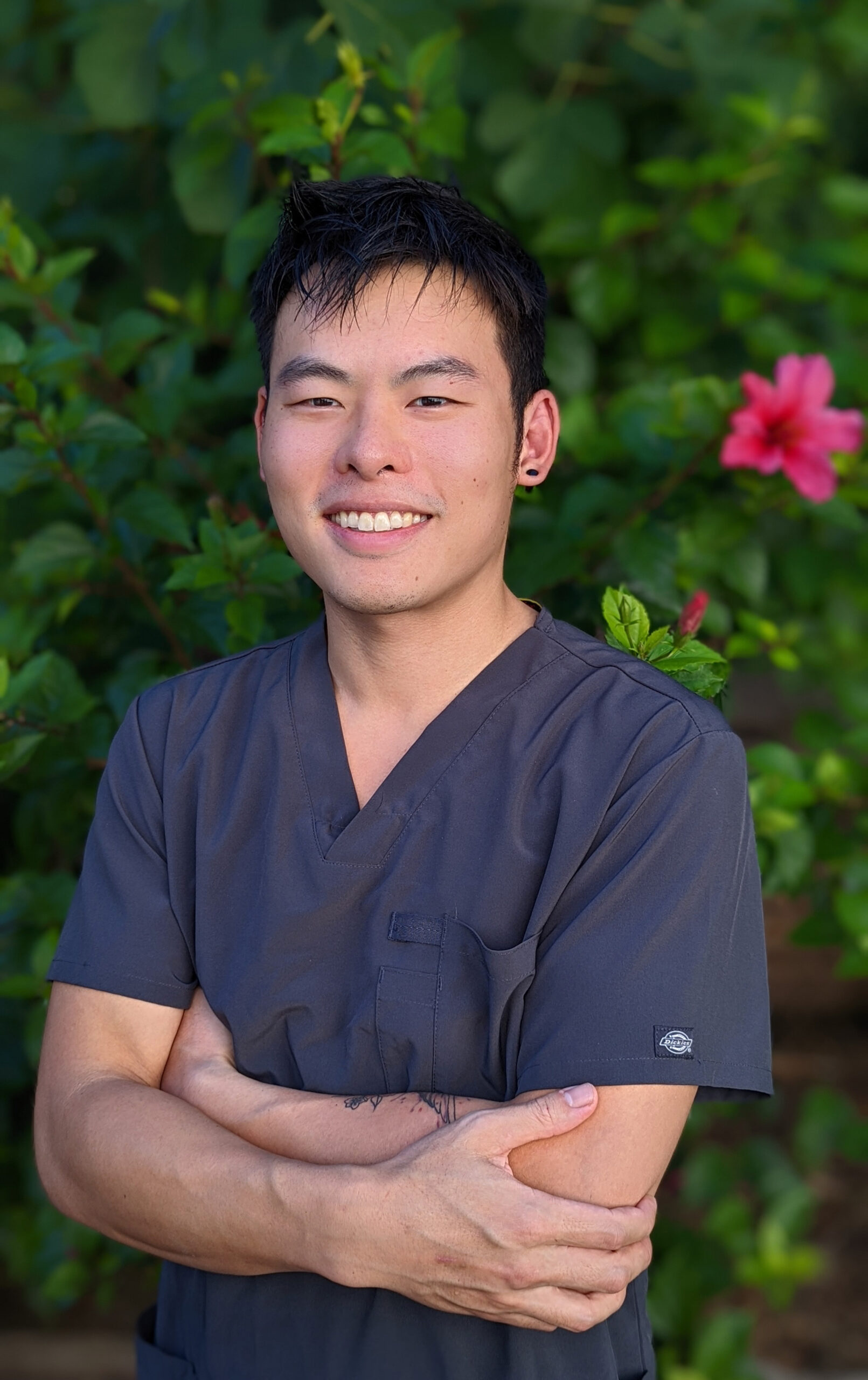

Jimmy Pang has spent the past few months trying to map out a long-term plan to keep his health care while growing his physical therapy practice in San Diego.

It’s a conundrum millions of small business owners and self-employed Americans are now facing. Health care through the federal Affordable Care Act is getting more expensive, and the tax credits that helped make it affordable will shrink or disappear in 2026. The change comes after a Republican-led Congress refused to extend the enhanced credits despite pleas from voters and a sustained push from Democrats that shuttered the government.

“I have chronic health issues, and I am very dependent on my health insurance,” said Pang, who suffers from chronic headaches and pain. “I’m seen by multiple specialists. That is the biggest thing for me.”

Pang pays about $350 a month for his plan through the federal health care exchange, and a $350 subsidy pays for the rest. Next year, he estimates he’ll pay $750 a month and may qualify only for a $50 subsidy because he moved his therapy practice from the Bay Area to San Diego to be close to his family. He expects 2027 to be even worse, with no subsidy and monthly costs of around $800 or more.

Covered California estimates that on average, consumers will see a 97% increase in premiums in 2026 without the enhanced tax credits. The state expects to lose $2.5 billion in enhanced premium tax credits, the state exchange reported.

The changes will be especially tough for the millions of small business owners and self-employed workers across the U.S.. They are three times more likely than others to rely on the health care exchange for their own care, according to the Treasury Department.

If lawmakers do nothing by Dec. 31, the consequences will ripple through communities and we all stand to lose. Small business owners are the country’s biggest job creators and power local economies. They preserve neighborhood culture, prepare our food, care for our children, create entertainment and build community. Yet, they now face choosing between health care and their livelihoods.

The enhanced premium tax credits for middle- to higher-income earners were created in 2021 during the pandemic as part of the American Rescue Plan Act and extended the following year through the Inflation Reduction Act. President Joe Biden signed both laws, which had been unanimously rejected by Republicans in Congress.

The enhanced premium credits were intended to help people who earn more than 400% of the federal poverty level — $62,600 for an individual and $128,600 for a family of four. For small business owners and gig-economy workers, the credits were a lifeline.

The effort worked. Enrollment surged. Uninsured rates dropped. Entrepreneurs finally had a foothold in a system that often overlooked them.

Roughly 4.2 million small business owners and self-employed workers received their health coverage through the ACA in 2023 — up from 3.3 million the year before, federal Treasury Department data shows. In 2025, the number of self-employed or small business enrollees is expected to reach 5 million, with nearly half a million in California alone, found the Center for Budget and Policy Priorities, a progressive-leaning think tank.

The surge was powered almost entirely by affordability. According to the Center on Budget and Policy Priorities, 93% of marketplace enrollees rely on premium tax credits.

Now, among overall participants, the Congressional Budget Office predicts 4.2 million people will become uninsured by 2034 once those enhanced credits disappear. But the number could be even higher and happen more quickly — 4.8 million by 2026, the Urban Institute, a nonpartisan think tank, estimated in a September report.

Not everyone is losing subsidies, but nearly all enrollees on the exchange face massive price hikes, and those two factors will drive people out of the program, according to experts.

The Urban Institute projects that those who earn the least will see the largest increases. Average net premiums for individuals or families earning below 250% of the federal poverty level — or $39,125 for an individual and $80,375 for a family of four — are projected to quadruple in 2026 compared to what they are this year.

“This is a major hit,” said Matthew Buettgens, senior fellow at the Urban Institute and co-author of the September report. “For someone at a higher income, the premium may seem small. But to someone at the lower end, even paying anything at all could be very difficult.”

For small business owners, the exchange may be their only choice for health care. Most have too few employees to negotiate group plans and don’t earn enough to make private insurance affordable without assistance.

Small businesses owned by people of color are especially vulnerable, research shows. They are less likely to have access to group plans and are more likely to rely on the exchange.

“A lot of people try to run a business, and they are on high-deductible plans because they are healthy, but everyone is one second away from an accident,” said Pang. “I can’t imagine what restaurants, coffee shops and others are going to do. All of their costs are going up as well and now they have this on top.”

Pang also worries about losing protections for preexisting conditions.

“If that happened, I’d be pretty screwed,” Pang said. “I don’t have a life-threatening condition but I have serious conditions.”

In California, new preliminary estimates show that 280,000 people are expected to drop off Covered California once the enhanced premium subsidies expire, said Dylan Roby, faculty associate at the UCLA Center for Health Policy Research and professor at UC Irvine’s School of Population & Public Health. Of those, about 80,000 may find other coverage and the rest are likely to go uninsured. Roby said the figures are part of “preliminary unpublished estimates” that he is working on with UCLA and UC Berkeley.

While not everyone is losing their credits, the expiration of the enhanced credits for higher earners is rippling through the marketplace and spiking prices even for enrollees who will not lose subsidies. Insurance actuaries priced 2026 coverage higher based on expectations that healthier and younger people will leave the exchange once subsidies disappear.

“If subsidies had been extended,” Roby said, “premiums could have been about 20% lower.”

In Los Angeles, independent television editor David Dennick has talked to three insurance brokers and spent hours comparing plans, poring over documents and estimating his budget for his family of four knowing that they will lose the $850 enhanced subsidy they have relied on for years.

Staying on the same Blue Shield of California plan, through Covered California, would push their premiums from $1,389 to $2,478 a month. Switching to a lesser HealthNet plan will still cost them $1,837, nearly $500 more than today — and that’s before higher deductibles and fees.

Navigating expensive health care isn’t a new experience for Dennick, but it’s frustrating to be in this position again.

Dennick and his wife, a marriage and family therapist, have been buying their own coverage for decades. Before the Affordable Care Act, it was expensive and one year they were denied coverage due to a false “preexisting condition” notation based on a random abnormal test many years prior.

The passage of Obamacare in 2010 changed that. For a time, it made care accessible and affordable, especially when the enhanced premium tax credits began four years ago.

But without the enhanced premium credit, they will again be paying far more than they can comfortably afford. Dennick says the math is keeping him up at night.

“We can’t afford it and can’t afford not to have it,” Dennick said. “We could potentially lose everything we have worked our whole lives for because of unrealistic health insurance.”

With inflation, an unstable entertainment industry and rising costs everywhere, Dennick says it feels like pressure from all sides.

“It feels crushing. I feel like we are just basically trying to stay afloat,” he said. “With inflation and everything it’s so much tougher to feel like the future is bright.”

During the 43-day government shutdown that ultimately ended with Democrats giving in without securing protection for health care prices or credits, Dennick was so outraged that he wrote letters to both California senators, Adam Schiff and Alex Padilla. He implored them to fight to keep the enhanced credits. He got a standard letter in response.

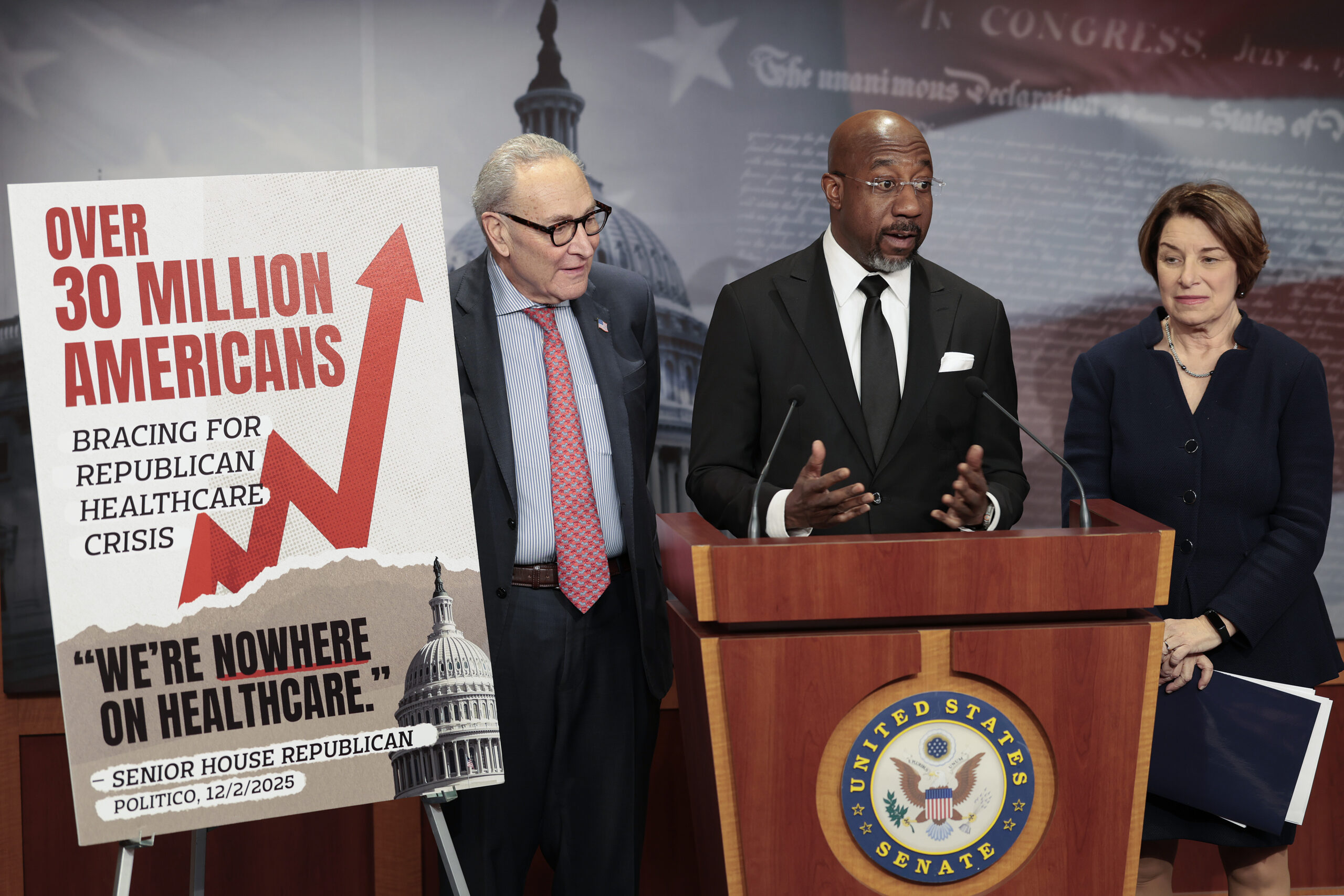

On Thursday, the U.S. Senate blocked an effort by Democrats to extend the expiring subsidies, essentially killing any hope for a last minute save.

In West Hollywood, Alison Gordon, known professionally as the “Insurance Mom,” manages about 2,000 clients. Many of them, she says, are facing the loss of the enhanced premium subsidy and don’t want to switch plans or lose their doctors. There are two paths she’s seeing her clients following. Families and people with chronic conditions are scrambling to keep the same or lesser coverage even if it costs more. And younger, healthier people are weighing whether to drop out entirely.

Gordon said there has been confusion over which subsidies are going away. She is reassuring some clients about the program and helping others consider their options. She encourages consumers to talk to a broker, like Dennick did.

“Covered California is too easy to navigate incorrectly. People need help right now,” she said.

Even for those who remain insured, access remains a challenge. Many Californians with coverage still face long waits for specialists, inadequate provider networks, increased deductibles and unpredictable out-of-pocket costs.

Dennick was billed $2,000 for his son’s 15-minute emergency room visit this year where a doctor examined his son’s throat and gave him antinausea medication. Dennick and his wife spent hours contesting the inflated bill and it was eventually lowered.

They’re not alone. It’s a sad indictment of our health care system that so many Californians have to make similar calls to decipher and contest expensive bills, and that small business owners who power our local economies have to stress about when and how to go to the doctor.

The solutions are straightforward. Congress could restore or extend the enhanced tax credits. States like California could offer supplemental subsidies, as they’ve done before — though mainly for very low-income families.

But the overarching problem, that health care premiums are becoming out of reach for most Americans, will require more investigation — and action — by state and federal officials to fix.