/Video%20game%20controllers%20by%20TheXomil%20via%20Pixabay.jpg)

OpenAI’s new deal with Advanced Micro Devices (AMD) looks to be a game-changing event for the semiconductor company. Long living in the shadow of its mammoth competitor, Nvidia (NVDA), AMD got a shot in the arm on Monday when the company announced a deal to outfit generations of OpenAI infrastructure with AMD’s graphics processing units (GPUs).

The deal calls for OpenAI, the maker of ChatGPT, to purchase 6 gigawatts of GPUs, starting with 1 GW of AMD Instinct MI450 GPUs to begin in the second half of 2026. AMD is opening a warrant for OpenAI to purchase up to 160 million shares of AMD common stock, with the warrant vesting as specific milestones are reached.

If all warrants are fully vested, OpenAI would have a 10% stake in AMD. AMD Chief Financial Officer Jean Hu said the OpenAI relationships would deliver “tens of billions of dollars in revenue for AMD.”

AMD stock is up a whopping 30% in the last week since the deal was announced. And while investors are giving the semiconductor stock another look, they may not be aware that there’s another vehicle for investing not only in AMD but also in some of the best tech names in the market—the Amplify Video Game Leaders ETF (GAMR), in which AMD is the No. 1 holding.

About the Amplify Video Game Leaders ETF

Operated by Amplify ETFs, the GAMR ETF tracks the performance of the VettaFi Video Game Leaders Index, which is a collection of 20 stocks involved in game development and publishing, mobile games, online gaming, platforms, and infrastructure. About 40% of the VettaFi Video Game Leaders Index is comprised of media and communications companies, while another 40% are tech companies and roughly 18% are consumer discretionary stocks.

The GAMR ETF has $51.5 million in assets under management. It’s notable that the trading volume on the ETF is low, with an average daily volume of only 3,000 shares. (AMD shares have an average trading volume of 58 million shares.) It has an expense ratio of 0.59%, or $59 annually per $10,000 invested.

Shares of the GAMR ETF are up 51% so far in 2025, by far outperforming the S&P 500’s ($SPX) 15% gain. If you had invested in GAMR, you would actually have better year-to-date (YTD) returns than with Nvidia (up 38%), but not as much as with AMD (up 75%, thanks to its 30% run this week). The ETF has a net asset value of $99.43, which means shares are currently at a slight discount.

GAMR has a hefty price-to-earnings ratio of 36, but that also compares favorably to Nvidia (52.3) and AMD (126).

What Do You Get in the GAMR ETF?

The ETF's top holdings represent well-known names in the technology and gaming space, with AMD having the greatest weighting at nearly 13%.

The fund is primarily made up of U.S.-based stocks, but there is also representation from Japan, China, Singapore, Australia, and Taiwan.

| Company | Market Value | Fund Weighting |

| Advanced Micro Devices | $6.71 million | 12.98% |

| Tencent Holdings | $5.31 million | 10.28% |

| Microsoft | $5.16 million | 9.99% |

| Nvidia | $5.15 million | 9.98% |

| Meta Platforms | $4.68 million | 9.07% |

| AppLovin | $2.73 million | 5.28% |

| Sony | $2.54 million | 4.91% |

| Sea Limited | $2.40 million | 4.64% |

| Roblox | $2.32 million | 4.49% |

| Nintendo | $2.20 million | 4.26% |

Source: Amplify ETFs. Data as of Oct. 7, 2025

What Can You Expect from the GAMR ETF?

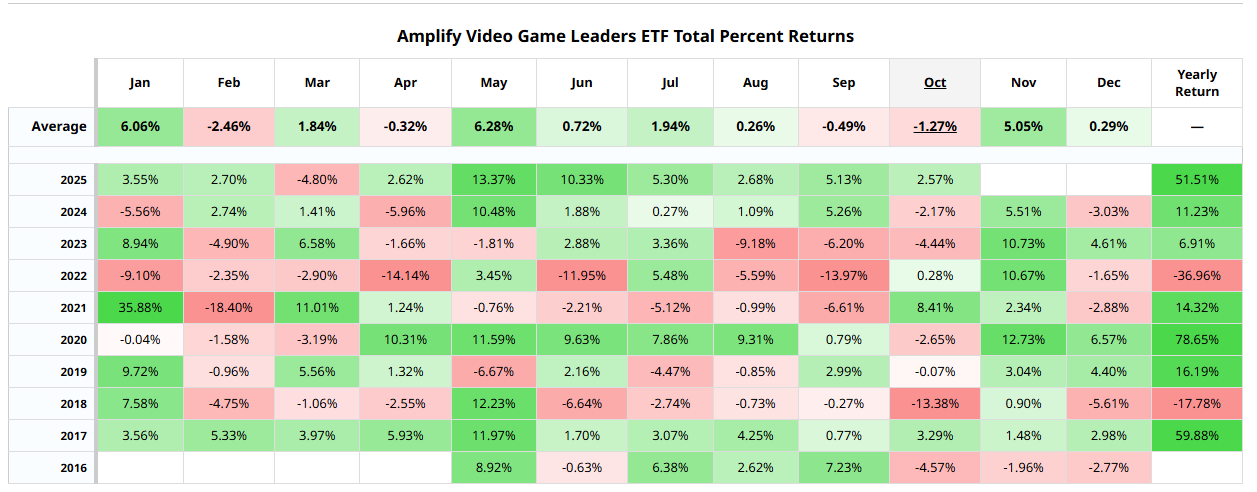

The GAMR ETF has been on a roll for much of the year, having charted positive gains every month this year except for March, when much of the market fell on concerns about threatened tariffs. However, it’s interesting to note that the GAMR ETF is coming up on what has historically been one of the best-performing months of the year.

The GAMR ETF averages a 5% gain in the month of November, as well as averaging a 6% return in January. That means in the next four months, the GAMR ETF will hit two of its best-performing months of the year.

So far, 2025 has been the GAMR ETF’s best year since 2020, when it gained a whopping 78.6%. While that full-year gain may be out of reach for the Amplify Video Game Leaders ETF, it's undeniable that the fund is an alternative way to invest in the semiconductor space while doing so at a valuation better than you would get by investing in either AMD or Nvidia stock.