Realty Income (O), often referred to as “The Monthly Dividend Company,” has long been a favorite among income investors due to its ability to generate consistent, dependable cash flows.

With a track record of 663 consecutive monthly dividend payments, Realty Income has demonstrated that scale, diversity, and discipline can deliver stability even during unpredictable economic cycles. The company currently yields around 5.4%, making it an appealing option for investors seeking passive income. However, it is not just high yield that makes Realty Income a reliable income stock.

A Global Portfolio Built for Stability

Valued at $54.6 billion, Realty Income is a real estate investment trust (REIT) that buys commercial properties, leases them to reliable tenants under long contracts, and collects rent as a source of revenue. However, Realty isn’t just another REIT. The secret to its resiliency is its business strategy. The company specializes in net lease real estate, in which tenants pay the majority of property-level running costs such as taxes, insurance, and upkeep. This lowers Realty Income's financial burden while providing predictable rental income.

As of the second quarter of 2025, the company owned over 15,600 properties spanning 91 industries. Its client base of over 1,600 provides extensive diversification, which helps to reduce risk because no single tenant or sector dominates the portfolio. Major tenants include well-known firms like Walmart (WMT), Walgreens, Dollar General (DG), Tesco (TSCDY), and 7-Eleven, which continue to generate consistent cash flow across all economic cycles.

In the second quarter, Realty Income invested $1.2 billion, the majority of which was aimed towards Europe. Since entering the U.K. in 2019, the company has expanded into eight European countries, accounting for 17% of its annualized base rent.

Moreover, its leasing performance remains robust, with a 103.4% rent recapture rate on 346 leases and 93% renewals from existing tenants. Even during difficult times, such as tenant bankruptcies, the company has managed to reach positive resolutions, showing the consistency of its cash flows.

Furthermore, Realty has a weighted average remaining lease term of nine years, which means tenants are legally bound to pay rent for nearly a decade on average. This assures consistent, recurrent cash flows to fund Realty Income's monthly dividend, making the company less sensitive to short-term market swings or recessions.

As a REIT, Realty Income is legally required to distribute 90% of its taxable income in dividends, making it appealing to income-oriented investors. In the case of a REIT, adjusted funds from operations (AFFO), which is similar to net income for non-REITs, determines the amount of profits to be distributed as dividends.

A Reliable Dividend Payer

Unlike other dividend companies that pay quarterly dividends, one of Realty Income's most enticing and distinguishing characteristics is its monthly dividend payments. Since its inception in 1969, the firm has declared 663 monthly dividend payments, including 132 dividend increases since going public in 1994. Furthermore, by increasing dividends consistently for 30 years, Realty has earned a place in the Dividend Aristocrat Index, which includes S&P 500 ($SPX) firms that have raised dividends for at least 25 years in a row. The company just announced a 0.186% rise in its monthly cash dividend, to $0.2695 per share.

Realty Income’s attractive dividend yield of 5.4% exceeds the real estate sector average of 4.5%. The company’s AFFO dividend payout ratio of 75.7% (amount of AFFO it pays out as dividends) is slightly on the higher side. However, Realty can continue to pay dividends as long as its AFFO grows.

In the second quarter, AFFO rose 2.8% to $947.5 million. Total revenue climbed by 5.2% to $1.41 billion during the quarter. Analysts covering Realty Income predict its funds from operations (FFO) will increase by 6.6% in 2025, followed by another 3.5% growth in 2026.

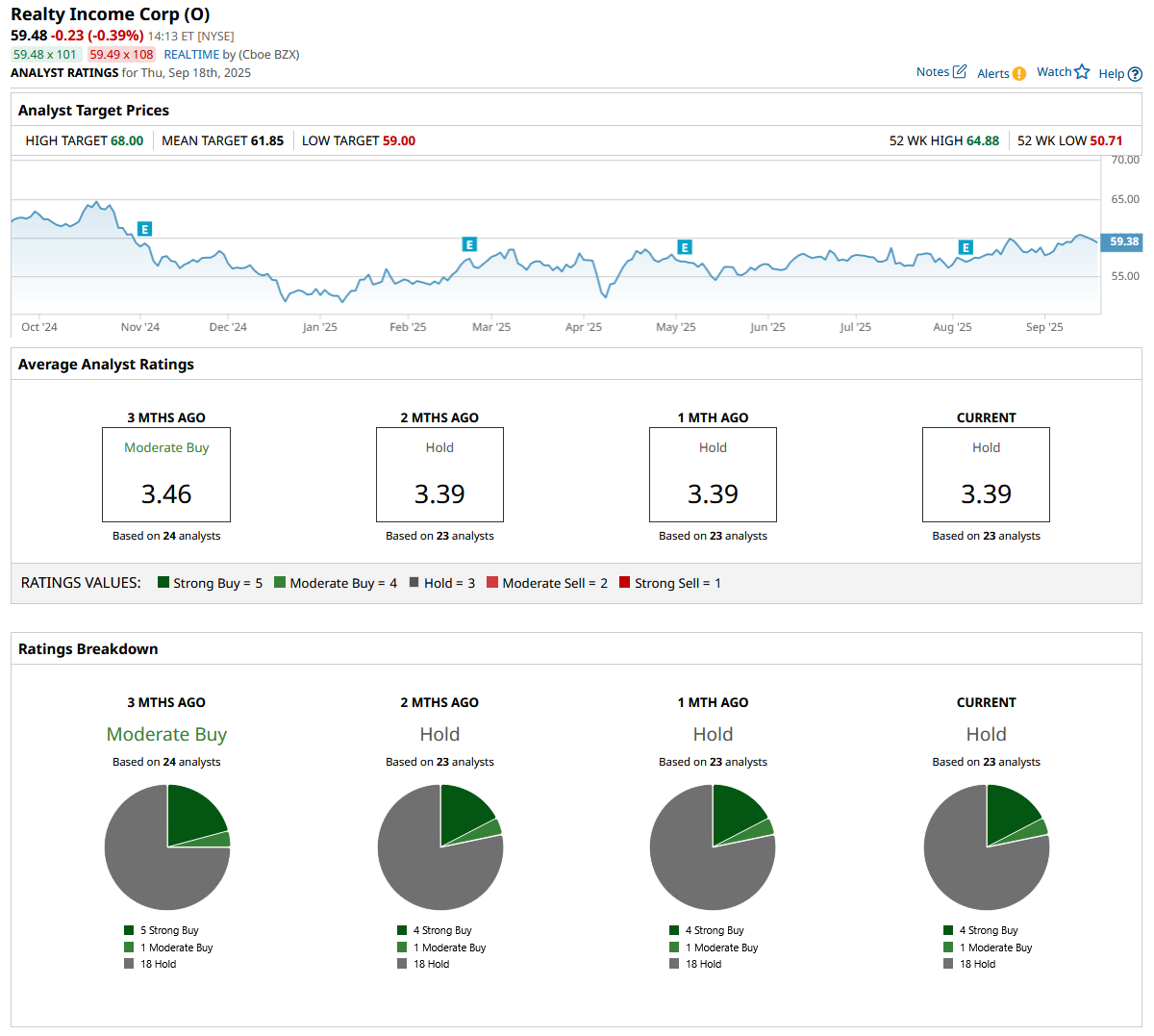

What Does Wall Street Say About O Stock?

Overall, on Wall Street, O stock is a “Hold.” Out of the 23 analysts that cover the stock, four rate it a “Strong Buy,” one rates it a “Moderate Buy,” and 18 rate it a “Hold.”

The mean target price for the stock is $61.85, which is 4% above current levels. The Street-high estimate of $68 implies upside of 14% over the next 12 months.

Realty Income is living up to its reputation as one of the most secure passive income opportunities in real estate. With a yield of more than 5%, a rising European platform, and a conservative balance sheet, O stock appears to be well positioned for long-term investors looking for stable and growing dividends.