(Editor’s note: The future prices of benchmark tracking ETFs and the headline were updated in the story.)

U.S. stock futures declined on Tuesday after Monday’s mixed moves. Futures of major benchmark indices were lower.

The declines come as chatter around an AI bubble gained more ground, with Michael Burry, known for his "Big Short" bet against the 2008 housing market, buying put options worth over $1 billion on Nvidia Corp. (NASDAQ:NVDA) and Palantir Technologies Inc. (NASDAQ:PLTR).

Meanwhile, the U.S. Government shutdown stretched into its 34th day, with experts warning that the economic consequences are becoming more severe as the standoff continues.

The 10-year Treasury bond yielded 4.08% and the two-year bond was at 3.58%. The CME Group's FedWatch tool‘s projections show markets pricing a 70.1% likelihood of the Federal Reserve cutting the current interest rates during its December meeting.

| Futures | Change (+/-) |

| Dow Jones | -1.02% |

| S&P 500 | -1.33% |

| Nasdaq 100 | -1.67% |

| Russell 2000 | -1.81% |

The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, fell in premarket on Tuesday. The SPY was down 1.07% at $676.01, while the QQQ declined 1.36% to $623.50, according to Benzinga Pro data.

Stocks In Focus

Advanced Micro Devices

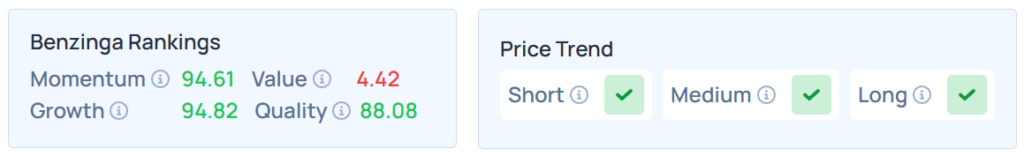

- Advanced Micro Devices Inc. (NASDAQ:AMD) fell 2.22% in premarket on Tuesday ahead of its earnings scheduled to be released after the closing bell. Analysts expect it to report earnings of $1.16 per share on revenue of $8.74 billion.

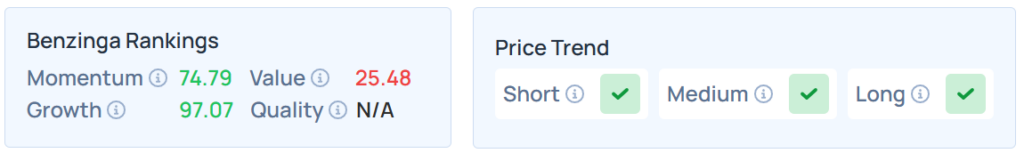

- Benzinga’s Edge Stock Rankings indicate that AMD maintains a stronger price trend over the short, medium, and long terms, with a poor value ranking. Additional performance details are available here.

Upwork

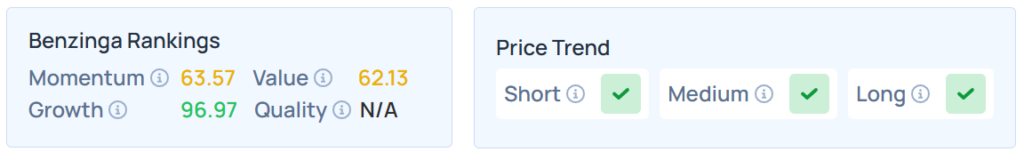

- Upwork Inc. (NASDAQ:UPWK) jumped 18.30% after reporting better-than-expected third-quarter financial results and issuing fourth-quarter guidance above estimates. Also, the company raised its FY25 guidance above estimates.

- UPWK maintained a stronger price trend over the short, medium, and long terms, with a solid growth ranking. Additional performance details, as per Benzinga’s Edge Stock Rankings, are available here.

Denny's Corporation

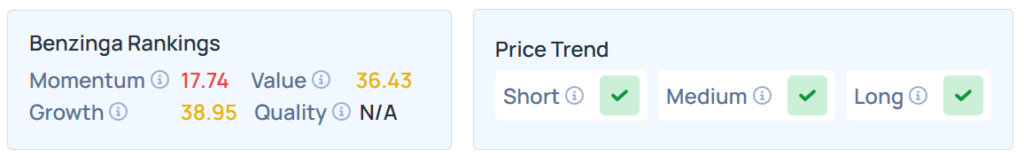

- Denny's Corp. (NASDAQ:DENN) surged 49.15% after the company announced late Monday it had entered a definitive agreement to be acquired and taken private for approximately $620 million.

- It maintained a stronger price trend over the long, short, and medium terms, with a moderate growth ranking. Additional performance details, as per Benzinga's Edge Stock Rankings, are available here.

Palantir Technologies

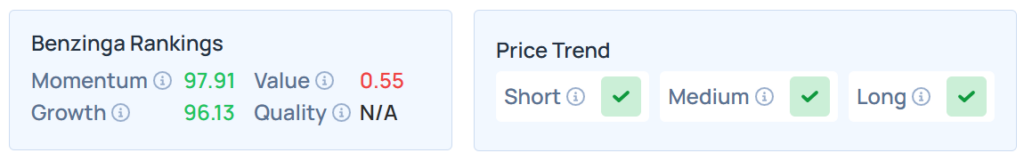

- Palantir Technologies Inc. (NASDAQ:PLTR) tumbled 7.51% despite strong earnings as Burry’s Scion Asset Management purchased $186.58 million worth of put options.

- PLTR maintains a strong price trend over the short, medium and long term, with a poor value ranking. Additional information is available here.

Uber Technologies

- Uber Technologies Inc. (NYSE:UBER) dropped 2.47% after it reported revenue of $11.2 billion, missing the $13.27 billion estimate, and its gross bookings grew 16% year-over-year to $41 billion, missing the management outlook between $48.25 billion and $49.25 billion.

- UBER maintained a stronger price trend over short, medium, and long terms, with a strong growth ranking. Additional performance details, as per Benzinga’s Edge Stock Rankings, are available here.

Cues From Last Session

Sectors gaining on Monday included consumer discretionary and information technology stocks.

| Index | Performance (+/-) | Value |

| Nasdaq Composite | 0.46% | 23,834.72 |

| S&P 500 | 0.17% | 6,851.97 |

| Dow Jones | -0.48% | 47,336.68 |

| Russell 2000 | -0.33% | 2,471.24 |

Insights From Analysts

According to the LPL Financial commentary, the outlook for the economy and stock market is mixed, as “monetary policy is less predictable, trade risks are easing, and earnings are surprising to the upside”.

The Federal Reserve delivered an expected 0.25% rate cut and ended its quantitative tightening (QT) program. However, Fed Chair Powell's subsequent warning that a December rate cut is “not a foregone conclusion, far from it” caught markets off guard and reduced visibility.

While a new U.S.-China trade truce provides a tailwind for corporate earnings and third-quarter results have been strong, the stock market rally is showing “structural cracks”.

Gains have been highly concentrated in a few mega-cap stocks, and investors are beginning to demand a “show me story” for the massive return on AI investments.

This narrow leadership has created a “growing divergence between price and breadth,” which introduces the “risk of a potential false breakout”. Given these conflicting signals, LPL's allocation committee maintains a “tactical neutral stance on equities,” suggesting a “selective and tactical approach may be warranted” heading into year-end.

See Also: How to Trade Futures

Upcoming Economic Data

Here's what investors will be keeping an eye on Tuesday;

- Fed Vice Chair for Supervision Michelle Bowman will speak at 6:35 a.m. ET and September’s U.S. trade deficit, factory orders, and job openings data will be delayed because of the shutdown.

Commodities, Gold, Crypto, And Global Equity Markets

Crude oil futures were trading lower in the early New York session by 1.64% to hover around $60.05 per barrel.

Gold Spot US Dollar fell 0.35% to hover around $3,997.17 per ounce. Its last record high stood at $4,381.6 per ounce. The U.S. Dollar Index spot was 0.12% higher at the 99.9940 level.

Meanwhile, Bitcoin (CRYPTO: BTC) was trading 3.26% lower at $103,715.47 per coin.

Asian markets closed lower on Tuesday, including South Korea's Kospi, Japan's Nikkei 225, Australia's ASX 200, Hong Kong's Hang Seng, India’s NIFTY 50, and China’s CSI 300 indices. European markets were also lower in early trade.

Read Next:

Photo courtesy: godongphoto / Shutterstock.com