The Nasdaq composite was under heavy selling pressure in the stock market today, weighed down by weakness in some semiconductor stocks like Nvidia and Advanced Micro Devices. Futures were down sharply overnight — plunging more than 1% — as news broke that Israel retaliated against Iran with limited strikes.

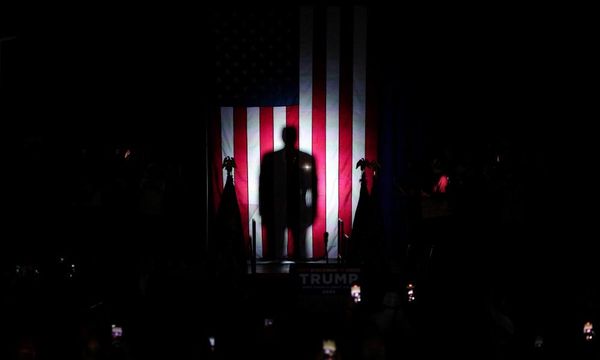

Meanwhile, Donald Trump stock Trump Media added another 12% early in the session but backed off highs. The company on Friday notified the Nasdaq about potential manipulation of the stock.

The Dow Jones Industrial Average added 0.5% as investors weighed earnings from blue chips like American Express and Procter & Gamble. American Express shares jumped 4% after earnings and revenue topped expectations. The stock is in a buy zone as it finds support at the 10-week moving average. Procter & Gamble slid 1% after revenue of $20.2 billion came in slightly below analyst views for $20.41 billion.

The S&P 500 was near session lows, down 0.5%. The benchmark index broke through the 5,000 level after a sharp break of its 50-day moving average earlier this week.

AmEx stock was a top gainer in the S&P 500, along with other financials like Bank of America and Wells Fargo. Bank of America is also in a buy zone after reclaiming its 10-week line.

Small Caps Outperform The Market

While the tech-heavy Nasdaq composite was down around 1.4%, small caps held up relatively well, with the Russell 2000 down 0.2%. The Russell 2000's performance was impressive in light of a 15% drop for index component Super Micro Computer. SMCI flashed a sell signal with a sharp break of its 50-day line.

The stock market uptrend is under pressure, hurt by a multitude of factors. The Nasdaq composite and S&P 500 still have a distribution-day count. Further, breadth has been weakening more on the Nasdaq exchange and the New York Stock Exchange, and there's been upward pressure on interest rates.

Despite stiff selling in the Nasdaq, winners had a slight edge over losers. Breadth was better on the NYSE at more than 2-to-1 positive.

The 10-year Treasury yield was down 4 basis points to around 4.61%. West Texas Intermediate crude oil futures were flat around $82.75 a barrel.

Stock Market Today: Netflix Falls, Shopify Gains

Netflix cratered 8% after the company reported another strong quarter, but its revenue outlook proved disappointing. Revenue growth accelerated for the third straight quarter, up 15% to $9.4 billion. Netflix added 9.33 million subscribers in the first quarter, well ahead of analyst estimates for 5.48 million.

Shopify faded after an early pop, helped by a Morgan Stanley upgrade to overweight. Shopify still offers a compelling growth story, but sellers have knocked the stock more than 20% off its high. Analysts expect full-year earnings to jump 38% this year and another 36% in 2025.

See Which Stocks Are In The Leaderboard Model Portfolio

Bitcoin added 1.5% on the stock market today to near $64,500. Crypto exchange operator Coinbase popped 3% early but faded off highs as it battles for support near the 50-day moving average.

Nvidia surrendered early gains and plunged nearly 3% in recent trades. The hard-charging leader in artificial intelligence chips has given up its flat base, but could form a new cup base with the stock nearly 4% below its 10-week line.

Meanwhile, Advanced Micro dropped another 2% and is down 7% for the week. The chipmaker has been in the red for five of the last six weeks. Nvidia and AMD are tracked in the fabless chip group, which was one of the day's worst performers, down more than 2%.

Stocks On The Move

Elsewhere, Intuitive Surgical soared early but reversed lower and got turned away at its 50-day line after reporting earnings.

Inside the MarketSurge Growth 250, Oscar Health continued work on the right side of a cup base amid signs of accumulation. The little-known name in the health care sector is growing significantly. Over the past four quarters, revenue growth has ranged from 44% to 51%.

In the insurance sector, Allstate rallied for the second straight session in heavy volume. It's still in a buy zone from a 168.05 entry.

The coming week will be an important one for the stock market with Magnificent Seven stocks like Tesla, Microsoft, Meta Platforms and Google-parent Alphabet set to report.

Tesla stock remains on a sharp downtrend that started in late December amid slowing growth. Microsoft has also come under selling pressure, but Meta and Google are still showing relative strength, holding near highs.

Follow Ken Shreve on X @IBD_KShreve for more stock market analysis and insight.