/AI%20(artificial%20intelligence)/AI%20engineer%20working%20on%20laptop%20by%20ART%20STOCK%20CREATIVE%20via%20Shutterstock.jpg)

When a fast-growing cybersecurity company unexpectedly becomes the poster child for artificial intelligence (AI)-driven security, everyone takes notice. And that attention has resulted in a string of recent price-target increases for CrowdStrike (CRWD) on Wall Street. CrowdStrike, valued at $105.8 billion, is an AI-powered cybersecurity company that specializes in protecting computers, servers, cloud workloads, and identities from modern cyber threats via its cloud-based security platform, Falcon.

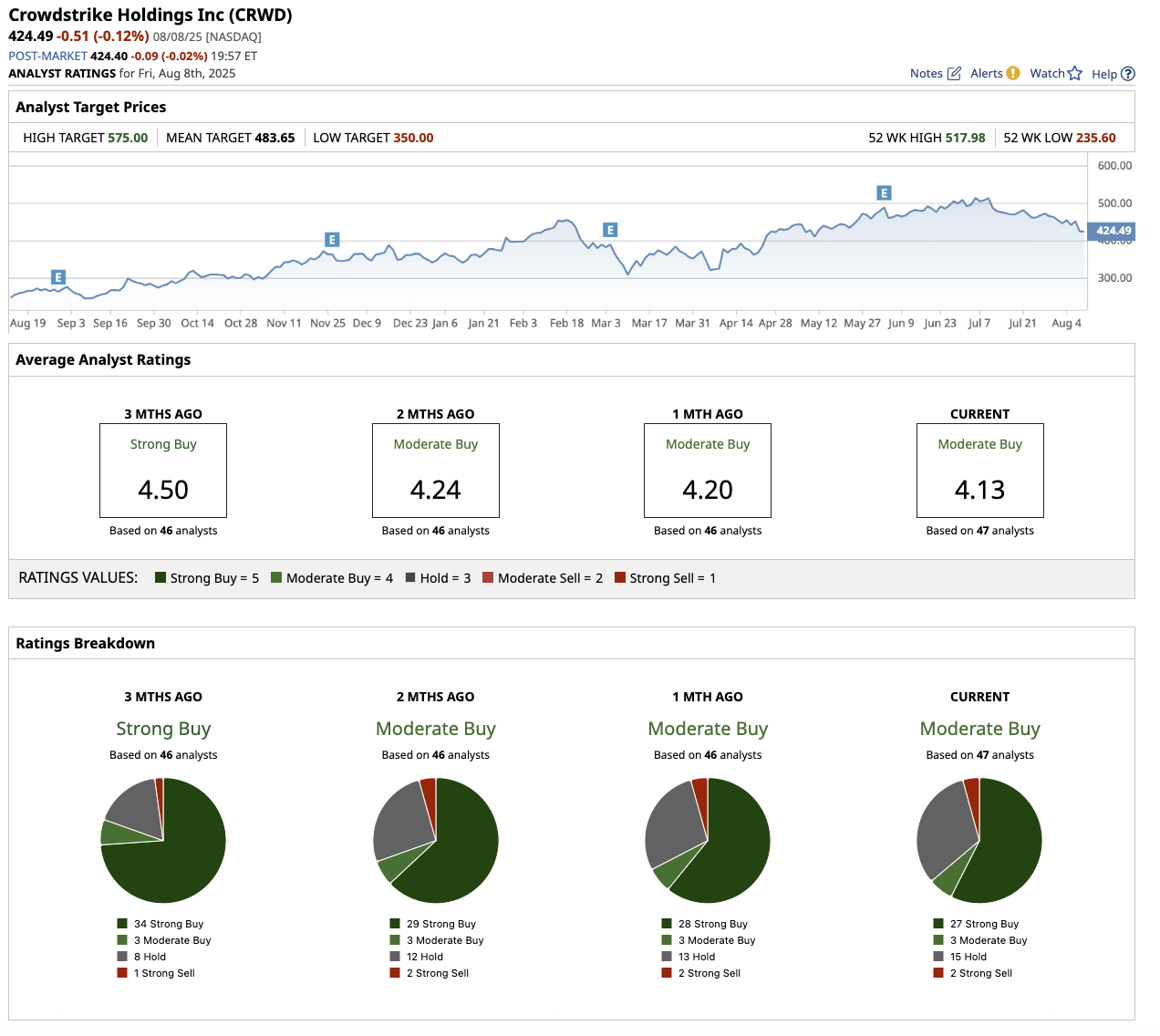

Recent Price-Target Moves on The Street

Jefferies raised CRWD's price target to $530 from $520 and assigned a “Buy” rating, citing cybersecurity as a long-term trend due to its growing importance. Wedbush analyst Dan Ives maintained his “Hold” rating with a new price target of $575, which is also the stock’s high price estimate. Citi analyst Fatima Boolani also maintains the high price target of $575 and a “Buy” rating.

Separately, while raising the price target to $495 from $490, Morgan Stanley analyst Keith Weiss downgraded the stock to “Equal Weight” from “Overweight.”

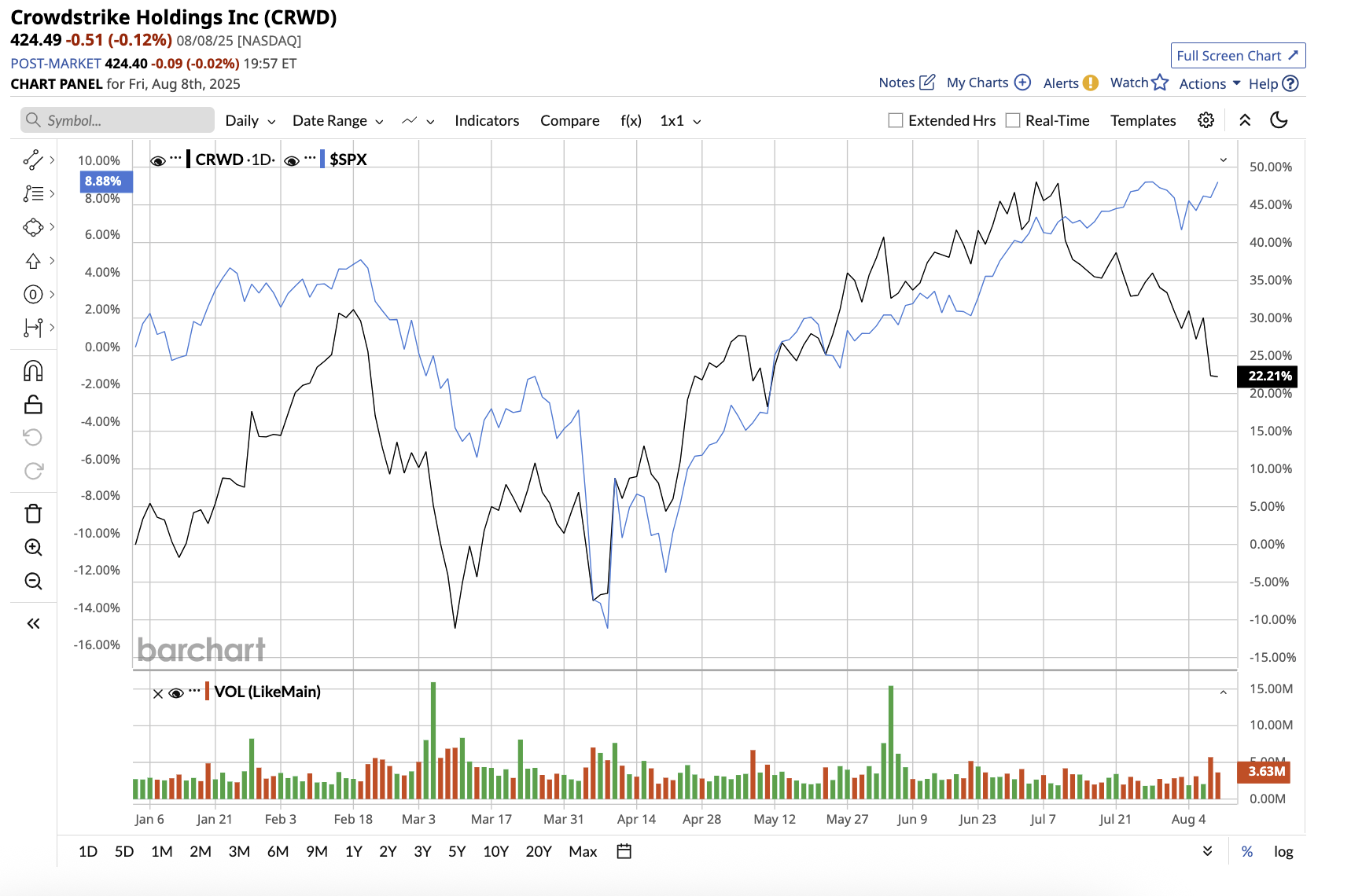

These upward price target revisions followed a strong first quarter of its fiscal 2026. CEO George Kurtz stated on the Q1 earnings call that the company began the fiscal year “from a position of strength,” and the numbers back this up. CRWD stock is up 25.7% year-to-date, compared to the S&P 500 Index ($SPX) gain of 8.7%.

CrowdStrike’s success story revolves around FalconFlex, a subscription model that bundles multiple Falcon platform modules into a flexible, outcome-based agreement. Launched less than two years ago, FalconFlex has already been adopted by over 820 accounts, with deal sizes averaging more than $1 million in ARR and contract lengths averaging 31 months. In the first quarter, the value of new accounts reached $774 million. The total value of the Falcon Flex deals reached $3.2 billion, a sixfold increase year on year.

In Q1, the company reported a 20% increase in revenue to $1.1 billion, but adjusted earnings per share (EPS) fell to $0.73 from $0.79. While earnings exceeded analyst expectations, revenue fell short by $1.83 million. Q1 net new ARR (average recurring revenue) of $194 million exceeded internal expectations. Total ARR surpassed $4.4 billion, which management claimed to be the highest among pure-play cybersecurity software companies. The subscription gross margin stood at 80%, showing the efficiency of its AI-native platform. The company generated $279 million in free cash flow. At the end of the first quarter, the company had $4.61 billion in cash and cash equivalents.

Crowdstrike will report fiscal second-quarter earnings on Aug. 27. Management expects a 19% increase in revenue to $1.14 billion to $1.15 billion, with adjusted EPS ranging from $0.82 to $0.84 per share, in line with consensus estimates. Overall, analysts covering CRWD stock expect revenue to grow by 21% in fiscal 2026 and 2027. Earnings, however, may fall by 10.6% in fiscal 2026 before rising by 34.6% in fiscal 2027. CRWD stock is currently trading at a premium of 89 times forward 2027 earnings.

Why Wall Street Likes CrowdStrike’s Growth Story

Analysts are optimistic about CrowdStrike for a variety of reasons. First, high ARR growth, long contract durations, and 97% retention all indicate predictable revenue streams. Second, FalconFlex shortens sales cycles while significantly increasing customer lifetime value. CrowdStrike’s use of Agentic AI and Charlotte AI positions it at the forefront of securing next-generation attack surfaces, including autonomous AI agents. Additionally, CrowdStrike’s expansion is not limited to a single product line. The company is expanding into several product categories, including cloud security, exposure management, next-generation SIEM, and identity protection. Finally, a strong balance sheet and expanding product portfolio may be further reasons why Wall Street sees more upside.

Overall, the word on the Street is a “Moderate Buy” for CRWD stock. Of the 47 analysts that cover the stock, 27 rate it a “Strong Buy,” three say it is a “Moderate Buy,” 15 rate it a “Hold,” and two rate it a “Strong Sell.” The average target price for the stock is $483.65, which implies the stock can rally 13% above current levels.

The global cybersecurity market is estimated to be worth $500.7 billion by 2030. CrowdStrike, with a clear mission to stop breaches, record global wins, deep technology partnerships, and strong financial performance, is well-positioned to be the world’s leading cybersecurity platform for the AI-driven future. Analysts’ upward price target revisions are a sign that CrowdStrike has a rewarding future in store.