Incyte (INCY) reported a breakout quarter on Oct. 28, beating Wall Street’s revenue and earnings estimates. Best known for its blockbuster drug Jakafi and expanding oncology pipeline, this biotech combines profitability, pipeline depth, and long-term growth potential while trading under $100.

Valued at $18.2 billion, Incyte stock is up 31.9% year-to-date, outperforming the broader market gain of 17.3%. Should you grab this biotech stock now?

About Incyte

Incyte is a biotech company that discovers, develops, and commercializes innovative medicines, primarily for cancer and autoimmune diseases. Currently, the company has at nine approved products. Its flagship drug, Jakafi (ruxolitinib), treats blood cancers like myelofibrosis and polycythemia vera.

A Strong Quarter Anchored by Blockbusters

Incyte’s revenue comes from both product sales and collaboration royalties with major pharmaceutical partners. In the third quarter, the company reported a healthy 20% year-over-year growth in total revenue to $1.37 billion, driven by rising demand for its flagship therapies and expanding momentum across its hematology and oncology portfolio. Despite a 15% increase in the cost of goods and minor SG&A increases, Incyte’s profitability increased significantly in the quarter, reflecting operating leverage from its expanding product base. Adjusted earnings rose by an astonishing 111.2% to $2.26 per share.

Notably, Jakafi brought in $791 million in revenue, up 7% from last year. Management stated that this growth was driven by significant patient demand across all approved indications, as well as sustained dominance in myeloproliferative neoplasms (MPNs). Additionally, Opzelura, the topical ruxolitinib cream, saw an impressive 35% jump in revenue to $188 million, owing to its acceptance in the treatment of atopic dermatitis and vitiligo.

Incyte’s hematology-oncology portfolio, which includes Niktimvo (axatilimab-csfr), generated $46 million in the first few months after its launch, contributing $171 million to total revenue. Its financial position remained solid, with $2.9 billion in cash, cash equivalents, and marketable securities at the end of the quarter.

Driven by higher-than-expected demand for Jakafi and other oncology drugs, Incyte raised its full-year 2025 net product revenue guidance to range between $4.23 billion and $4.32 billion. Analysts expect revenue of $4.85 billion, with earnings increasing by 455.5% to $6 per share.

Incyte is also refining its R&D portfolio, halting lower-priority projects, including anti-CD122 and BET inhibitor prospects, to allocate resources to assets with more commercial and clinical promise. The company has a growing pipeline of oncology and dermatology therapies in mid- to late-stage clinical development programs, which could drive the next wave of revenue growth.

What Is Wall Street Saying About Incyte Stock?

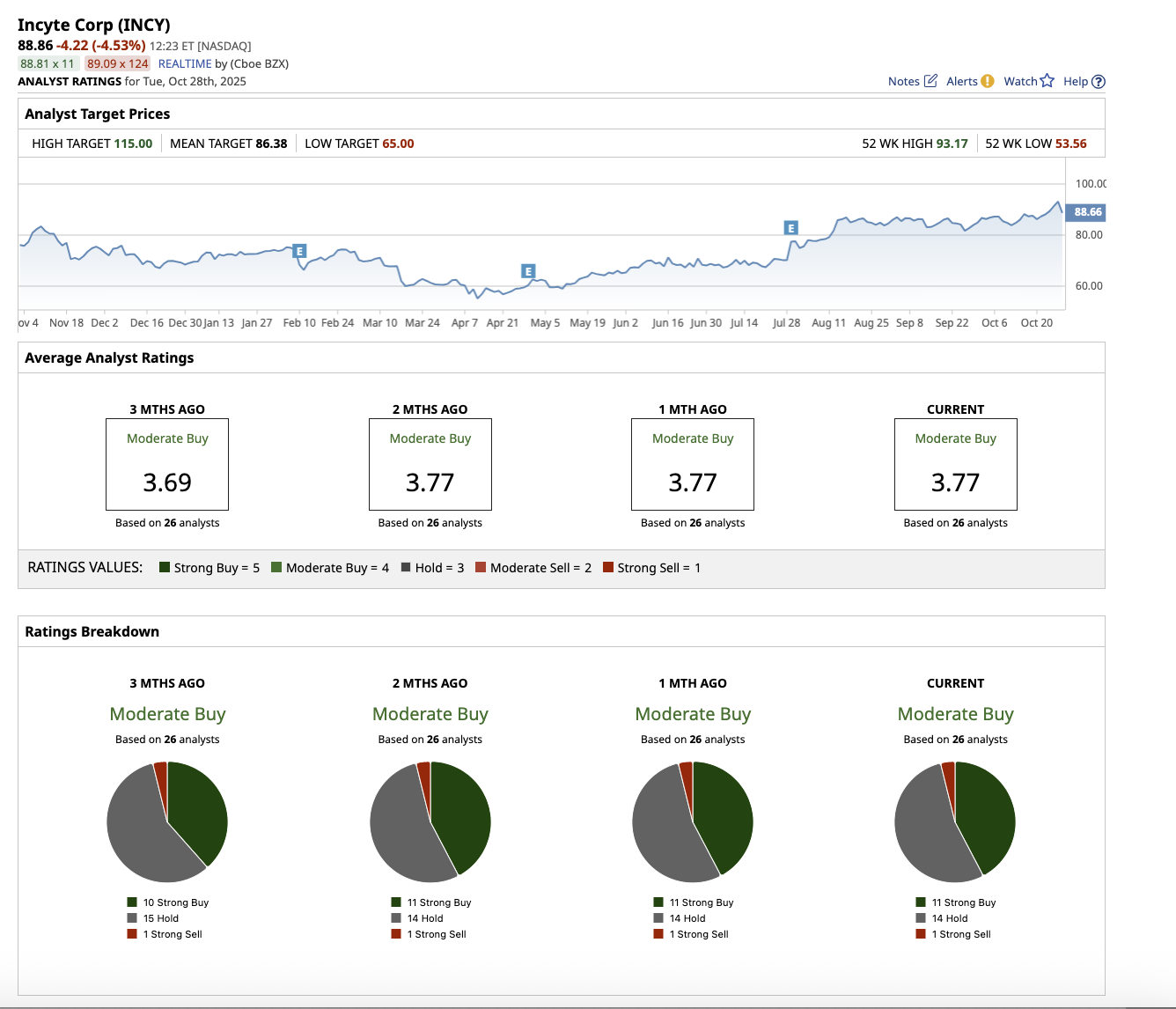

Overall, on Wall Street, Incyte stock is rated a “Moderate Buy.” Out of the 26 analysts who cover INCY stock, 11 rate it a “Strong Buy,” 14 suggest it is a “Hold,” and one says it is a "Strong Sell.” The stock has surpassed its average price target of $86.38. However, its high target price of $115 implies upside potential of 24% over the next 12 months.

With steady cash flow from Jakafi, fast-rising dermatology revenues from Opzelura, and high-upside opportunities in oncology, immunology, and dermatology, Incyte is positioned for strong long-term growth. With shares still trading under $100, Incyte offers a rare combination of profitability, growth, and pipeline depth in the biotech sector. This may be an appealing entry point before the next leg higher.