White House National Economic Council Director Kevin Hassett has emerged as the leading candidate to become the next Federal Reserve Chair, according to a report published Tuesday.

Trump’s ‘Close Ally’ For Fed’s Top Position?

Hassett, who led the Council of Economic Advisers during Trump’s first term, is seen as the frontrunner by President Donald Trump’s allies and advisers, Bloomberg reported, citing people familiar with the matter.

Hassett is viewed as a “close ally” who would carry Trump’s “approach” for lowering interest rates at the Fed, the report said, quoting sources.

However, the nomination is reportedly not final until it is made public, as Trump is known for “surprise” policy decisions.

The White House didn’t immediately return Benzinga’s request for comment.

See Also: Bitcoin, Ethereum, Dogecoin Consolidate, While XRP Dips: Popular Analyst Spots ‘Bearish’ Flag On BTC Chart, Says Drop To $79,000 Possible

Meanwhile, bettors on Polygon (CRYPTO: POL)-based prediction market, Polymarket, placed 52% odds of Trump nominating Hassett as the next Fed Chair. Similarly, Kalshi punters predicted a 55% chance of this happening.

Trump And Powell Have Rocky History

Trump has been sharply critical of incumbent Fed Chair Jerome Powell for not cutting interest rates soon enough, while calling for benchmark rates to drop to "1% or 2%," from their current 3.75% to 4.00%.

Powell's term is set to conclude in May 2026.

Hassett’s Crypto Credentials

Hassett has made clear his preference for lower interest rates. After the Fed’s 25-basis-point rate cut in September, Hassett said, “That’s a good first step in the right direction of much lower rates.”

Notably, Hasset is known to have a cryptocurrency leaning. Before his current role, he was part of Coinbase Global Inc.’s (NASDAQ:COIN) advisory council.

Earlier in June, he disclosed a stake in the company, worth at least $1 million, according to Bloomberg.

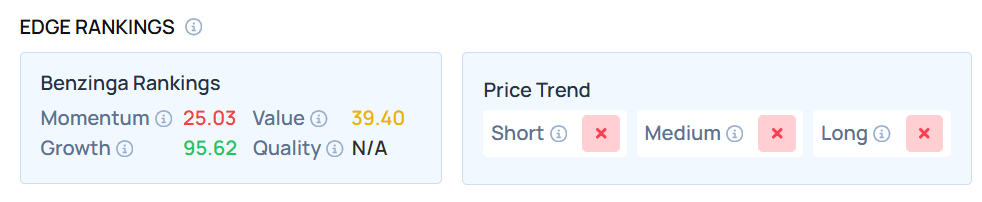

Price Action: Coinbase shares rose 0.26% in after-hours trading to $254.79. The stock closed 0.72% lower at $254.12 during Tuesday's regular trading session, according to data from Benzinga Pro.

As of this writing, COIN ranked high on Growth, an indicator of a stock's combined historical expansion in earnings and revenue across multiple periods. Visit Benzinga Edge Stock Rankings to compare it to the “Mag 7” tech giants and the cryptocurrency exchange-traded funds.

Read Next:

Photo Courtesy: Shutterstock/Joshua Sukoff