Stocks surged ahead of the Thanksgiving holiday, with the tech-heavy Nasdaq leading the charge, gaining 0.82% to 23,214.69. The S&P 500 gained 0.69% to 6,812.61, while the Dow Jones Industrial Average gained 0.67% to 47,427.12.

Investors are optimistic as the market enters a typically strong period for corporate sales. Fresh labor-market data, showing a drop in initial jobless claims, further boosted sentiment.

These are the top stocks that gained the attention of retail traders and investors through the day:

Robinhood Markets Inc. (NASDAQ:HOOD)

Robinhood’s stock surged 10.93%, closing at $128.20. The stock reached an intraday high of $128.90 and a low of $120.86, with a 52-week high of $153.86 and a low of $29.66.

Robinhood announced it will launch a futures and derivatives exchange and clearinghouse through a joint venture where it will serve as the controlling partner. Susquehanna International Group was named as the initial liquidity provider, with more firms expected to join. Analysts said the venture could help Robinhood scale prediction markets by allowing it to design its own contracts and improve liquidity, supported by MIAXdx's existing licenses and products.

Beyond Meat Inc. (NASDAQ:BYND)

Beyond Meat’s stock rose 19.01%, closing at $1.02. It hit an intraday high of $1.05 and a low of $0.86, with a 52-week high of $7.69 and a low of $0.50.

The meat-alternative company saw shares rebound despite no new company developments, with the move appearing tied to broader pre-Thanksgiving market optimism. The company recently reported third-quarter revenue of $70.2 million, down 13.3% year-over-year, and issued a weak fourth-quarter outlook of $60–65 million, which had contributed to prior heavy selling.

Tilray Brands Inc. (NASDAQ:TLRY)

Tilray’s stock increased by 4.76%, closing at $1.03. The stock’s intraday high was $1.06, and the low was $0.99, with a 52-week high of $2.32 and a low of $0.35.

Tilray announced a 1-for-10 reverse stock split set to take effect Dec. 1, with shares trading split-adjusted on Dec. 2. The move aims to cut about $1 million in annual costs and make the stock more appealing to institutional investors.

ASML Holdings NV (NASDAQ:ASML)

ASML’s stock climbed 3.76%, closing at $1040.97. The stock reached an intraday high of $1055 and a low of $1037.30, with a 52-week high of $1086.11 and a low of $578.51.

The photolithography giant continued to benefit from strong AI-driven demand and its monopoly in EUV tools. Goldman Sachs projected long-term revenue could more than double, while ASML expanded in South Korea and reiterated China will account for over 25% of 2025 sales. The stock is up sharply this year.

SMX (Security Matters) PLC (NASDAQ:SMX)

SMX’s stock skyrocketed 194.42%, closing at $17.40. The stock reached an intraday high of $17.40 and a low of $5.91, with a 52-week high of $66187.39 and a low of $3.12. In the after-hours trading the stock shot up another 49.3% to $25.98.

The Dubai Multi Commodities Centre is pushing a shift toward built-in gold verification by spotlighting SMX's molecular tagging technology, which embeds identity markers directly into metal and remains intact through melting and transport, according to a press statement.

The system aims to replace vulnerable paper-based tracking and improve auditability across major gold routes. Interest from operators like Brink's indicates growing industry momentum toward stronger traceability and chain-of-custody standards.

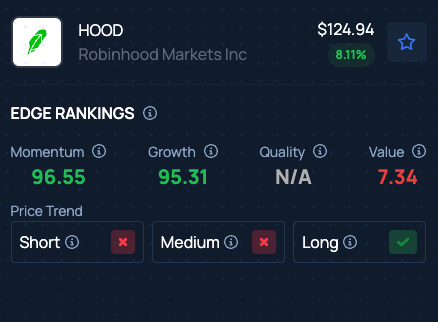

Benzinga Edge Stock Rankings indicate Robinhood Stock has Momentum in the 96th percentile. Here is how it ranks on other metrics.

Prepare for the day’s trading with top premarket movers and news by Benzinga.

Read Next:

Photo: Golden Dayz / Shutterstock

This story was generated using Benzinga Neuro and edited by Shivdeep Dhaliwal