U.S. stock futures declined on Friday after Thursday’s sharp sell-off. Futures of major benchmark indices were lower.

This came despite the government reopening, as the Donald Trump administration stated that two of the most vital inputs for the Federal Reserve wouldn’t be released.

White House Press Secretary Karoline Leavitt said, “All of that economic data released will be permanently impaired, leaving our policymakers at the Federal Reserve flying blind at a critical period."

Meanwhile, despite November being the best-performing month for the Nasdaq 100, the index was down 3.34% month-to-date. Since 1985, the index has averaged gains of 2.64%, closing higher 70% of the time.

The 10-year Treasury bond yielded 4.13% and the two-year bond was at 3.58%. The CME Group's FedWatch tool‘s projections show markets pricing a 49.6% likelihood of the Federal Reserve cutting the current interest rates during its December meeting.

| Futures | Change (+/-) |

| Dow Jones | -0.18% |

| S&P 500 | -0.32% |

| Nasdaq 100 | -0.60% |

| Russell 2000 | -0.240% |

The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, were lower in premarket on Friday. The SPY was down 0.24% at $670.42, while the QQQ declined 0.50% to $605.34, according to Benzinga Pro data.

Stocks In Focus

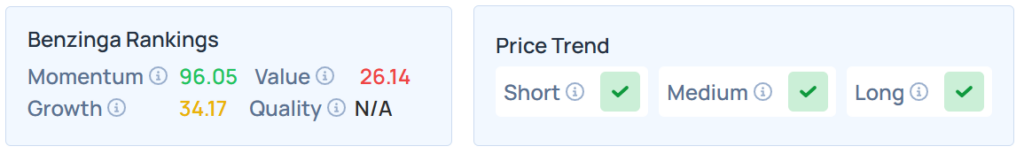

Warner Bros Discovery

- Warner Bros Discovery Inc. (NASDAQ:WBD) rose 3.34% as Comcast Corp. (NASDAQ:CMCSA), Netflix Inc. (NASDAQ:NFLX), and Paramount prepare bids for Warner Bros. Discovery acquisition.

- Benzinga’s Edge Stock Rankings indicate that WBD maintains a stronger price trend over the short, medium, and long terms, with a poor value ranking. Additional performance details are available here.

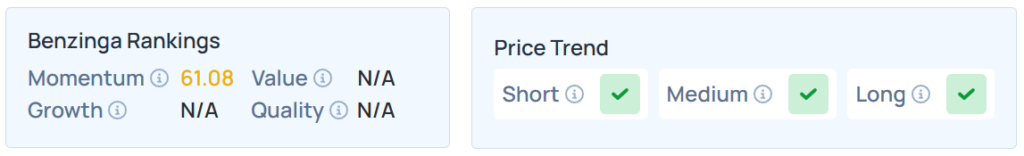

Nu Holdings

- Nu Holdings Ltd. (NYSE:NU) gained 2.98% after reporting better-than-expected earnings and adding 4.3 million new customers during the third quarter across Brazil, Mexico, and Colombia.

- NU maintained a stronger price trend over the short, medium, and long terms. Additional performance details, as per Benzinga’s Edge Stock Rankings, are available here.

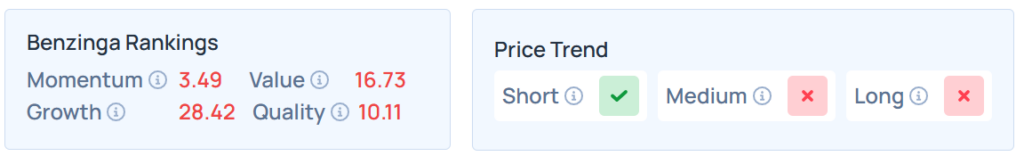

Globant

- Globant SA (NYSE:GLOB) fell 3.31% after reporting downbeat earnings for the third quarter. Its earnings of $1.53 per share missed the analyst consensus estimate of $1.54 per share, but sales of $617.143 million beat the estimate of $615.376 million.

- GLOB maintains a weaker price trend over the long and medium terms, but a strong trend in the long term, with a poor quality ranking. Additional information is available here.

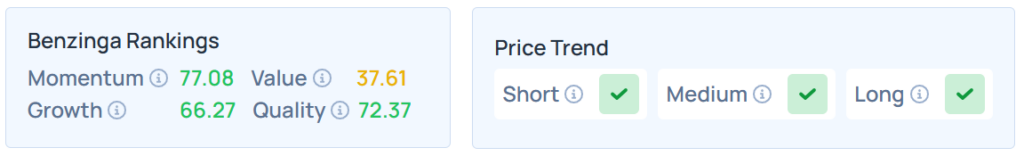

Applied Materials

- Applied Materials Inc. (NASDAQ:AMAT) declined 4.82% despite better-than-expected fourth-quarter financial results for fiscal 2025, as its China revenue tumbled as part of its total sales.

- It maintained a strong price trend over the short, medium, and long terms, with a moderate growth ranking. Additional performance details, as per Benzinga's Edge Stock Rankings, are available here.

Fluent

- Fluent Inc. (NASDAQ:FLNT) dropped 6.93% after it reported worse-than-expected third-quarter financial results.

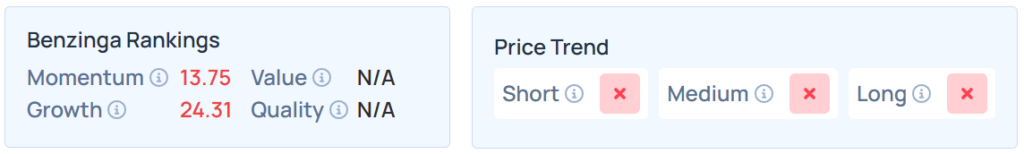

- FLNT maintained a weaker price trend over the short, medium, and long terms, with a poor growth ranking. Additional performance details, as per Benzinga’s Edge Stock Rankings, are available here.

Cues From Last Session

Sectors recording the biggest losses on Thursday included consumer discretionary, information technology, and communication services, as most S&P 500 segments closed negative. Energy stocks, however, bucked the overall market trend to close higher.

| Index | Performance (+/-) | Value |

| Nasdaq Composite | -2.29% | 22,870.36 |

| S&P 500 | -1.66% | 6,737.49 |

| Dow Jones | -1.65% | 47,457.22 |

| Russell 2000 | -2.77% | 2,382.98 |

Insights From Analysts

Scott Wren, Senior Global Market Strategist at Wells Fargo, describes the current environment as a “K-shaped economy,” which illustrates the “bifurcated consumer landscape”.

He notes that while high-income consumers have benefited from rising assets, low-income households are “being squeezed by high prices, softening wage growth, and weak job growth”.

Looking forward, Wren is optimistic, stating, “We think there may be a reversal as the trends converge for a better economy in 2026”.

He sees tailwinds from potential “tax cuts, deregulation, and lower interest rates” and growth in small business hiring, which should “help improve the bottom leg of the ‘K'”.

For the stock market, Wren believes these same trends will drive efficiencies that “increase profit margins, earnings, and equity prices in 2026”.

He specifically points to “investment opportunities… in technology-related trends, such as artificial intelligence (AI) data centers”.

Consequently, he advises investors to “retain exposure to the AI theme” and rates the Financials sector as “most favorable,” alongside favorable ratings for Industrials and Utilities.

See Also: How to Trade Futures

Upcoming Economic Data

Here's what investors will be keeping an eye on Friday;

- U.S. retail sales and PPI data will be delayed despite the government reopening. Kansas City Fed President Jeff Schmid will speak at 10:05 a.m., and Dallas Fed President Lorie Logan will speak at 2:30 p.m. ET.

Commodities, Gold, Crypto, And Global Equity Markets

Crude oil futures were trading higher in the early New York session by 1.98% to hover around $59.85 per barrel.

Gold Spot US Dollar fell 0.08% to hover around $4,168.32 per ounce. Its last record high stood at $4,381.6 per ounce. The U.S. Dollar Index spot was 0.10% higher at the 99.2530 level.

Meanwhile, Bitcoin (CRYPTO: BTC) was trading 5.81% lower at $97,076.89 per coin.

Asian markets closed lower on Friday, including Australia's ASX 200, China’s CSI 300, India’s NIFTY 50, South Korea's Kospi, Hong Kong's Hang Seng, and Japan's Nikkei 225 indices. European markets were also lower in early trade.

Read Next:

Image via Shutterstock