U.S. stock futures rose on Wednesday after Tuesday’s mixed close. Futures of major benchmark indices were higher.

Investors are awaiting a House vote on the temporary spending bill expected to end the record-long government shutdown.

Meanwhile, the 10-year Treasury bond yielded 4.08% and the two-year bond was at 3.56%. The CME Group's FedWatch tool‘s projections show markets pricing a 63.4% likelihood of the Federal Reserve cutting the current interest rates during its December meeting.

| Futures | Change (+/-) |

| Dow Jones | 0.17% |

| S&P 500 | 0.40% |

| Nasdaq 100 | 0.71% |

| Russell 2000 | 0.19% |

The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, were higher in premarket on Wednesday. The SPY was up 0.37% at $685.55, while the QQQ advanced 0.68% to $625.79, according to Benzinga Pro data.

Stocks In Focus

Cisco Systems

- Cisco Systems Inc. (NASDAQ:CSCO) was up 0.49% in premarket on Wednesday as analysts expect it to report quarterly earnings at 98 cents per share on revenue of $14.77 billion, after the closing bell.

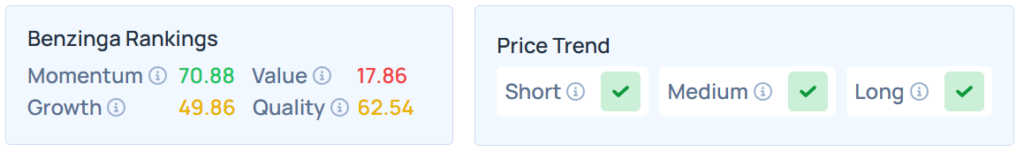

- Benzinga’s Edge Stock Rankings indicate that CSCO maintains a stronger price trend over the short, medium, and long terms, with a poor value ranking. Additional performance details are available here.

Advanced Micro Devices

- Advanced Micro Devices Inc. (NASDAQ:AMD) jumped 5.13% in pre-market after its analyst day on Tuesday, during which the company made bold projections regarding its near-term future and that of the broader AI chip and data center industry.

- AMD maintained a stronger price trend over the short, medium, and long terms, with a solid quality ranking. Additional performance details, as per Benzinga’s Edge Stock Rankings, are available here.

BILL Holdings

- BILL Holdings Inc. (NYSE:BILL) surged 13.12% after a Bloomberg report revealed that the provider of a financial operations platform for small and medium businesses (SMB) is eyeing a potential sale.

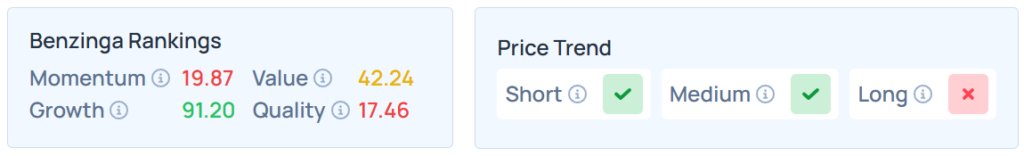

- It maintained a weaker price trend in the long term but a strong trend over the short and medium terms with a strong growth ranking. Additional performance details, as per Benzinga's Edge Stock Rankings, are available here.

TotalEnergies

- TotalEnergies SE (NYSE:TTE) rose 0.72% after inking an agreement with Alphabet Inc.‘s (NASDAQ:GOOG) (NASDAQ:GOOGL) to supply 1.5 terawatt hours of renewable electricity from its solar farm in Ohio for 15 years.

- TTE maintains a stronger price trend over the short, medium, and long terms, with a strong value ranking. Additional information is available here.

Alcon AG

- Alcon AG (NYSE:ALC) gained 5.42% after reporting upbeat third-quarter financial results. The company said it sees FY25 earnings of $3.05 to $3.15 per share on sales of $10.3 billion to $10.4 billion.

- ALC maintained a weaker price trend over the long term but strong trends over the short and medium terms, with a poor quality ranking. Additional performance details, as per Benzinga’s Edge Stock Rankings, are available here.

Cues From Last Session

Sectors that gained on Tuesday included health care, energy, and consumer staples, which recorded the biggest advances as most segments of the S&P 500 closed positively.

Information technology stocks, however, bucked the overall market trend, closing the session lower.

| Index | Performance (+/-) | Value |

| Nasdaq Composite | -0.25% | 23,468.30 |

| S&P 500 | 0.21% | 6,846.61 |

| Dow Jones | 1.18% | 47,927.96 |

| Russell 2000 | 0.11% | 2,458.28 |

Insights From Analysts

LPL Financial has identified AI infrastructure as a new “pillar of economic growth,” highlighting that AI-related business investment is rapidly becoming a “cornerstone” of U.S. economic expansion.

This investment in software, data centers, and equipment, led by hyperscalers like Microsoft Corp. (NASDAQ:MSFT) and Amazon.com Inc. (NASDAQ:AMZN), contributed to the majority of economic growth in the first half of 2025.

LPL believes there is “room for more expansion in AI-related capital spending,” a view supported by strong loan demand from large firms for capital investments.

Regarding the stock market, LPL’s Strategic and Tactical Asset Allocation Committee (STAAC) “maintains its tactical neutral stance on equities”.

While fundamentals are seen as “broadly supportive,” the committee warns that investors should brace for “occasional bouts of volatility” given the high optimism reflected in current valuations.

LPL remains wary of the “concentration risk” in a market heavily reliant on a few tech giants. Tactically, the STAAC favors growth over value, large caps over small caps, and the communication services and financials sectors.

Economically, LPL also notes a weakening job market could potentially lead the FOMC to cut rates in December.

See Also: How to Trade Futures

Upcoming Economic Data

Here's what investors will be keeping an eye on Wednesday;

- New York Fed President John Williams will speak at 9:20 a.m., Philadelphia Fed President Anna Paulson will speak at 10:00 a.m., Fed Governor Chris Waller will speak at 10:20 a.m., Atlanta Fed President Raphael Bostic will speak at 12:15 p.m., Fed Governor Stephen Miran will speak at 12:30 p.m., and Boston Fed President Susan Collins will speak at 4:00 p.m. ET.

Commodities, Gold, Crypto, And Global Equity Markets

Crude oil futures were trading lower in the early New York session by 0.93% to hover around $60.46 per barrel.

Gold Spot US Dollar fell 0.07% to hover around $4,123.95 per ounce. Its last record high stood at $4,381.6 per ounce. The U.S. Dollar Index spot was 0.15% higher at the 99.5910 level.

Meanwhile, Bitcoin (CRYPTO: BTC) was trading 0.39% lower at $104,504.92 per coin.

Asian markets closed higher on Wednesday, except Australia's ASX 200 and China’s CSI 300 indices. India’s NIFTY 50, South Korea's Kospi, Hong Kong's Hang Seng, and Japan's Nikkei 225 indices rose. European markets were mostly higher in early trade.

Read Next:

Photo courtesy: Shutterstock