SanDisk Corporation (NASDAQ:SNDK) is on the brink of a significant milestone, with its rapid growth potentially propelling it into the S&P 500 index, a market analyst said. This could potentially hinder the inclusion of Strategy (NASDAQ:MSTR) in the benchmark index.

SanDisk's Surge Reshapes Index Picks

SanDisk’s remarkable growth in 2025 has made it an ‘elephant’ in the S&P’s small-cap index, potentially leading to its promotion to the S&P 500, Melissa Roberts, an analyst at Stephens, Inc., told MarketWatch. SanDisk’s current market capitalization stands at about $40 billion, significantly surpassing its peers in the small-cap index.

Roberts has highlighted that this could pose a challenge for Strategy’s inclusion in the S&P 500. Strategy, formerly known as MicroStrategy, is also newly eligible for S&P 500 inclusion this quarter. However, SanDisk’s substantial impact on the small-cap index could prioritize its inclusion over Strategy’s.

Roberts pointed out that the S&P Dow Jones Indices allow for quarterly index rebalancing, with the next round of updates scheduled for Dec. 5. SanDisk's 585% rally over the past six months, fueled by a strong memory market and sharp price increases, now makes it eligible for addition to the S&P 500.

However, SanDisk's share price has become highly volatile amid the AI-driven surge in memory and storage stocks, prompting Roberts to say the index committee may "wait and see" whether its market value and recent gains hold before considering inclusion.

Chip Shock Lifts SanDisk; Bitcoin Hits Strategy

SanDisk’s stock surge has been attributed to a supply shock in the memory chip industry, triggered by Samsung’s (OTC:SSNLF) aggressive price hikes. This supply shock has created a bullish environment for SanDisk and its competitor Micron Technology Inc. (NASDAQ:MU).

SanDisk’s stock also received a boost following its upbeat Q1 results and improved guidance, which revealed sales of $2.31 billion and net income of $112 million. The company’s continued robust demand in data center and consumer markets indicated a shift in growth priorities post-separation from Western Digital.

Meanwhile, Strategy’s stock has been affected by a decline in Bitcoin, with crypto-linked stocks dropping as traders debate whether Bitcoin’s typical four-year halving cycle is weakening or completely coming undone.

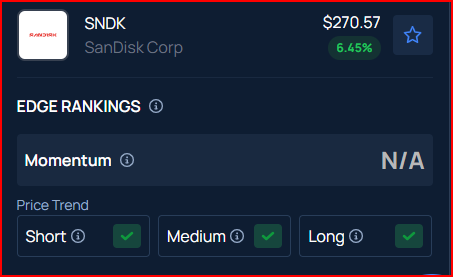

Benzinga Edge Stock Rankings shows that Sandisk had a strong price trend over the short, medium, and long term. Check the detailed report here.

Price Action: On Monday, Sandisk stock climbed 4.61% to close at $265.88, as per Benzinga Pro.

READ NEXT:

Image via Shutterstock

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.