Hollywood is gearing up for its most consequential bidding war in years as first-round offers for Warner Bros. Discovery (NASDAQ:WBD) arrive on Thursday, drawing in some of the biggest names in entertainment.

With the studio’s valuation soaring and its assets suddenly back in vogue, it’s a striking turn for a company that has already cycled through three owners in seven years.

David Ellison Starts The Fire

The HBO studios owner put itself up for sale last month, and now reportedly faces three very different suitors: Paramount Skydance (NASDAQ:PSKY), Comcast (NASDAQ:CMCSA), and, most unexpectedly, Netflix (NASDAQ:NFLX). The world's largest streamer, famously allergic to major acquisitions, is now contemplating one of the biggest deals in Hollywood history.

But it was Paramount’s new owner, David Ellison, who set the whole thing in motion.

Barely weeks after closing his $8 billion takeover of Paramount, the 42-year-old tech-scion-turned-studio boss had reportedly already lobbed in three bids for Warner Bros. Discovery, reaching as high as $23.50 a share—an eye-watering 90% premium to where the stock traded before his pursuit began.

Rebuffed each time, he reportedly doubled down, lining up talks with Gulf sovereign wealth funds and leaning on deep family ties in Washington, where his billionaire father Larry Ellison remains one of President Donald Trump‘s most influential donors.

Paramount Skydance’s new chief legal officer, Makan Delrahim, previously served as Trump's antitrust chief. In a race shadowed by regulatory risk, those connections are not trivial.

Earlier this week, Axios reported that Warner Bros. Discovery wants Paramount Skydance to sweeten its latest bid of $23.5 per share to about $30 apiece, which would value the company at over $74 billion.

What Rivals Want

Ellison's aggressive courtship has forced traditional rivals off the sidelines.

Comcast sees a chance to bolt Warner’s studio and HBO Max onto NBCUniversal, creating a heavyweight content engine to compete with Apple‘s AppleTV (NASDAQ:AAPL) and Amazon‘s Prime Video (NASDAQ:AMZN). But the company is also weighed down by about $99 billion in debt, and its shares are down 28% this year, potentially limiting how adventurous it can be if the bidding accelerates.

Which leaves the wild card: Netflix. The company has never executed a transaction remotely this large, but the allure is obvious: adding Warner's lucrative franchises—Batman, Harry Potter, Game of Thrones—to its global content machine. With only $17 billion in borrowings and a stock that is up 24% in 2025, Netflix could be uniquely positioned to make a bid.

For now, Paramount is viewed as the bidder to beat. Warner Bros. Discovery’s board is expected to make a final decision by Christmas. Meanwhile, the company is working on separating its cable networks business from the rest of its businesses by next year.

What Is WBD Stock Doing?

Shares of Warner Bros. Discovery have almost doubled in value since initial interest came in from Ellison. They closed down at $23.09 on Wednesday and were up 1.2% in trading before the bell on Thursday.

The company’s market cap stands at about $58 billion, according to data from Benzinga Pro.

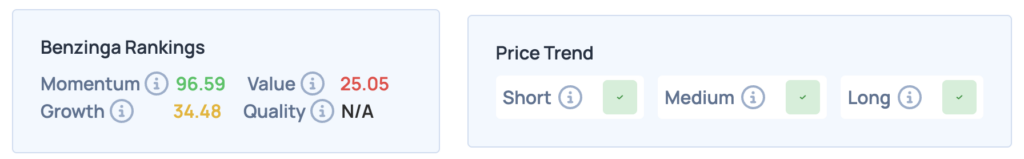

Benzinga’s Edge rankings show exceptionally strong momentum, but weak value, with moderate growth. The stock's price trend remains positive across short, medium, and long-term periods.

READ NEXT:

Image via Shutterstock