Wall Street analyst Gordon Johnson has predicted a major dip in value for Tesla Inc. (NASDAQ:TSLA) in 2026, slamming the Elon Musk-led automaker's autonomous driving and Optimus goals.

Check out the current price of TSLA here.

Elon Musk's Missed Promises

Quoting a post by a user on the social media platform X who predicted that Tesla would be at $3,000/share, Johnson expressed his views on Tuesday. "Wrong. $TSLA will be <$30/shr," by this time in 2026, Johnson said in the post. He also predicted that Tesla would record zero sales for its Optimus humanoid robots.

Johnson also predicted that Tesla's “FSD” vaporware will still have a driver behind the wheel, calling it "a glorified taxi." He then called out Musk in his post, saying that "people will be sick/tired" of Musk's "missed promises."

Tesla, Elon Musk Tout Autonomous Capabilities

The news comes as Tesla has touted its autonomous capabilities, with the company's Head of Business Development, George Bahadue, saying that the automaker is creating a full end-to-end autonomous driving stack, unlike rivals like Alphabet Inc.'s (NASDAQ:GOOGL) (NASDAQ:GOOG) autonomous driving company Waymo.

Meanwhile, Musk also reiterated the automaker's autonomous driving setup, claiming that the technology could be "spreading faster" than other systems despite an ongoing NHTSA investigation into the technology that has affected over 2.88 million Tesla vehicles.

Gary Black Hails FSD Progress

Elsewhere, investor Gary Black, who is the managing director of the Future Fund LLC, hailed the company's Full Self-Driving (FSD) system's latest V14 update, calling it a huge step up from the previous version. He hailed the FSD system's 1,677 miles per critical disengagement figure as an improvement over the previous system.

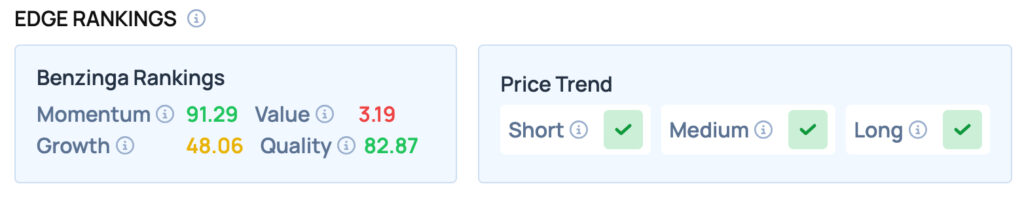

Tesla scores well on Momentum and Quality metrics, while offering satisfactory Growth, but poor Value. Tesla also has a favorable price trend in the Short, Medium and Long term. For more such insights, sign up for Benzinga Edge Stock Rankings today!

Check out more of Benzinga’s Future Of Mobility coverage by following this link.

Read Next:

Photo courtesy: Shutterstock