Investment firm Gerber Kawasaki's co-founder Ross Gerber says that Tesla Inc. (NASDAQ:TSLA) CEO Elon Musk's trillion-dollar pay package would dilute the company's share value.

Check out the current price of TSLA here.

$275 Million Per Day Dilution, Says Ross Gerber

Taking to the social media platform X on Tuesday, Gerber said that the stock dilution would be "the equivalent of $275,000,000 a day if/when the pay package passes."

Dilution Concerns

Gerber's concerns about dilution are also shared by Norway's sovereign wealth fund Norges Bank Investment Management (NBIM), which holds a 1.12% stake in the automaker worth $17 billion.

The fund has said it will vote against the pay package. "We are concerned about the total size of the award, dilution, and lack of mitigation of key person risk," the fund said. Proxy advisory firm Glass Lewis also said that there was a risk of "significant dilution" with the pay package.

Gerber Kawasaki, NBIM and Glass Lewis did not immediately respond to Benzinga's request for comment.

Interestingly, the conditions mentioned in the award outline that Musk would only receive the tranches if the milestones mentioned in the package are met. However, Musk could still pocket billions of dollars from the pay package by hitting some of the ‘easier’ milestones, even if Tesla does not reach every single goal outlined by the Board.

Package Receives Criticism

It's worth noting that Musk had called proxy advisory firms Glass Lewis and International Shareholder Services (ISS) "corporate terrorists" at the automaker's third-quarter earnings call. ISS had advised shareholders to vote against Musk's pay package last month.

The package has also been receiving criticism from the California Public Employees Retirement System (CalPERS), which will reportedly vote against the pay package. CalPERS holds over $2.3 billion in Tesla shares. Gerber, meanwhile, had earlier criticized the package, calling it "insanity."

Pay Package Receives Support From Florida Fund, Charles Schwab

However, the pay package has also received support from the funds like the Florida Retirement System's (FRS) State Board of Administration (SBA), an agency responsible for investing on behalf of the FRS trust fund, which has backed the package.

Charles Schwab, an investment firm, also said that it was supporting the pay package. "Schwab Asset Management intends to vote in favor of the 2025 CEO performance award proposal," the firm said in a statement to Benzinga after receiving criticism from the Tesla faithful.

The pay package has also received support from industry experts like ARK Invest CEO Cathie Wood, who predicted that the package would win “decisively” at the shareholder meeting.

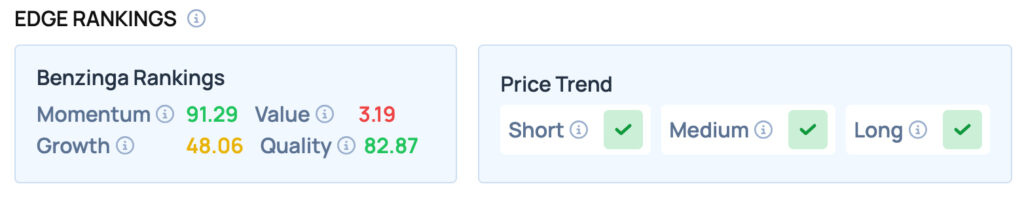

Tesla scores well on Momentum and Quality metrics, while offering satisfactory Growth, but poor Value. Tesla also has a favorable price trend in the Short, Medium and Long term. For more such insights, sign up for Benzinga Edge Stock Rankings today!

Check out more of Benzinga's Future Of Mobility coverage by following this link.

Read Next:

Photo courtesy: Shutterstock