Shares of CoreWeave Inc (NASDAQ:CRWV) declined 8.72% during Tuesday’s pre-market trading session as the Nvidia (NASDAQ:NVDA) backed company trimmed its annual revenue forecast.

Data Center Delays To Impact Fourth Quarter

On Monday, the company lowered its 2025 revenue outlook, citing delays at a third-party data center partner. Chief Financial Officer Nitin Agrawal, during its third-quarter earnings call, projected 2025 revenue in the range of $5.05 billion and $5.15 billion, compared to its previous forecast of $5.15 billion to $5.35 billion.

However, Agrawal added that these delays are temporary and the impacted customer has agreed to revise the delivery schedule to maintain their full capacity and uphold the total value of the original agreement.

Upbeat Q3 Results

CoreWeave announced its Q3 financial results on Monday, surpassing analysts’ estimates. The company reported a revenue of $1.36 billion, exceeding the projected $1.29 billion. The adjusted loss per share for the quarter was eight cents, far better than the estimated 37 cents per share.

The company, which provides large tech and AI-focused firms with access to Nvidia GPUs, ended the quarter with a revenue backlog of $55.6 billion. This is nearly double the previous figure.

CoreWeave’s operating expenses for the period amounted to $1.31 billion, and it concluded the quarter with approximately $1.89 billion in cash and cash equivalents.

AI Cloud Firm Sustains Rapid Expansion

CoreWeave’s financial success in Q3 is a continuation of its impressive growth trajectory. In October, a top digital infrastructure analyst predicted that the company’s revenue would nearly quintuple to the “mid-$20s billion” by 2028. This forecast underscored CoreWeave’s rapid rise as a key player in the AI infrastructure boom.

Earlier in October, CoreWeave announced a partnership with Poolside, a foundation model company. The partnership involved CoreWeave providing Poolside with a cluster of Nvidia GB300 NVL72 systems and access to its cloud solutions for Project Horizon, Poolside’s 2 GW AI campus in West Texas.

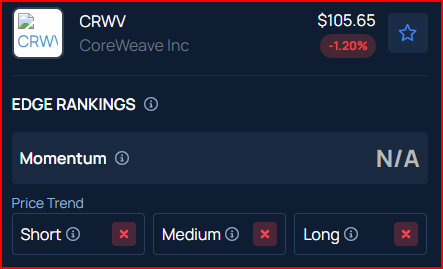

Benzinga Edge Stock Rankings shows that CoreWeave has a weak price trend over the short, medium, and long term. Check the detailed report here.

Price Action: On a year-to-date basis, CoreWeave stock surged 164.03%, as per data from Benzinga Pro. On Monday, the stock rose 1.54% to close at $105.61.

READ NEXT:

Image via Shutterstock

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.