/Chipset%20held%20over%20rush%20hour%20traffic%20by%20Jae%20Young%20Ju%20via%20iStock.jpg)

Amkor Technology (AMKR) may not be the flashiest name, but it is a key behind-the-scenes part of the global chip industry. Amkor doesn’t design or sell its own chips. Instead, it works with the world’s leading chipmakers and electronics companies and is the most strategically positioned player in the global chip supply chain.

With the stock still trading under $50, investors might be looking at one of the best under-the-radar semiconductor opportunities.

About Amkor

Valued at $7.7 billion, Amkor Technology is a semiconductor packaging and testing company. After semiconductor companies such as Nvidia (NVDA), AMD (AMD), Intel (INTC), and Qualcomm (QCOM) design and manufacture their chips, they must be packed before being used in phones, computers, or automobiles. They must also be tested to ensure that they perform well, are fast, and are reliable. Here, Amkor enters the picture, which specializes in advanced packaging technologies and also provides a full suite of electrical and system-level testing services.

Amkor stock has gained 26.7% year-to-date (YTD), outperforming the broader market gain.

Riding the AI and Advanced Packaging Wave

Amkor is directly profiting from the current surge in artificial intelligence (AI), advanced packaging, and high-performance computing. The company's proprietary high-density fan-out (HDFO) technology is currently in high-volume production for a major customer. This is the next-generation packaging method that enables increased performance, lower power consumption, and smaller form factors, making it critical for AI processors, GPUs, and memory integration. With Amkor's 2.5D and advanced flip-chip capabilities, the company now supports everything from data centers and AI accelerators to personal computing and networking.

In the second quarter, revenue of $1.51 billion increased by 3% year-over-year (YoY), surpassing expectations and signaling renewed momentum across all its key markets. The company’s ability to deliver double-digit sequential growth in every end market, from communications to automotive, reflects its growing relevance as a key partner to the world's biggest chipmakers. Notably, communications revenue increased 15% sequentially, driven by Apple's (AAPL) iOS ecosystem and upcoming smartphone launches. Computing revenue increased by 16%, driven by personal computing and memory demand. Automotive and industrial revenue jumped 11%, while consumer revenue increased 16%, aided by wearables and a recovery in traditional devices.

In the Q2 earnings call, CEO Giel Rutten stated that Amkor’s factories are primarily located in free trade zones. This is why, despite trade and export challenges, Amkor is resilient and adaptable to changing demand patterns across regions and technologies.

Amkor strives to strike a balance between growth investments and shareholder value. The company ended the second quarter with $2 billion in cash and short-term investments and overall liquidity of $3.1 billion, against $1.6 billion in total debt. Management noted that while investing in organic growth and capacity expansion, Amkor intends to return 40% to 50% of free cash flow to shareholders over time.

Why This Cheap Stock Matters

Once seen as a cyclical outsourced semiconductor assembly and test provider, it’s now emerging as a key enabler of the AI and high-performance computing era. Semiconductor packaging and testing are critical steps in the chip supply chain, especially as AI, 5G, and advanced computing push the boundaries of semiconductor design. With its expertise in advanced packaging and system-level testing, Amkor will continue to play a central role in enabling the performance and efficiency of next-generation chips. At under $50 per share, Amkor is an attractively valued AI infrastructure play in the market today.

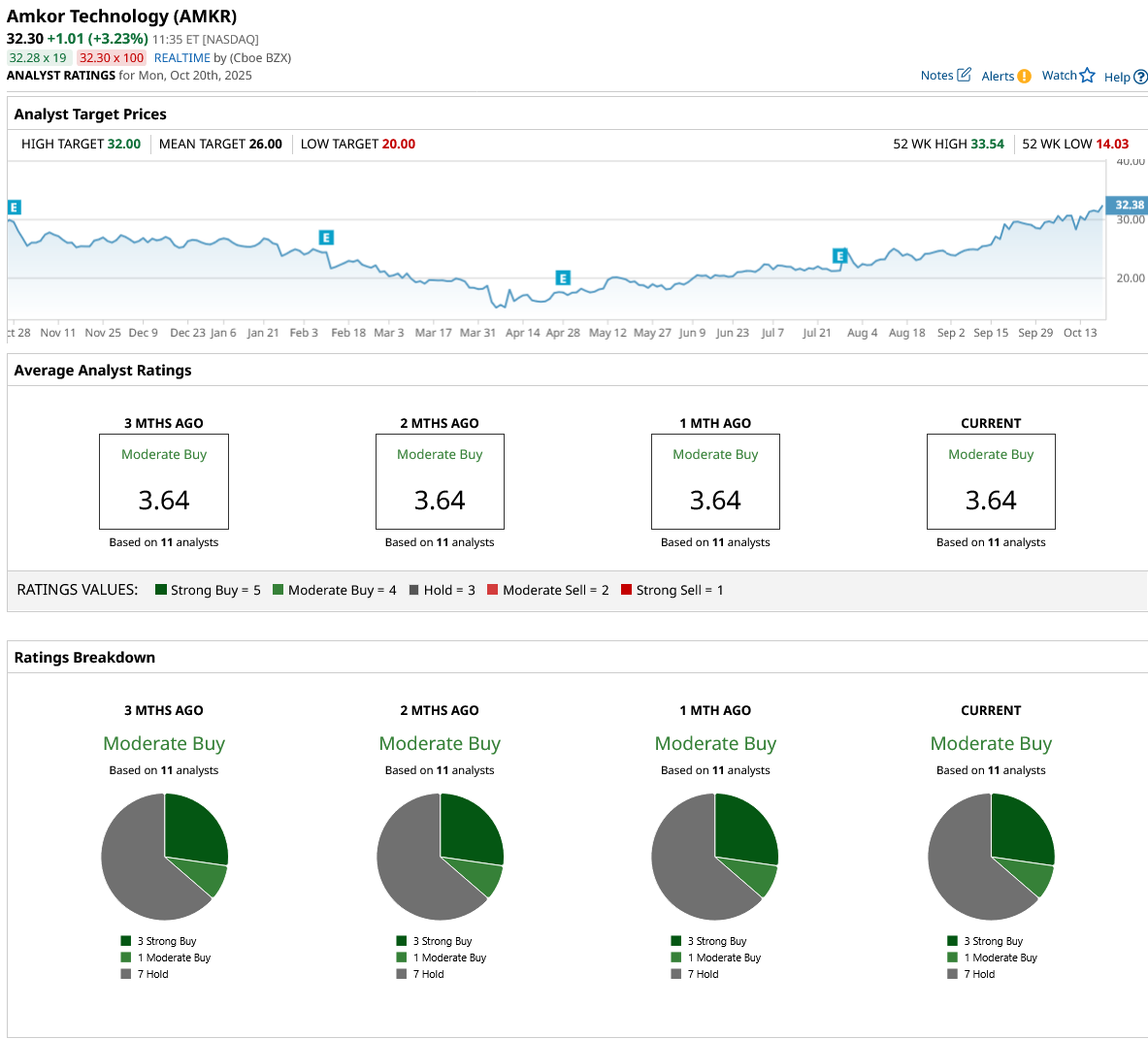

What Are Analysts Saying About AMKR Stock?

Overall, Wall Street rates AMKR stock a consensus “Moderate Buy.” Out of the 11 analysts who cover AMKR, 11 recommend a “Strong Buy,” one suggests a “Moderate Buy,” and seven rate it a “Hold.” The stock has surpassed its average analyst price target of $26 and is trading close to its high price estimate of $32.