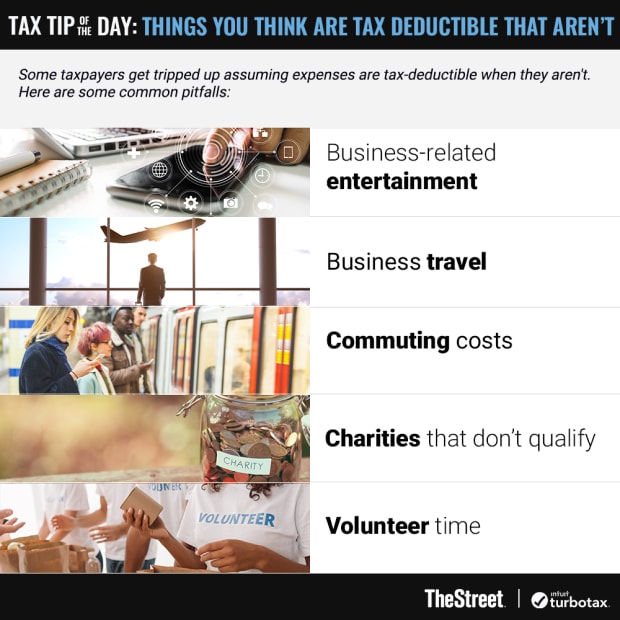

Things You Think Are Tax-Deductible That Aren’t

Some taxpayers get tripped up assuming expenses are tax-deductible when they aren't. Here are some common pitfalls:

- Business-related entertainment

- Business travel

- Commuting costs

- Charities that don’t qualify

- Volunteer time

Recommended Read: Are Medical Expenses Tax Deductible?

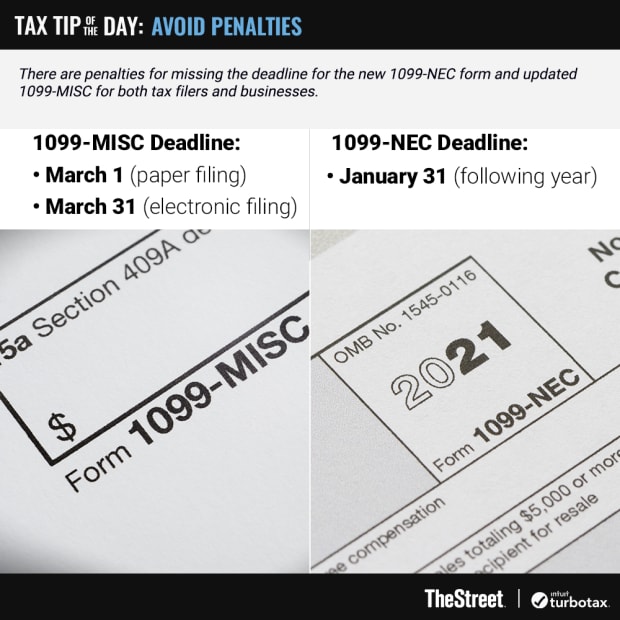

Avoid Tax Penalties

There are penalties for missing the deadline for the new 1099-NEC form and updated 1099-MISC for both tax filers and businesses.

1099-MISC Deadline:

- March 1 (paper filing)

- March 31 (electronic filing)

- 1099-NEC Deadline:

- January 31 (following year)

Tax Tip: Know When Seniors Must File

If Social Security is your sole source of income, then you don't need to file a tax return - but other forms of income are taxable.

Recommended Read: Tax Counseling for Seniors and Retired

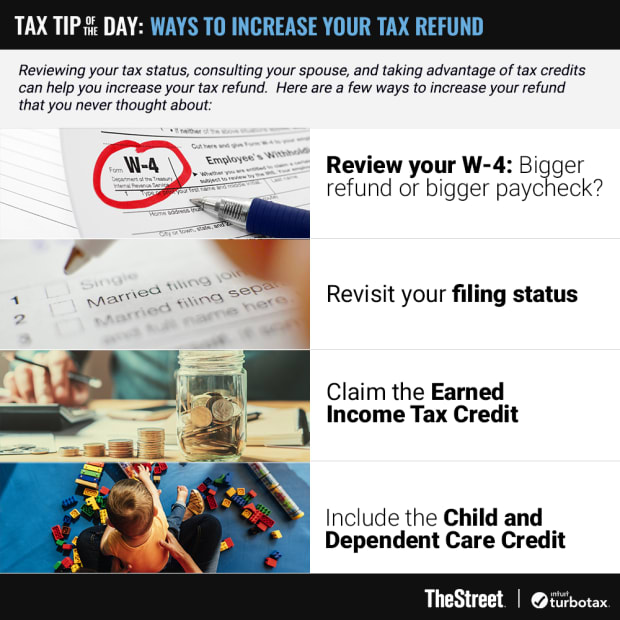

Ways to Increase Your Tax Refund

Reviewing your tax status, consulting your spouse, and taking advantage of tax credits can help you increase your tax refund. Here are a few ways to increase your tax refund that you never thought about:

- Review your W-4: Bigger refund or bigger paycheck?

- Revisit your filing status

- Claim the Earned Income Tax Credit

- Include the Child and Dependent Care Credit

Recommended Read: Where Is my Tax Refund: IRS Timetable Explained

5 Overlooked Tax Deductions

Whether you want to lower your tax bill or increase your refund, here are 5 things you may not have realized were tax-deductible.

- Sales Taxes

- Health Insurance Premiums (in some cases)

- Tax Savings for Teachers

- Paying the Babysitter (tied to work)

- Looking for Work

Recommended: Guide to Advanced Child Tax Credit

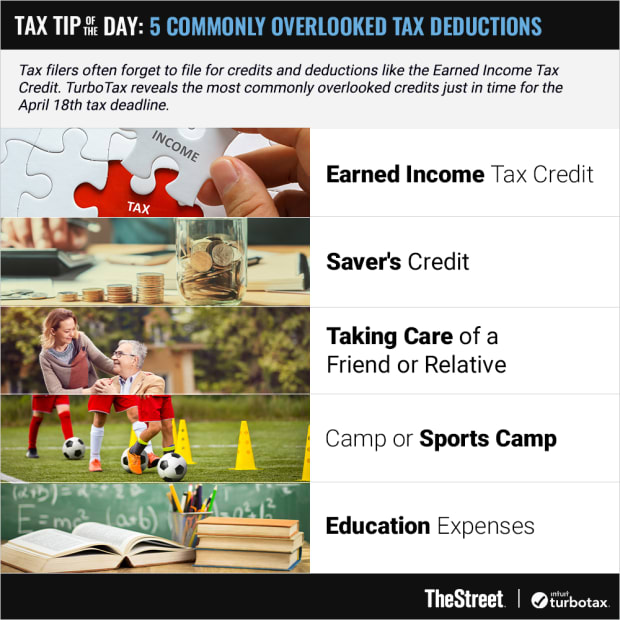

5 Commonly Overlooked Tax Deductions

Tax filers often forget to file for credits and deductions like the Earned Income Tax Credit. TurboTax reveals the most commonly overlooked credits just in time for the April 18th tax deadline.

- Earned Income Tax Credit

- Saver's Credit

- Taking Care of a Friend or Relative

- Camp or Sports Camp

- Education Expenses

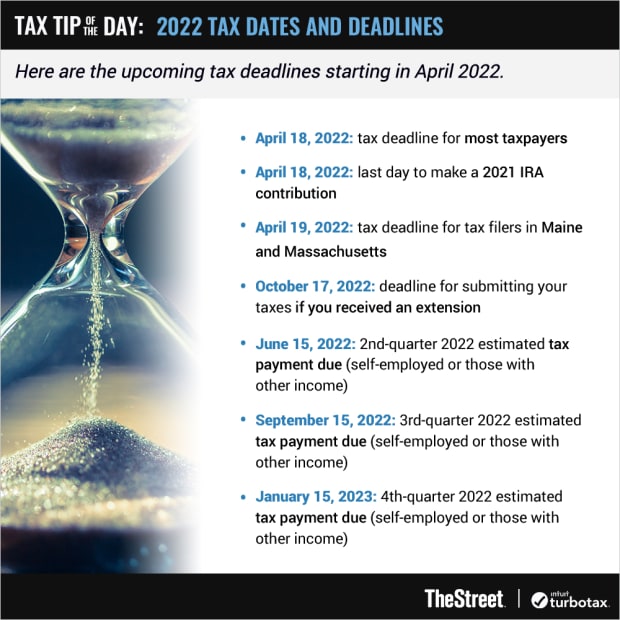

Tax Tip: 2022 Tax Dates and Deadlines

Here are the upcoming tax deadlines starting in April 2022.

- April 18, 2022: tax deadline for most taxpayers

- April 18, 2022: last day to make a 2021 IRA contribution

- April 19, 2022: tax deadline for tax filers in Maine and Massachusetts

- October 17, 2022: deadline for submitting your taxes if you received an extension

- June 15, 2022: 2nd-quarter 2022 estimated tax payment due (self-employed or those with other income)

- September 15, 2022: 3rd-quarter 2022 estimated tax payment due (self-employed or those with other income)

- January 15, 2023: 4th-quarter 2022 estimated tax payment due (self-employed or those with other income)

Recommended Read: Tax Deadline Is Approaching: 10 Things Tax Filers Should Know

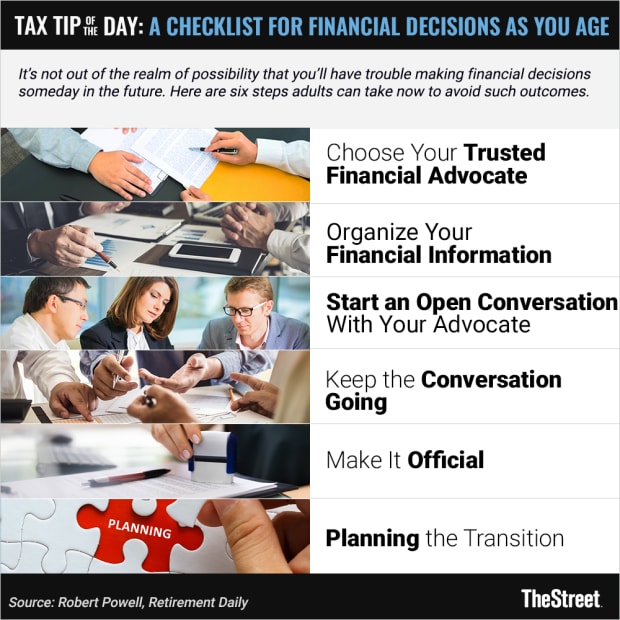

Tax Tip: A Checklist for Financial Decisions As You Age

It's not out of the realm of possibility that you'll have trouble making financial decisions someday in the future. Here are six steps adults can take now to avoid such outcomes

- Choose Your Trusted Financial Advocate

- Organize Your Financial Information

- Start an Open Conversation With Your Advocate

- Keep the Conversation Going

- Make It Official

- Planning the Transition

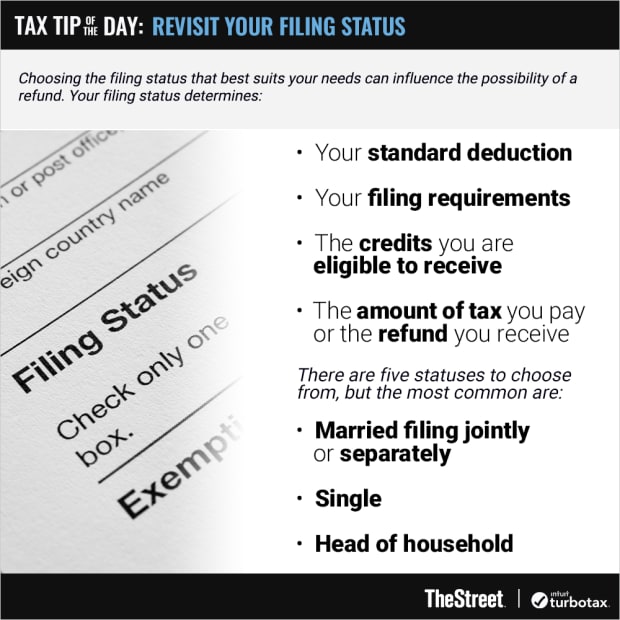

Tax Tip: Revisit Your Filing Status

Choosing the filing status that best suits your needs can influence the possibility of a refund. Your filing status determines:

- Your standard deduction

- Your filing requirements

- The credits you are eligible to receive

- The amount of tax you pay or the refund you receive

There are five statuses to choose from, but the most common are:

- married filing jointly or separately

- single

- head of household