Tesla (TSLA) shares are inching up this morning after the company’s board proposed a nearly $1 trillion pay plan for Elon Musk, one that further improves his voting power as well.

The automaker’s shareholders will vote on the new package at its annual meeting on November 6.

Elon Musk will receive the proposed compensation in a total of 12 tranches over the next 10 years, contingent on TSLA meeting ambitious operational and valuation targets.

Despite today’s gain, Tesla stock is down roughly 6% versus its high set in the final week of May.

What the New Package May Mean for Tesla Stock

According to Robyn Denholm, the chairwoman of Tesla, the outsized plan will serve as motivation for Musk to stay focused and deliver for the company.

“It’s 1% for each half a trillion dollars of market cap, plus operational milestones…,” she revealed in an interview with CNBC today.

However, the proposed compensation package does not restrict the billionaire from spending time on other ventures or commit him to any minimum number of hours per week to the EV maker.

In short, it does little to resolve the long-term profitability and governance concerns. If anything, it just introduces unnecessary dilution risk for those already invested in TSLA stock.

What Could Weigh on TSLA Shares Moving Forward

Bank of America analyst John Murphy continues to recommend caution on Tesla shares following reports that the automaker continues to lose share in Europe and is failing to spur demand in India as well.

In his latest research note, Murphy said TSLA stock could struggle with gains moving forward as the “EV demand likely remains soft over the next few quarters.”

Plus, the scheduled removal of federal EV tax credits on Sept. 30 may also prove a material headwind for Tesla in the final quarter of 2025.

BofA currently has a “Neutral” rating on the EV stock with a $341 price target indicating potential downside of about 3% from here.

Wall Street Agrees With BofA’s Stance on Tesla

Other Wall Street analysts agree with Murphy’s cautious stance on Tesla stock as well.

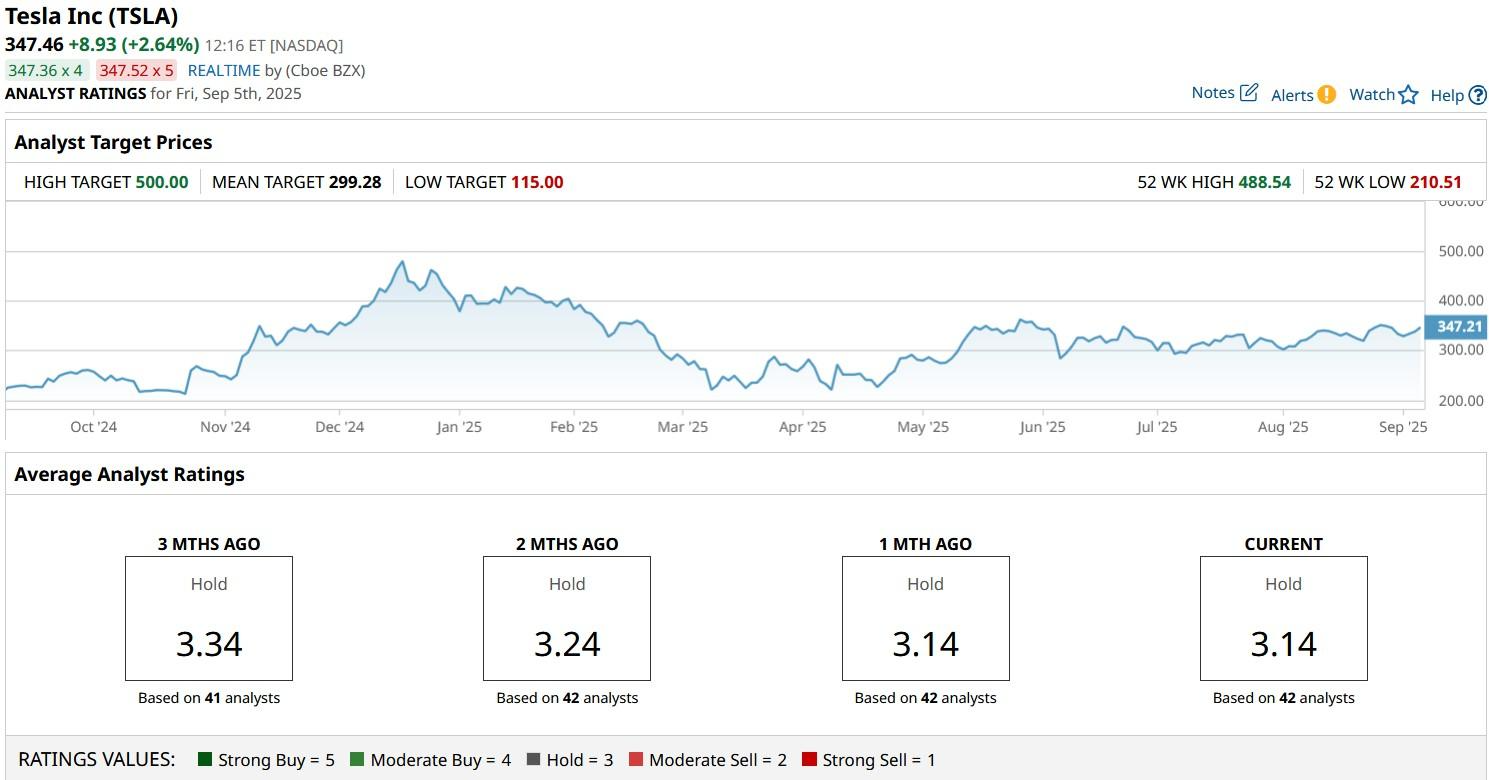

The consensus rating on TSLA shares currently sits at “Hold” only with the mean target of roughly $300 suggesting potential for about a 14% decline from here.