(Editor’s note: The future prices of benchmark tracking ETFs, the lede, and headline were updated in the story.)

U.S. stock futures turned negative after initial positive moves on Friday following Thursday's declines. Futures of major benchmark indices were lower.

Thursday’s action was part of a broad selloff across Wall Street that saw U.S. stocks settle lower, with the Nasdaq Composite dipping more than 400 points during the session.

Risk-off sentiment returned sharply, with AI-linked stocks leading the decline and renewed pressure hitting crypto markets.

Meanwhile, reports emerged that the Donald Trump administration has decided to block Nvidia Corp.‘s (NASDAQ:NVDA) sale of its latest scaled-down AI chip to China.

The 10-year Treasury bond yielded 4.11% and the two-year bond was at 3.58%. The CME Group's FedWatch tool‘s projections show markets pricing a 65.1% likelihood of the Federal Reserve cutting the current interest rates during its December meeting.

| Futures | Change (+/-) |

| Dow Jones | 0.19% |

| S&P 500 | 0.27% |

| Nasdaq 100 | 0.31% |

| Russell 2000 | 0.42% |

The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, fell in premarket on Friday. The SPY was down 0.44% at $667.39, while the QQQ declined 0.63% to $607.83, according to Benzinga Pro data.

Stocks In Focus

Tesla

- Tesla Inc. (NASDAQ:TSLA) rose 2.08% in premarket on Friday as its shareholders approved the trillion-dollar pay package for CEO Elon Musk during the company's annual shareholder meeting.

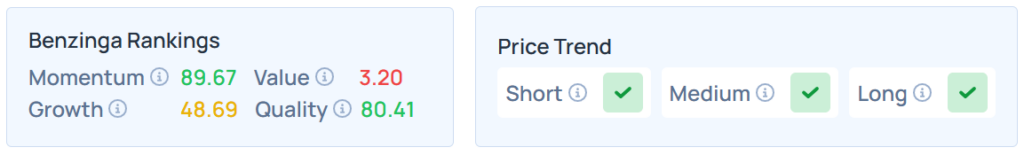

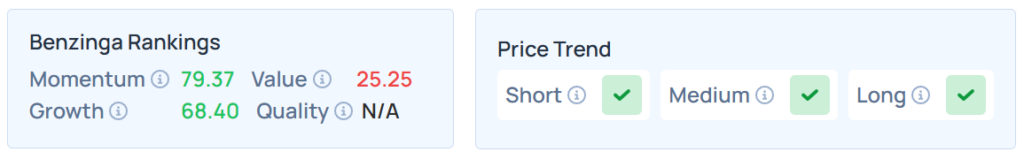

- Benzinga’s Edge Stock Rankings indicate that TSLA maintains a stronger price trend over the short, medium, and long terms, with a poor value ranking. Additional performance details are available here.

IREN

- IREN Ltd. (NASDAQ:IREN) jumped 5.18% after its first-quarter revenue came in at $240.3 million, which beat the Street estimate of $235.5 million.

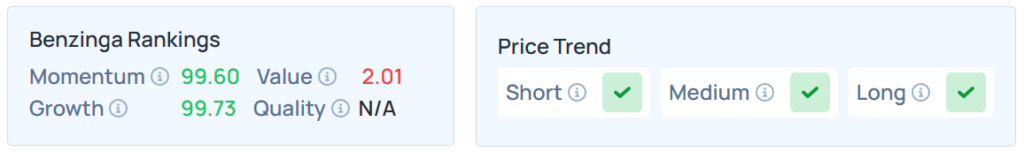

- IREN maintained a stronger price trend over the short, medium, and long terms, with a solid growth ranking. Additional performance details, as per Benzinga’s Edge Stock Rankings, are available here.

Archer Aviation

- Archer Aviation Inc. (NYSE:ACHR) dropped 8.33% after reporting a third-quarter loss of 20 cents per share. It also signed definitive agreements to acquire Hawthorne Airport in Los Angeles for $126 million in cash.

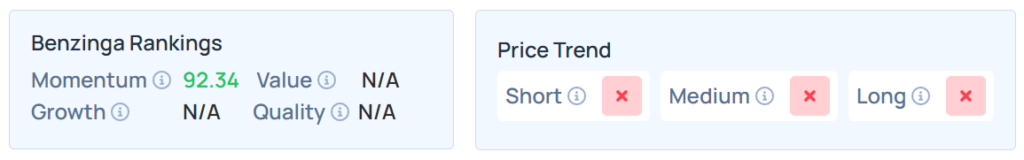

- It maintained a weaker price trend over the long, short, and medium terms. Additional performance details, as per Benzinga's Edge Stock Rankings, are available here.

Take-Two Interactive Software

- Take-Two Interactive Software Inc. (NASDAQ:TTWO) tumbled 6.26% despite reporting better-than-expected second-quarter financial results for fiscal 2026, as the company said that the long-awaited release of “Grand Theft Auto VI” is still more than a year away.

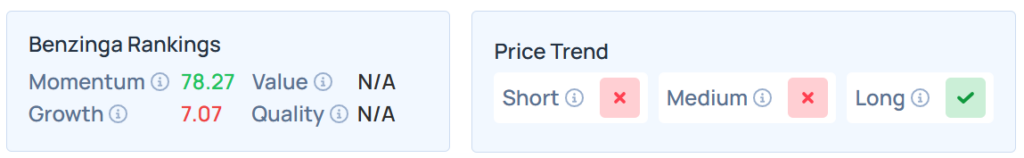

- TTWO maintains a weaker price trend over the short and medium terms but a strong trend in the long term, with a poor growth ranking. Additional information is available here.

Expedia Group

- Expedia Group Inc. (NASDAQ:EXPE) soared 15.23% after the online travel company posted stronger-than-expected third-quarter results and raised its full-year outlook.

- EXPE maintained a stronger price trend over short, medium, and long terms, with a poor value ranking. Additional performance details, as per Benzinga’s Edge Stock Rankings, are available here.

Cues From Last Session

Most sectors on the S&P 500 closed on a negative note, with communication services, consumer discretionary, and information technology stocks recording the biggest losses on Thursday.

However, energy and health care stocks bucked the overall market trend, closing the session higher.

| Index | Performance (+/-) | Value |

| Nasdaq Composite | -1.90% | 23,053.99 |

| S&P 500 | -1.12% | 6,720.32 |

| Dow Jones | -0.84% | 46,912.30 |

| Russell 2000 | -1.86% | 2,418.82 |

Insights From Analysts

According to a new note from LPL Financial, tech's biggest players are pouring “staggering” sums into the artificial intelligence race, even as the core business remains unprofitable.

Capital expenditures from five key hyperscalers, Amazon.com Inc. (NASDAQ:AMZN), Microsoft Corp. (NASDAQ:MSFT), Alphabet Inc.‘s (NASDAQ:GOOG) (NASDAQ:GOOGL) Google, Meta Platforms Inc. (NASDAQ:META), and Oracle Corp. (NYSE:ORCL) are projected to soar to $600.1 billion by 2027, up from $155.1 billion in 2023.

This 40% compound annual growth rate highlights a sector “fully convinced that this is a race worth winning.” Yet, LPL notes a critical disconnect: “the large language model business that is leveraging these new technologies is currently unprofitable.”

This has fueled concerns over “circular financing,” where chipmakers like Nvidia Corp. invest in their own unprofitable customers to sustain demand. “A more pessimistic take would be that this circular financing is being used to buttress the financial position of unprofitable business lines,” LPL stated.

Analysts are also flagging the use of Special Purpose Vehicles (SPVs) to manage risk, a structure LPL notes “is how Enron hid its fraud.” While enthusiasm shows signs of “waning,” LPL concedes the “momentum behind this theme is strong.”

See Also: How to Trade Futures

Upcoming Economic Data

Here's what investors will be keeping an eye on Friday;

- New York Fed President John Williams will speak at 3:00 a.m. and Fed Vice Chair Philip Jefferson will speak at 7:00 a.m. ET. October’s U.S. employment report, unemployment rate, and hourly wages data will be delayed.

- Dallas Fed President Lorie Logan will speak at 9:30 a.m. and Fed governor Stephen Miran at 3:00 p.m. ET.

- November’s preliminary consumer sentiment data will be out by 10:00 a.m., and September’s consumer credit data by 3:00 p.m. ET.

Commodities, Gold, Crypto, And Global Equity Markets

Crude oil futures were trading higher in the early New York session by 1.19% to hover around $60.14 per barrel.

Gold Spot US Dollar rose 0.86% to hover around $4,011.13 per ounce. Its last record high stood at $4,381.6 per ounce. The U.S. Dollar Index spot was 0.11% higher at the 99.8450 level.

Meanwhile, Bitcoin (CRYPTO: BTC) was trading 1.81% lower at $101,152.85per coin.

Asian markets closed lower on Friday, including India’s NIFTY 50, South Korea's Kospi, Japan's Nikkei 225, Australia's ASX 200, Hong Kong's Hang Seng, and China’s CSI 300 indices rose. European markets were also lower in early trade.

Read Next:

Image via Shutterstock