Artificial intelligence (AI) has emerged as one of the most powerful forces driving the stock market, presenting both tremendous opportunities and risks for investors. While some companies are leveraging AI to drive real growth and profits, others are struggling to live up to the hype. In 2025, one AI stock stands out as a clear buy, while another looks better left on the sidelines.

1 AI Stock to Avoid: C3.ai

Before we get into why Meta Platforms (META) is the AI stock worth buying now, let us go over why C3.ai (AI) should be avoided.

Valued at $2.5 billion, C3.ai is an enterprise AI software company that provides applications, infrastructure, and services to customers looking to implement AI solutions. The company makes money mainly from subscriptions to its AI software and from professional services (engineering and support).

Once regarded as a leader in enterprise AI, the company delivered disappointing first-quarter fiscal 2026 results that sparked numerous red flags among investors. C3.ai stock is down 47% year-to-date and over 60% from its all-time high.

In the first quarter, revenue fell 19% year-over-year to $70.3 million. Subscription revenue accounted for the majority at $60.3 million, but software licensing revenue fell dramatically, down $15.9 million sequentially to $17.9 million. Professional services added another $10 million, but total revenue growth is slowing at a time when AI usage is expected to accelerate globally. The main concern is profitability. Net losses amounted to $49.8 million, or $0.37 per share. Furthermore, free cash flow was negative at $34.3 million, highlighting the company’s continuous inability to create sustainable cash. Despite having $711.9 million in cash on hand, C3.ai continues to burn significant amounts each quarter.

Management acknowledged the poor performance, calling it “completely unacceptable in virtually every respect,” and blamed it on poor sales execution and leadership disruptions. Since then, the company has revamped its sales and services departments, hired new executives, and named Stephen Ehigian as CEO. Nonetheless, restructuring is time-consuming, and investors suffer as a result.

Looking ahead, C3.ai guided for $72 million to $80 million in revenue in Q2, down from $94.3 million in the year-ago quarter. Operating losses might range from $49.5 million to $57.5 million. Even more alarming, the business pulled its full-year outlook, an unusual move that indicates significant uncertainty.

If you look at the positives, the company has a solid product portfolio, including over 131 enterprise AI apps and a new Agentic AI platform that is gaining traction. However, declining sales, shrinking margins, and mounting losses do not present a picture of a confident business, giving investors little reason to trust.

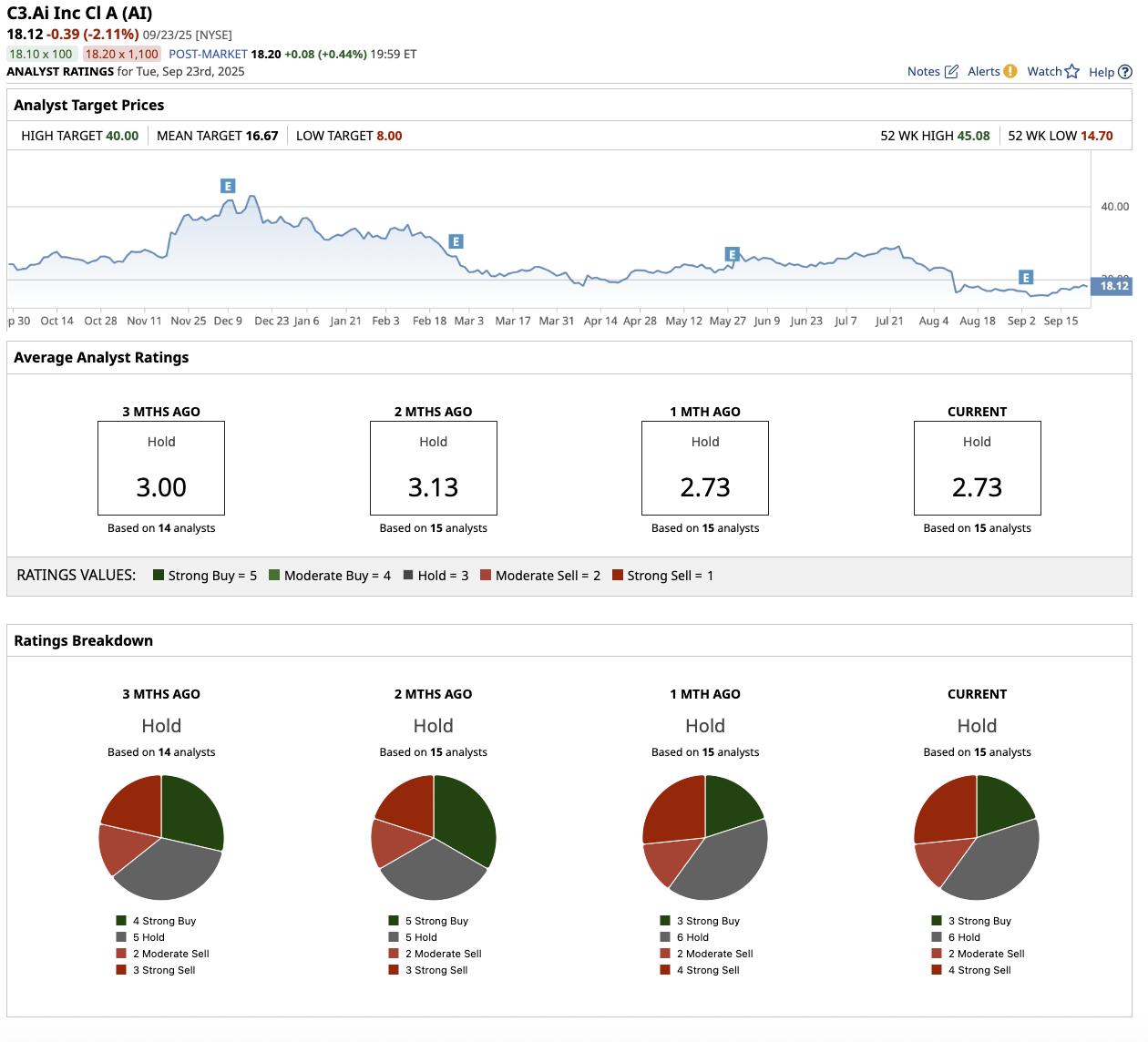

Given the AI surge, the market expected growth, but C3.ai’s Q1 earnings showed not only a slowdown, but also a revenue reduction compared to projections. A mismatch between expectations and delivery can often be punished harshly. This is why analysts at Morgan Stanley, Bank of America, and J.P. Morgan have given the stock a “Sell” recommendation, with some even lowering their target price.

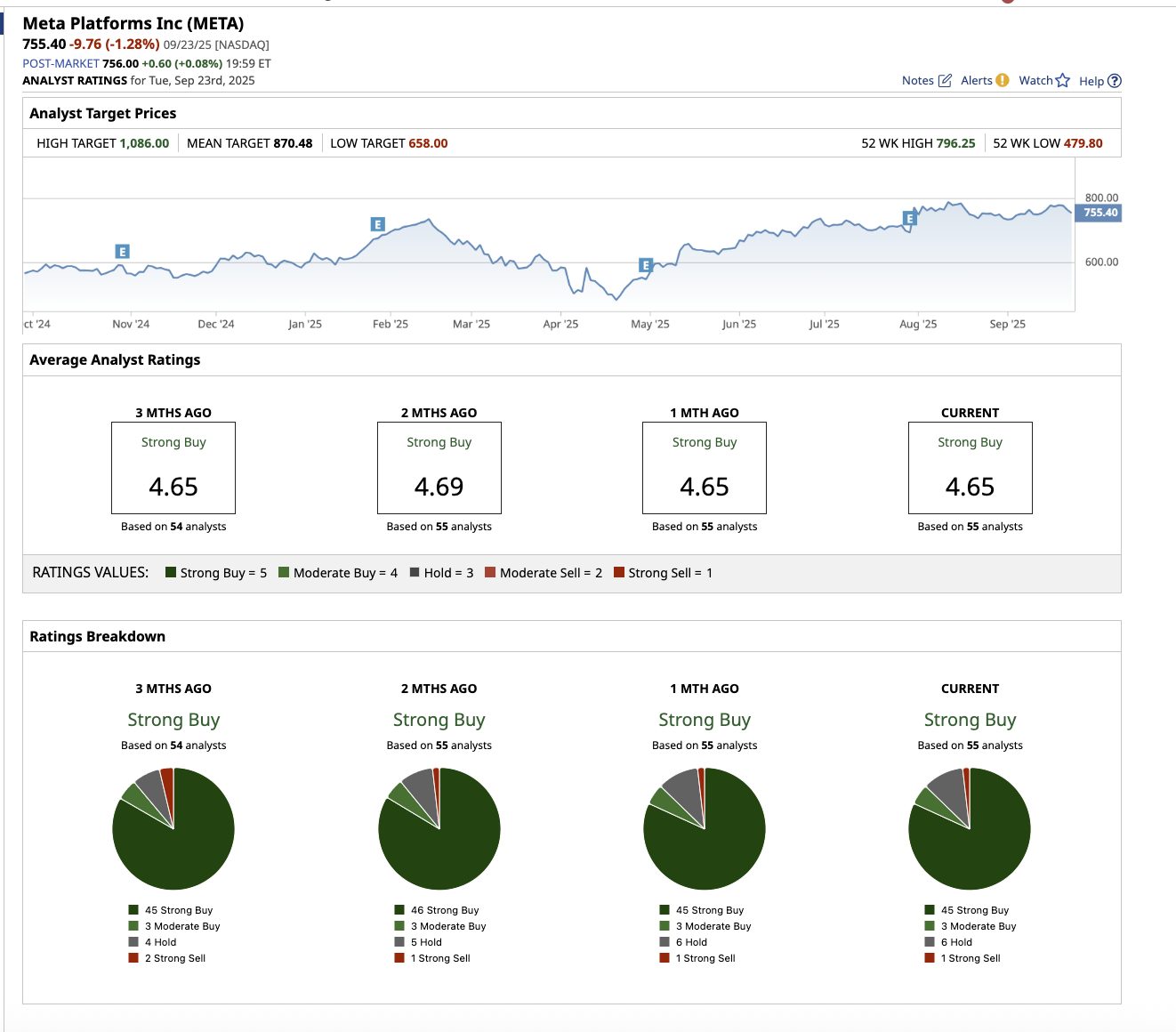

Overall, on Wall Street, C3.ai stock is a “Hold.” Out of the 15 analysts that cover the stock, three rate it a “Strong Buy,” six rate it a “Hold,” two say it is a “Moderate Sell,” and four say it is a “Strong Sell.” The stock has surpassed the mean target price of $16.6. The Street-high estimate of $40 implies upside of 120% over the next 12 months.

Until the new leadership proves it can deliver consistent growth and profitability, this remains one AI stock investors would be wise to avoid.

1 AI Stock to Buy: Meta Platforms

Meta Platforms, on the other hand, is quickly emerging as one of the most enticing AI investments in today’s market. The company is executing a broad AI strategy that spans everything from its core social media platforms to cutting-edge hardware, while delivering strong financial results.

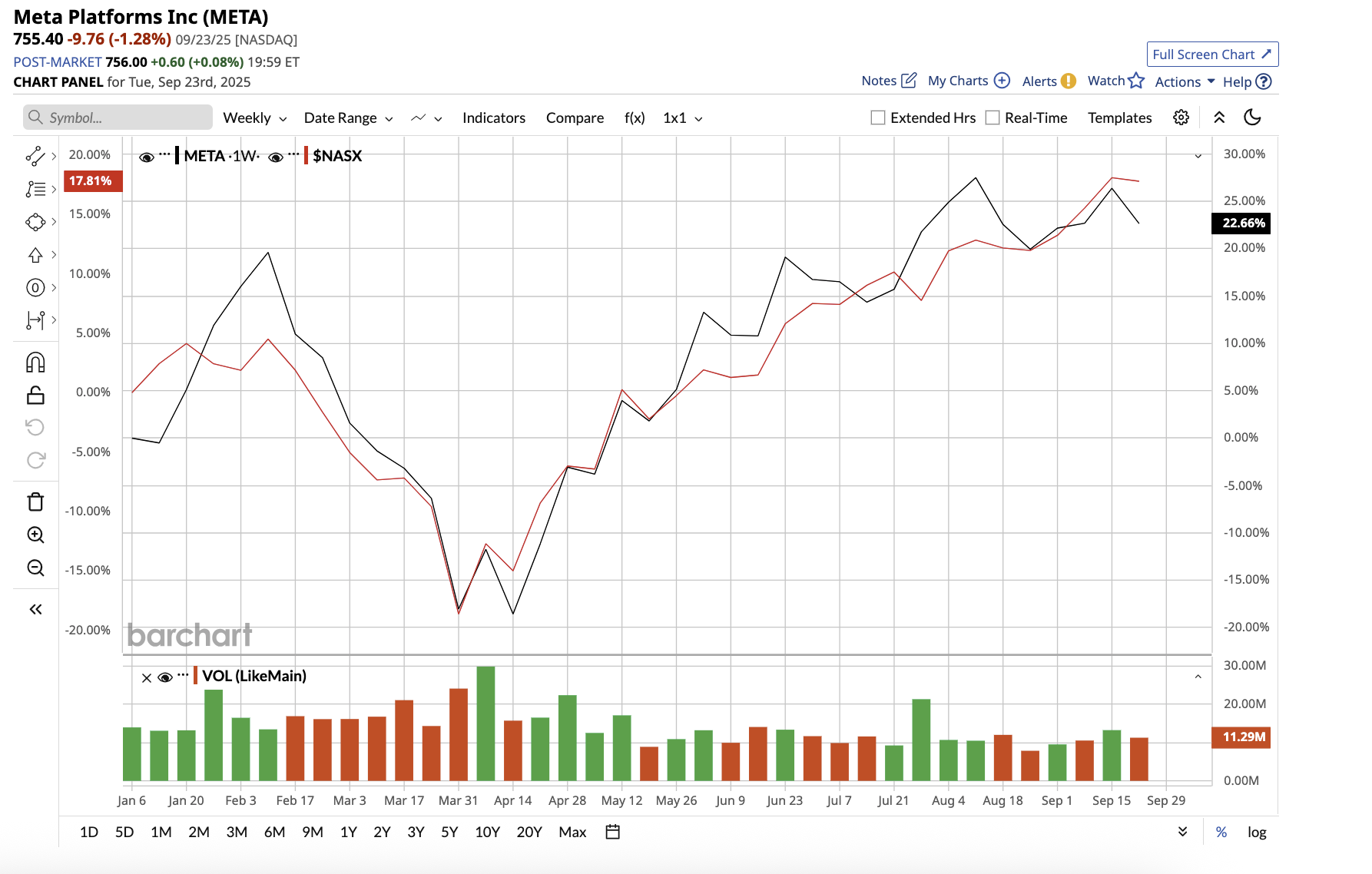

Valued at $1.9 trillion, META stock has soared 29% year-to-date, outpacing the tech-heavy NasdaqComposite Index ($NASX) gain of 17%.

CEO Mark Zuckerberg made it clear in the second quarter that Meta is pursuing superintelligence, which the firm defines as AI that outperforms human intelligence in all ways. The company’s newly formed Meta Superintelligence Labs combines its foundations, product, and FAIR research teams with a new elite division dedicated to next-generation models. The company is already working on Llama 4.1 and 4.2, while also developing future models that aim to push the boundaries of AI capabilities.

Meta sees AI reshaping its business over five key core areas. To begin, Meta’s ad business is booming as AI-powered recommendation models and generative tools increase efficiency, improve targeting, and deliver more conversions on Instagram and Facebook. Second, AI is strengthening Meta’s social media platforms by increasing content relevancy and engagement through more time spent on the applications.

Third, Meta is setting the basis for a future in which every organization has its own AI, with early tests in advertising and e-commerce pointing to a significant new long-term revenue source. Fourth, Meta AI already has over 1 billion monthly active users and is on its path to becoming the top personal AI assistant. Finally, Meta is betting big on AI hardware devices, with the Ray-Ban and new Oakley HSTN smart glasses gaining popularity.

Behind these ambitious AI initiatives are solid fundamentals that serve as the foundation. In the second quarter, Meta’s sales increased 22% year-on-year to $47.5 billion, while net income increased 38% to $7.14 per share. Advertising remains the growth engine, earning $46.6 billion in quarterly revenue and showing robust growth in all regions. Over 3.4 billion individuals use one of Meta’s apps on a daily basis, indicating that user growth remains strong. The Family of Apps segment’s sales increased by 21.8% to $47.1 billion, while operating income increased by 29%.

Reality Labs, Meta’s hardware and immersive segment, posted $370 million in revenue, up 5%, thanks to AI glasses momentum. However, it continues to operate at a loss as the company invests in the future.

Meta’s combination of financial strength, unmatched user base, and aggressive push into the metaverse and AI superintelligence makes it one of the best AI stocks to grab now.

Overall, META stock is a “Strong Buy” on Wall Street. Among the 55 analysts covering the company, 45 give it a “Strong Buy” rating, three recommend a “Moderate Buy,” six suggest holding, and one rates it a “Strong Sell.” The average price target of $870.48 indicates potential 15.2% upside from current levels. Meanwhile, the high price target of $1,086 implies the stock could surge by as much as 44% over the next year.