(Editor’s note: The future prices of benchmark tracking ETFs and the headline were updated in the story.)

U.S. stock futures advanced on Friday after a day of decline on Thursday. Futures of major benchmark indices were higher.

Amazon.com Inc. (NASDAQ:AMZN) and Apple Inc. (NASDAQ:AAPL) drove gains on Friday after their strong quarterly results.

This followed a decline in the Nasdaq Composite index, dipping more than 350 points on Thursday as it was weighed down by mixed earnings reports from Meta Platforms Inc. (NASDAQ:META) and Microsoft Corp. (NASDAQ:MSFT)

Meanwhile, the 10-year Treasury bond yielded 4.11% and the two-year bond was at 3.61%. The CME Group's FedWatch tool‘s projections show markets pricing a 66.8% likelihood of the Federal Reserve cutting the current interest rates during its December meeting.

| Futures | Change (+/-) |

| Dow Jones | 0.11% |

| S&P 500 | 0.69% |

| Nasdaq 100 | 1.21% |

| Russell 2000 | -0.03% |

The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, rose in premarket on Friday. The SPY was up 0.84% at $685.54, while the QQQ advanced 1.37% to $634.65, according to Benzinga Pro data.

Stocks In Focus

Amazon.com

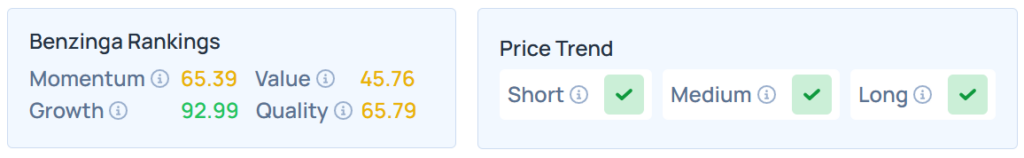

- Amazon.com Inc. (NASDAQ:AMZN) jumped 12.21% in premarket on Friday after reporting upbeat third-quarter results with net sales of $180.2 billion, up 13% year-over-year. It also said that it sees fourth-quarter net sales in a range of $206.0 billion to $213.0 billion, up 10% to 13% year-over-year, respectively.

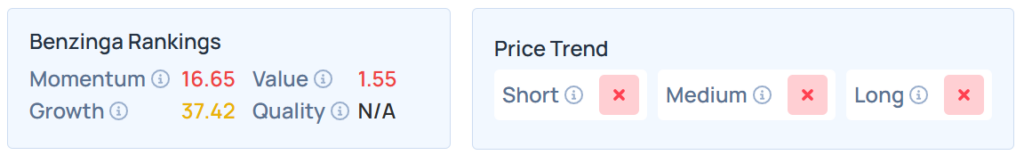

- Benzinga’s Edge Stock Rankings indicate that AMZN maintains a stronger price trend over the short, medium, and long terms, with a moderate value ranking. Additional performance details are available here.

Apple

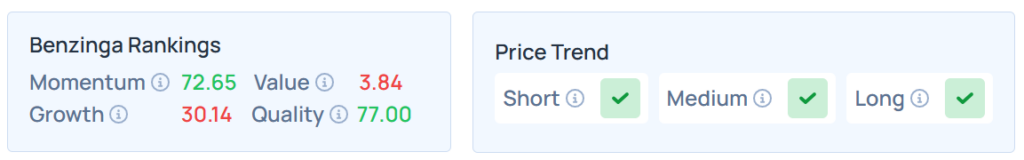

- Apple Inc. (NASDAQ:AAPL) rose 1.88% after reporting better-than-expected financial results with revenue of $102.47 billion, beating analyst estimates of $102.17 billion. It reported earnings of $1.85 per share, beating analyst estimates of $1.76 per share.

- AAPL maintained a stronger price trend over short, medium, and long terms, with a poor growth ranking. Additional performance details, as per Benzinga’s Edge Stock Rankings, are available here.

Netflix

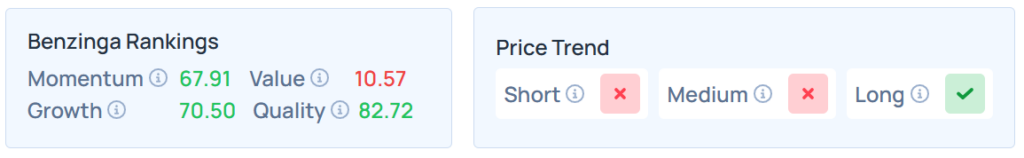

- Netflix Inc. (NASDAQ:NFLX) advanced 3.21% after announcing a 10-for-1 stock split.

- NFLX maintained a stronger price trend over the long term but a weak trend in the short and medium terms, as per Benzinga’s Edge Stock Rankings, with a robust quality ranking. Additional performance details are available here.

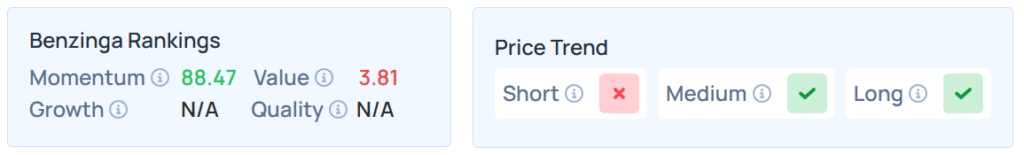

- Reddit Inc. (NYSE:RDDT) gained 12.39% as it reported third-quarter earnings of 80 cents per share, significantly beating the analyst estimate of 52 cents. Reddit also surpassed revenue expectations, reporting $585 million, which was higher than the consensus estimate of $545.71 million.

- RDDT maintains a weaker price trend over the short term but a strong trend in the long and medium terms, with a poor value ranking. Additional information is available here.

Strategy

- Strategy Inc. (NASDAQ:MSTR) soared 7.29% despite mixed third-quarter financials. However, it became the first Bitcoin-focused company to receive an S&P credit rating earlier in the week.

- MSTR maintained a weaker price trend over short, medium, and long terms, with a moderate growth ranking. Additional performance details, as per Benzinga’s Edge Stock Rankings, are available here.

Cues From Last Session

Most sectors on the S&P 500 closed on a negative note on Thursday, with consumer discretionary, communication services, and information technology stocks recording the biggest losses.

| Index | Performance (+/-) | Value |

| Nasdaq Composite | -1.57% | 23,581.14 |

| S&P 500 | -0.99% | 6,822.34 |

| Dow Jones | -0.23% | 47,522.12 |

| Russell 2000 | -0.76% | 2,465.95 |

Insights From Analysts

Scott Wren, Senior Global Market Strategist at Wells Fargo, advises investors to disregard short-term “noise” and headlines, suggesting any market impact will likely “dissolve quickly”. Instead, he urges a focus on long-term trends that will drive profits over the next 12 to 18 months or longer.

Wren notes that while the artificial intelligence (AI) secular theme has been a “major key” for the market, other trends also deserve attention. These include related tech trends like cybersecurity, factory automation, and robotics, as well as tax cuts and deregulation.

Wells Fargo Investment Institute, where Wren works, views pullbacks as “buying opportunities” and is targeting 7,400-7,600 for the S&P 500 by the end of 2026. To capitalize on these trends, they favor domestic large- and mid-capitalization equities.

They hold positive (favorable) ratings on the Technology, Financials, Industrials, and Utilities sectors. They expect Financials to benefit from deregulation, while Industrials and Utilities should profit from the data-center buildout and electrical grid upgrades.

See Also: How to Trade Futures

Upcoming Economic Data

Here's what investors will be keeping an eye on Friday;

- September’s personal income, consumer spending, headline, and core PCE Index data will all be delayed due to the shutdown. October’s Chicago Business Barometer (PMI) will be out by 9:45 a.m. ET.

- Dallas Fed President Lorie Logan will speak at 9:30 a.m., and Cleveland Fed President Beth Hammack and Atlanta Fed President Raphael Bostic will speak at 12:00 p.m. ET.

Commodities, Gold, Crypto, And Global Equity Markets

Crude oil futures were trading lower in the early New York session by 0.59% to hover around $60.21 per barrel.

Gold Spot US Dollar fell 0.12% to hover around $4,019.86 per ounce. Its last record high stood at $4,381.6 per ounce. The U.S. Dollar Index spot was 0.03% higher at the 99.5580 level.

Meanwhile, Bitcoin (CRYPTO: BTC) was trading 0.72% lower at $109,961.94 per coin.

Asian markets closed lower on Friday, except South Korea's Kospi and Japan's Nikkei 225 indices. Australia's ASX 200, Hong Kong's Hang Seng, India’s NIFTY 50, and China’s CSI 300 indices fell. European markets were mostly lower in early trade.

Read Next:

Photo courtesy: Shutterstock