/Apple%20Inc%20logo%20on%20Apple%20store-by%20PhillDanze%20via%20iStock.jpg)

I don’t know about coring an apple, but I like the idea of collaring one. Not the red delicious kind, but the Cupertino variety. None other than Apple (AAPL).

Everything to me starts with the chart. And with this formerly top market cap stock, now currently sitting in the No. 3 slot, a sliver behind Microsoft (MSFT), it has the setup I like.

Why I Like Trading Apple Stock Here

- It just had a big move higher, and is now resting. But there’s still momentum behind it, as long as the market’s tech-craze continues.

- Earnings are coming up in about two weeks. That could be a catalyst for another pop higher, albeit with some risk of disappointment.

-

This stock is about as big and liquid as they get.

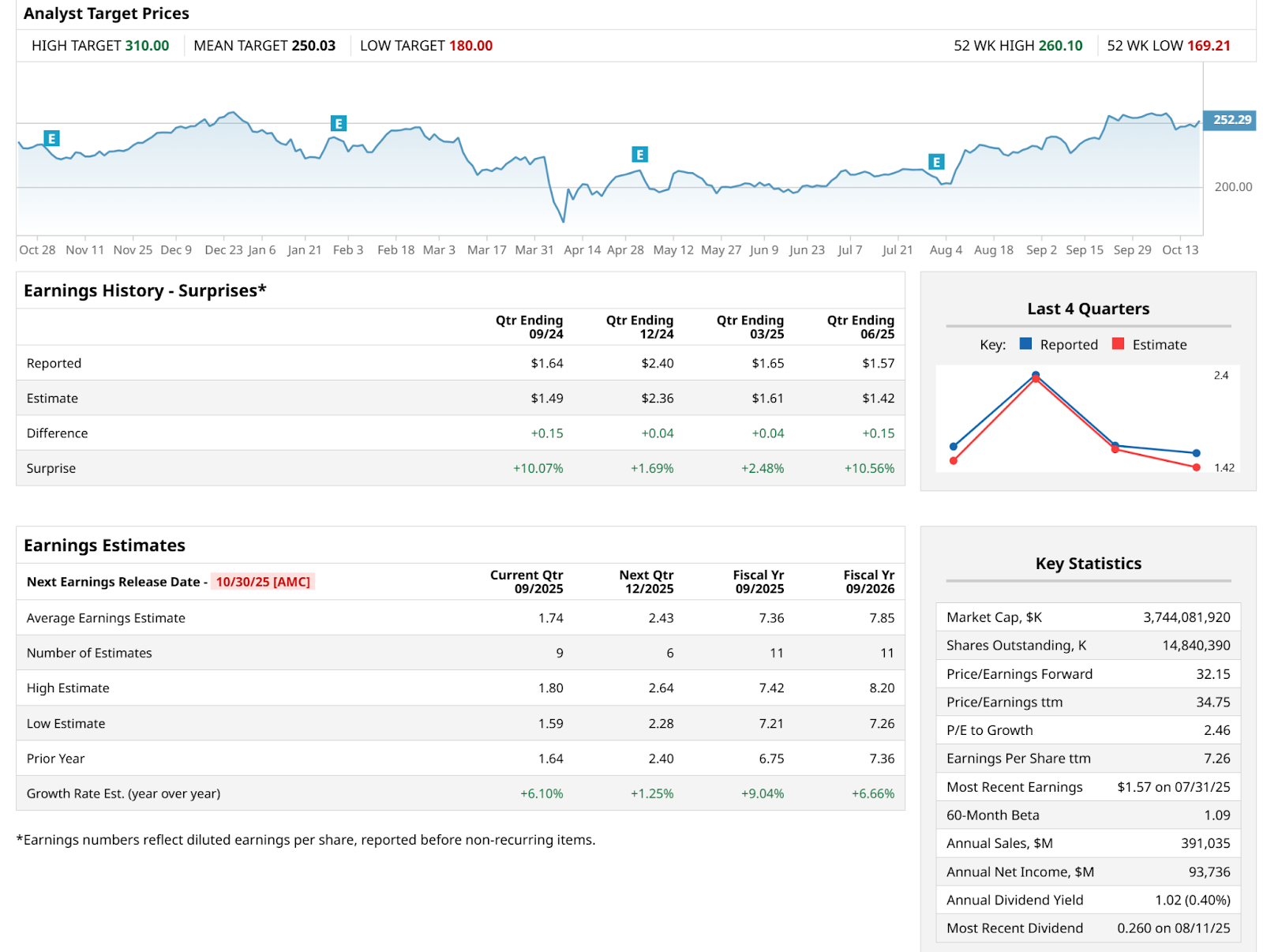

www.barchart.com

The chart looks a bit toppy, but this stock is essentially the market, given its nearly 7% weighting in the S&P 500 Index ($SPX). That means the index can’t go too far without AAPL, and vice versa. But a single stock is going to typically be more volatile than the index. That helps option pricing. So when we think about this mega-cap name, it is only really a step removed from collaring the index. But with better option pricing.

The chart above was a daily look. Below, in the weekly, I assess that AAPL has carved out a trading range of roughly $260 down to $180. Except for the very brief dive in early April, AAPL has traded in this range for about 18 months.

Should You Collar AAPL Now?

That only adds to the attractiveness of an option collar here. Because with a collar, the goal is to try to capture an extension of that nearly 30% move since early summer, but do so without having to endure the full brunt of a drop back down. The charts are somewhat in flux on that count.

AAPL is far from cheap technically. And as seen in the table above, at 32x trailing 12-month earnings, it is not cheap fundamentally either. So as much as anything, this is a bet on a continued tech stock follow-through to the upside.

Collaring a stock like this offers infinite possibilities, in terms of combinations of strike prices for the put and call, the cost one is willing to accept (if any) to put on the trade, and the resulting upside and downside ranges that come with that. And of course, the number of expiration dates here is dizzying. So I picked out one example to show here.

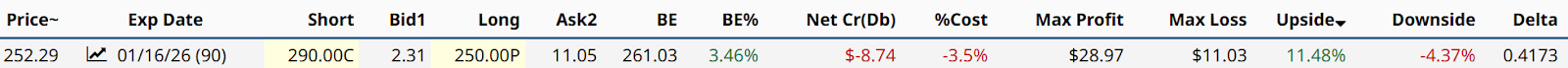

The one I landed on is structured as follows, using Friday’s closing data:

- AAPL closed at $252.29

- The puts cost $11.05 a share

- The calls bring in $2.31 a share to help offset more than 20% of the put price

- This results in an upside potential of 11.5% versus a downside worst-case of 4.4%. So more than a 2.5:1 up/down ratio.

- The collar only goes out to Jan. 16, which allows for this quarter’s earnings to hit and then gives me 3 months to see how this plays out.

- If I am so fortunate to earn 11.5% in 3 months, on a stock already up where it is, I won’t sweat being called. And depending on the chart, I’d consider replacing the shares if I did get called. AAPL’s new all-time high is just above $260.

- If the stock plunges, I cap my loss around the $240 area, which is where the stock peaked in early September.

All in all, this collar offers a strong up/down tradeoff, over a short time frame. And the underlying stock is so ubiquitous, there’s an excellent chance you are reading this article on one of their products!