Famed “Big Short,” investor Michael Burry, known for his prescient bet against the housing market, has publicly questioned Nvidia Corp.‘s (NASDAQ:NVDA) capital allocation strategy, asserting that the tech giant’s $112.5 billion spent on stock buybacks since 2018 has effectively yielded “zero” additional shareholder value.

Check out NVDA's stock price here.

Nvidia's Massive Buybacks Added Zero Shareholder Value

In an X post, Burry dissected Nvidia’s financial data, highlighting a disconnect between aggressive share repurchases and the company’s rising share count. Burry’s analysis points to Nvidia’s $20.5 billion in Stock-Based Compensation (SBC) since 2018.

While the company reported a robust $205 billion in net income and $188 billion in free cash flow over the same period, Burry argues that the $112.5 billion dedicated to buybacks primarily served to offset stock-based compensation (SBC)-related dilution.

“But it bought back $112.5B worth of stock and there are 47 million MORE shares outstanding,” Burry tweeted, adding, “The true cost of that SBC dilution was $112.5B, reducing owner's earnings by 50%.”

He suggests that the company's expenditures on buybacks were merely a defensive maneuver against dilution rather than a genuine reduction in outstanding shares.

This, he contends, fundamentally distorts the “owner’s earnings” perspective, presenting a less favorable picture for long-term investors.

NVDA Delivers Blockbuster Q3 Earnings

This critique comes amidst Nvidia’s continued market dominance and soaring stock price, largely fueled by its pivotal role in the AI revolution. Nvidia’s recent third-quarter results demonstrated record revenue of $57 billion, up 62% year-over-year, with CEO Jensen Huang proclaiming, “AI is going everywhere.”

The company’s earnings call highlighted overwhelming demand for its Blackwell and Rubin GPUs, with projections of $500 billion in revenue from these architectures by the end of calendar year 2026.

Nvidia's CFO, Colette Kress, addressed capital allocation in the recent earnings call, emphasizing the need for a strong balance sheet to fund growth and secure supply chains.

CEO Huang also noted plans for continued stock buybacks and strategic ecosystem investments, such as those with OpenAI and Anthropic, to expand the reach of Nvidia’s CUDA platform.

Nvidia Outperforms Nasdaq In 2025

Nvidia shares have outpaced the broader market this year, climbing 34.86% year-to-date compared to returns of 17.03% for the Nasdaq Composite and 17.47% for the Nasdaq 100.

On Wednesday, the stock finished the regular session up 2.85% at $186.52 before surging another 5.08% in extended trading. Over the last year, the stock has gained 27.85%.

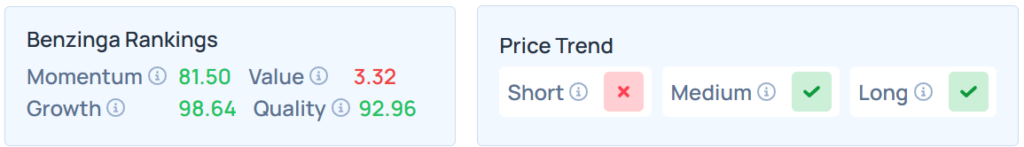

It maintained a stronger price trend over the medium and long terms and a weak trend in the short term, with a poor value ranking. Additional performance details, as per Benzinga Edge's Stock Rankings is available here.

The futures of the S&P 500, Nasdaq 100, and Dow Jones indices were trading higher on Thursday, after advancing on Wednesday.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo courtesy: Chung Hao Lee / Shutterstock