This year has not been a good one for aluminum prices (ALU23). The aluminum futures benchmark on the London Metal Exchange has fallen nearly a fifth since its January peak, and more than 40% from last year’s highs — largely due to economic weakness in Europe and the U.S., and poor construction demand in China.

The benchmark three-month future contract on the LME is currently about $2,180 a metric ton, down from more than $3,840 a ton at last year’s peak.

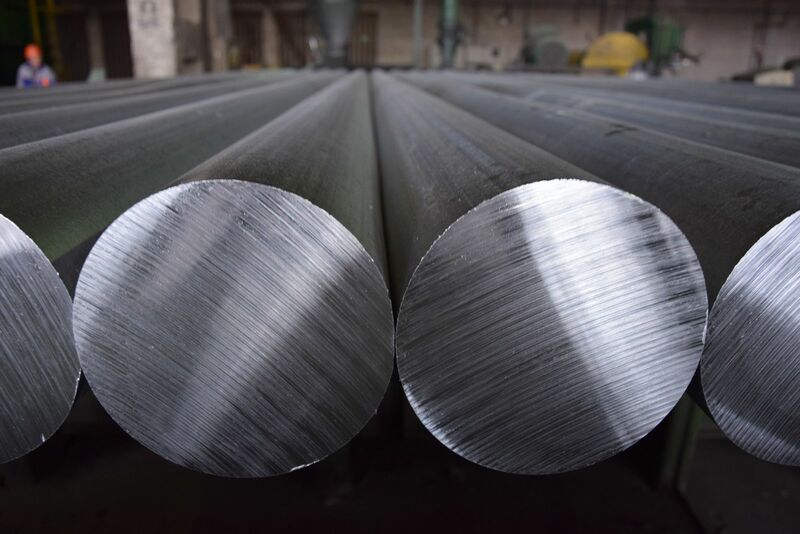

This slump in aluminum prices this year is reflecting the long-awaited, but yet-to-materialize global economic slowdown. Used in everything from buildings, beverage cans, solar panels, automobiles and airplanes, aluminum prices are often a proxy for expected industrial activity.

With aluminum trading at levels last seen in early 2021, it may be “nearing a bottom,” according to producers and industry analysts, who are growing increasingly bullish about demand over the medium term for the metal from quickly growing clean technologies. These technologies include electric vehicles (EVs) and solar panels.

Demand from the solar market is particularly strong at the moment. Solar farms typically use aluminum for frames and mounting solar panels. Electric vehicles also require more aluminum than traditional internal combustion engine cars.

The Aluminum Market Now

Aluminum prices this month experienced their largest contango since the 2008-09 global financial crisis. Contango means that aluminum bought currently is at a discount to the futures prices for aluminum. This reflects weak spot (immediate) demand, as well as the expectation that future prices will be higher than today.

Estimates are that there is currently a global surplus of just over 800,000 metric tons this year, and that is weighing on the price.

But there are also signs that the gloomy fog over aluminum is beginning to lift, as a period of running down global aluminum inventories appears to be coming to an end.Surprisingly to some, China has actually been a bright spot for aluminum demand. That’s due to the fact that rapidly growing spending on clean energy infrastructure is more than making up for slumping demand from the highly indebted Chinese property sector.

Graeme Train, head of metals research at trading house Trafigura (one of the world’s largest metals traders), told the Financial Times that “Chinese demand is running at a record high.”

In July, China’s imports of aluminum rose 20% compared with a year earlier. However, that positive is being partially offset by China’s domestic production of aluminum, which is close to a record high.

Add up all the factors, and the outlook for aluminum looks much more interesting - over the medium term - than it has been for a long time.

One way to participate in aluminum’s upside potential is by purchasing Alcoa (AA) stock. Let’s take a closer look at the company.

Alcoa Outlook

Alcoa, founded in 1888, is one of the world’s largest aluminum producers. It is a vertically integrated aluminum company that is comprised of bauxite mining, alumina refining, aluminum production (smelting and casting), and energy generation. The company has 27 operating locations (through direct and indirect ownership) in 9 countries on 6 continents, situated primarily in Australia, Brazil, Canada, Iceland, Norway, Spain, and the U.S.

Alcoa's assets include the largest bauxite mining portfolio in the world, a globally-diverse alumina refining system, and an aluminum smelting portfolio. The company is one of the world’s largest bauxite miners, with access to large bauxite deposit areas with mining rights that extend (in most cases) more than 20 years. Alcoa has ownership in seven active bauxite mines globally, four of which it operates, that are strategically located near key Atlantic and Pacific markets. This includes the Huntly mine in Australia, which the second largest bauxite mine in the world.

Alcoa is also the world’s largest alumina producer outside of China, with a highly competitive cost curve position. It has seven refineries on four continents, including one of the world’s largest alumina production facilities, the Pinjarra refinery in Western Australia. In addition to supplying its aluminum smelters with high-quality feedstock, AA also has significant alumina sales to third parties, with around two thirds of production being sold externally.

Alcoa’s stock is down 45% over the past year and 37.6% year-to-date. The shares have sold off over lower aluminum prices and the related fears of a steep global recession, and now trade just over $28.

Even if Alcoa stock goes back to $35 a share, it would imply an EV/EBITDA (enterprise value/earnings before interest, taxes, depreciation, and amortization ratio) of 4.8 times its 2024 EBITDA estimate. That’s in line with its three-year average forward EV/EBITDA - but a discount to its peers, which trade at an average of 7.5 times.

Given Alcoa’s compelling valuation and strong free cash flow yield, I am confident in the company, as it is increasingly relied upon to meet the growing structural demand from electrification and the global energy transition.

AA can be bought anywhere below $30 a share.

On the date of publication, Tony Daltorio did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.