President Donald Trump’s 50-year mortgage plan, aimed at tackling America’s housing affordability crisis, received the backing of real estate iBuying platform Opendoor Technologies Inc.’s (NASDAQ:OPEN) CEO, Kaz Nejatian, who described the move as being bullish for the sector.

Plan Will Allow Buyers To ‘Get Their Foot In The Door’

Nejatian said, “I'm super bullish on the 50-year mortgage,” while speaking to Fox Business’ “Making Money” on Tuesday, adding that the move addresses one of the biggest hurdles facing potential homeowners, that is, the burden of student loans.

“It has become difficult for the average person to buy a home,” Nejatian said, while placing the blame on the high burden of student loans on young adults. “This will allow people to get their foot in the door.”

See Also: Buy Now Pay Later Can Torpedo Mortgage Chances

“We have far too few homes and they're out of reach for the average person,” Nejatian said, while criticizing traditional mortgages for failing to meet the needs of everyday Americans. “Much of the credit rating world and the existing financial services are not serving us well.”

Nejatian praised the administration's willingness to experiment with new tools to improve access to housing. “If you believe that America is better when people own their homes, it is incredibly important to try a lot of different things to get people into homes,” he said. “I'm generally excited to see the government trying to help.”

Experts Criticize Trump’s Mortgage Move

Other prominent experts aren’t that impressed with the administration’s idea, with Betsey Stevenson, a former member of the Council of Economic Advisers under President Barack Obama, warning about the high costs involved.

“People will be contributing very little to equity in their home for years because payments will be covering all that interest,” she said in a post on X, clearly highlighting the long-term impact this is set to have on homebuyers and their finances over the course of five decades.

Realtor and founder of Aspire Commercial, Brandon Avedikian, notes that buyers would be better off just renting instead of going for a 50-year mortgage to finance their homes, while having to deal with the major repairs that come their way.

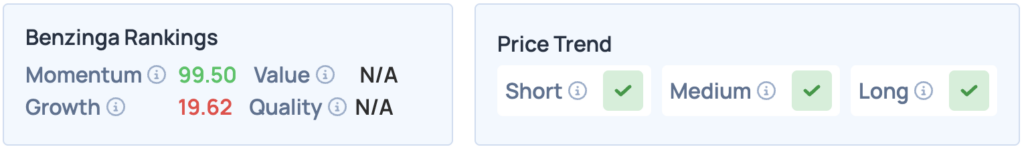

Shares of Opendoor Technologies were up 6.40% on Tuesday, closing at $8.48, and they are down 0.47% Overnight. The stock scores high on Momentum in Benzinga’s Edge Stock Rankings, with a favorable price trend in the short, medium and long terms. Click here for deeper insights into the stock, its peers and competitors.

Read More:

Photo Courtesy: PJ McDonnell from Shutterstock