Nebius Group N.V. (NASDAQ:NBIS) is accelerating its global data center expansion, unveiling plans to more than double capacity by 2026 as surging demand for AI compute drives a dramatic step-change in growth.

D.A. Davidson analyst Alexander Platt reiterated Buy rating and $150 price forecast on Nebius Group after the company delivered strong results.

The firm highlighted a step-function increase in Nebius’ data center capacity, with management now projecting contracted power of 2.5GW by the end of 2026 and an annualized revenue run-rate of $7-9 billion.

Also Read: Nebius CEO Says ‘We Sold Out Everything We Built’ As NBIS Plans Expansion Across Israel, UK, More

The analyst noted that demand for compute capacity remains elevated across GPU generations and global regions, positioning Nebius for continued expansion through fiscal 2026.

Revenue rose 237% year over year to $146.1 million, reflecting the strength of the company’s core AI compute business. Alongside a previously disclosed contract with Microsoft Corporation (NASDAQ:MSFT), Nebius also announced a $3 billion, five-year deal with Meta Platforms, Inc. (NASDAQ:META).

The agreement was reportedly constrained by current compute availability, with additional capacity for Meta expected to ramp up this quarter and reach full utilization by the first quarter of 2026. Microsoft’s allocation is expected to reach full capacity by the fourth quarter of 2026, with most of the growth back-end loaded into next year.

Nebius’ updated guidance, including 2.5GW of contracted power and up to 1GW of connected power by the end of 2026, suggests prior expectations of 1GW were conservative, D.A. Davidson said. Assuming favorable market conditions, the firm sees potential medium-term revenue exceeding $20 billion.

The analyst believes additional capacity, an incremental 400MW, could be achieved via expansion at the New Jersey site, which can support up to 1GW, also expects the company to secure two more mega-deals, potentially an expansion of the Meta contract and a new hyperscaler agreement, each roughly the size of the Microsoft deal.

D.A. Davidson said Nebius is positioned to generate double-digit returns on capital, citing its use of an ODM (original design manufacturer) model for NVIDIA Corporation (NASDAQ:NVDA) racks, which reduces compute costs by 15-20% compared with OEM alternatives. Compute hardware accounts for roughly 80% of total capital expenditures.

Combined with operational efficiencies in data center management, this structure could yield significantly higher returns than peers such as CoreWeave, Inc. (NASDAQ:CRWV), which currently posts a 4% return on capital.

D.A. Davidson reaffirmed its Buy rating and $150 price forecast on Nebius Group, valuing the stock at 7x projected 2026 revenue. The firm called Nebius one of its top AI picks and its favorite neocloud player.

Nebius Group’s financial outlook points to explosive growth, with revenue projected to surge from $571.8 million in 2025 to $5.38 billion in 2026. The company is also expected to swing to profitability, with GAAP earnings per share rising from $1.00 in 2025 to $6.11 in 2026.

Price Action: NBIS shares were trading lower by 8.23% to $93.81 at last check Wednesday.

Read Next:

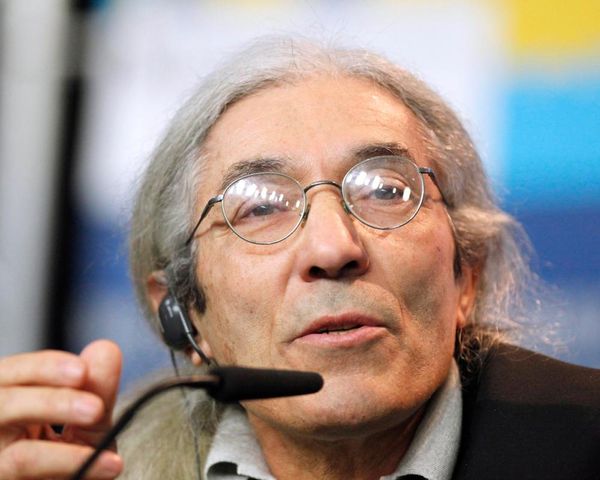

Photo by Piotr Swat via Shutterstock