The Social Security Administration (SSA) encourages retirees to set up online accounts to manage benefits. These portals let you check earnings, track eligibility, and prepare for filing. But here’s the catch: small mistakes in your SSA account can lead to big problems when it’s time to claim. Incorrect settings may delay payments, reduce monthly checks, or trigger unnecessary tax issues. Retirees who review their accounts before filing avoid headaches later. Here are 10 SSA account settings you must check before you claim.

1. Personal Information Accuracy

The simplest errors create the biggest delays. If your name, date of birth, or address doesn’t match government records, your claim may stall. Retirees who discover typos after applying often face weeks of verification delays. Double-check that every detail is correct now. Correcting errors early ensures smooth processing later.

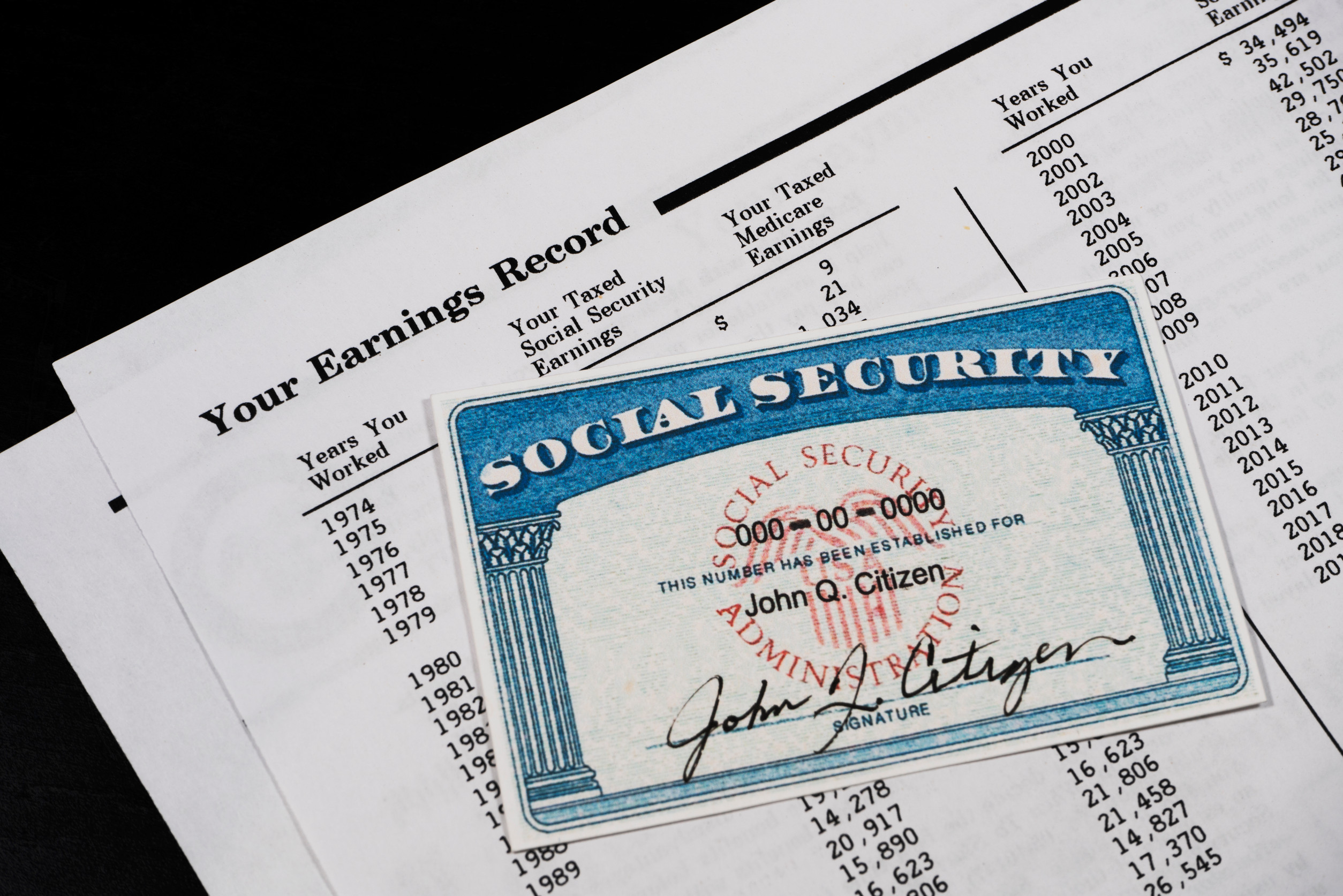

2. Earnings History Verification

Your future benefits depend on your lifetime earnings record. Missing wages or misreported amounts lower your monthly check permanently. Retirees should review each year listed in their account and compare it to tax returns or W-2s. If you spot errors, request corrections immediately with proof of income. An accurate record protects every dollar you’ve earned.

3. Direct Deposit Details

Paper checks are rare and far slower than electronic payments. Setting up direct deposit is the safest way to receive benefits, but it requires accuracy. Retirees should confirm that routing and account numbers are correct. A single typo could send money to the wrong account. Direct deposit ensures faster, more reliable access to funds.

4. Two-Factor Authentication Setup

Fraud against retirees is rising, and Social Security accounts are prime targets. SSA requires two-factor authentication to protect accounts, but many retirees skip setup or forget to update contact info. Without it, your account is more vulnerable to hackers. Ensure your authentication settings include a current phone number or email. Security begins here.

5. Beneficiary Information

Spouses, dependents, and survivors may qualify for benefits tied to your account. If this information is outdated, families risk losing money. Retirees should confirm that all eligible beneficiaries are correctly listed. Adding or updating this data avoids missed payments. Beneficiaries deserve the protection you’ve earned.

6. Communication Preferences

SSA communicates through mail or electronic notices, depending on your preference. Retirees who choose email but rarely check their inbox may miss critical updates. Likewise, those who prefer mail should confirm their addresses are current. Select the method you monitor most consistently. Clear communication prevents missed deadlines and appeals.

7. Tax Withholding Choices

Social Security benefits may be taxable depending on income levels. Retirees can request withholding directly through their SSA accounts to avoid year-end tax shocks. Without withholding, surprise bills from the IRS can hit hard. Reviewing and adjusting withholding choices aligns payments with your tax situation. Planning ahead beats scrambling later.

8. Representative Payee Designations

Some retirees assign a representative payee to manage benefits if they can’t. Over time, these designations may become outdated—especially after divorce, remarriage, or family changes. Retirees should review who is listed as their payee and update it if needed. Having the wrong person in control of your benefits creates serious risks. Accuracy matters.

9. Medicare Enrollment Links

SSA accounts link directly to Medicare enrollment, including Parts A, B, and D. Retirees who miss deadlines for these programs may face lifelong penalties. Checking your enrollment status through your SSA account ensures you’re on schedule. Don’t assume automatic enrollment covers everything. Confirm your Medicare choices before filing.

10. Claim Status Tracking

Once retirees apply for benefits, the SSA account provides real-time updates on claim status. Too many applicants ignore this feature and assume “no news is good news.” That’s a mistake. Monitoring your account helps spot missing documents or delays early. Proactive checking keeps your retirement timeline on track.

Why Vigilance Protects Retirement Benefits

Social Security accounts are powerful tools—but only when retirees use them wisely. Mistakes in earnings records, personal data, or tax settings can cost thousands over a lifetime. By reviewing all 10 settings before filing, retirees ensure accuracy, security, and smoother processing. The benefits you worked decades to earn deserve protection. Vigilance today guarantees stability tomorrow.

Have you checked your SSA account for errors yet—or are you waiting until it’s time to file your claim?

You May Also Like…

- 8 Social Security Overpayment Shocks—and How to Respond

- Could Your Social Security Be Smaller Because of a Single Earnings Gap?

- 10 Social Security Timing Rules That Change Your Lifetime Payout

- Social Security COLA at Risk? How Tariffs and Turmoil Could Cut Increase

- Is Your IRMAA Appeal Strong Enough—or Missing One Key Document?